Tech Stock Sell-Off Presents Long-Term Buying Opportunities

The stock market has faced a significant downturn amid concerns regarding a potential trade war that could negatively impact the U.S. economy. While recent declines have affected nearly every sector, the big technology stocks, particularly those capitalizing on the rise of artificial intelligence (AI), have experienced some of the steepest losses—many falling around 20%. These dips, however, may present an appealing investment opportunity.

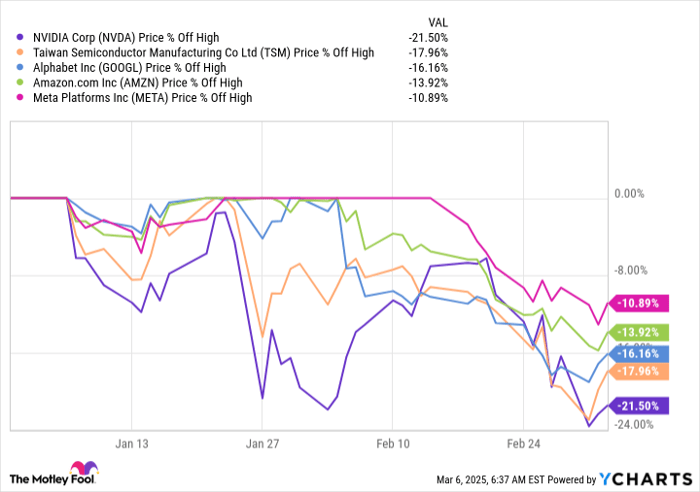

Currently, I am focusing on five stocks: Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Amazon (NASDAQ: AMZN). I believe the declines in these stocks create excellent buying opportunities as my investment strategy is focused on a five-year horizon rather than short-term fluctuations.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Prioritizing Long-Term Growth in a Volatile Market

Investors should remain grounded in the face of concerns about a potential trade war. President Donald Trump has implemented certain tariffs against countries like Mexico, Canada, and China while delaying others. There are indications that more tariffs are on the way, which could exacerbate fears regarding rising costs for consumers. Higher prices might lead to reduced spending, which adds to economic uncertainty.

Despite the legitimate short-term fears, I believe it is unlikely that a trade war will become a prolonged issue. Therefore, I am concentrating less on the immediate impacts on the five companies I mentioned and more on their long-term growth potential. While short-term predictions are challenging, I can identify ongoing trends, such as the ongoing development of AI infrastructure, that position these companies well for future success.

All five companies mentioned are currently significantly below their all-time highs achieved earlier in the year.

NVDA data by YCharts.

The long-term outlook for these companies appears positive, and this recent market sell-off offers a prime opportunity to acquire additional shares.

AI’s Future Impact Will Surpass Trade War Effects

Nvidia’s GPUs are integral to the AI infrastructure landscape. There is a growing demand for these GPUs, and in late February, the company projected a remarkable 65% year-over-year revenue growth for its current quarter (fiscal 2026 Q1), despite potential trade war developments. The AI megatrend is still in its infancy, and Nvidia is positioned to be a major beneficiary. Therefore, this recent downturn represents a compelling opportunity for investors.

Another stock to consider is Taiwan Semiconductor, which has managed to avoid significant tariff impacts. The company announced plans to invest an additional $100 billion in chip manufacturing facilities in the U.S., promoting goodwill towards the current administration. Although the stock experienced a brief uptick following the announcement, it remains below previous highs. Notably, management anticipates revenue growth at around 20% annually over the next five years, making it a strong buy at this junction.

Alphabet’s position is somewhat affected by the current economic landscape, as a large portion of its revenue depends on advertising. In times of economic downturn, advertising budgets often face cuts first. However, a trade war might merely shift advertising expenditures rather than diminish them entirely. Domestic production might see increased marketing, whereas the opposite could occur for imported goods. Ultimately, Alphabet’s business prospects remain sturdy in the long run, despite short-term challenges.

Amazon’s operations are intricately tied to the health of the U.S. economy; however, 58% of its operating profits in 2024 came from Amazon Web Services (AWS), its cloud computing segment. As businesses increasingly transition to the cloud and construct new data centers to support AI, AWS is likely to continue thriving, ensuring Amazon’s long-term resilience thanks to its diverse revenue streams.

In closing, Meta Platforms has experienced the least decline among these companies. Nearly all its revenue is generated through advertising, posing similar risks as Alphabet. Yet, just like the other stocks mentioned, the anticipated short-term effects of a trade war seem minimal compared to Meta’s robust future in the social media landscape and its growing capabilities in utilizing AI tools for ad delivery, which promises to enhance revenue.

While valid concerns regarding the economic repercussions of a trade war exist, I find it challenging to envisage a scenario where these international issues persist long-term. Therefore, I recommend that investors remain focused on long-term prospects and consider buying the dip in these well-established tech stocks.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before purchasing Nvidia stock, it is critical to evaluate this:

The Motley Fool Stock Advisor team recently identified what they consider to be the 10 best stocks for investment right now, and Nvidia was not among them. The stocks on this exclusive list are poised to deliver substantial returns in the coming years.

Consider that when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth $690,624!

Stock Advisor equips investors with a clear pathway to success, offering portfolio-building guidance, regular updates from analysts, and two new Stock picks each month. Since 2002, the Stock Advisor has generated returns exceeding four times that of the S&P 500.*Join Stock Advisor to access the latest top 10 list.

See the 10 stocks »

*Stock Advisor returns as of March 10, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. John Mackey, the former CEO of Whole Foods Market, now part of Amazon, is also a board member of The Motley Fool. Suzanne Frey, an executive at Alphabet, holds a board position at The Motley Fool. Keithen Drury has investments in Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has stakes in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.