# US Debt Downgrade Sparks Investment Opportunities for Contrarians

## Overview of Historical Downgrades

The recent downgrade of US debt has been recognized as a buying opportunity for contrarian investors. Historically, similar downgrades in 2011, 2023, and recently have led to profitable outcomes.

## Historical Context of Downgrades

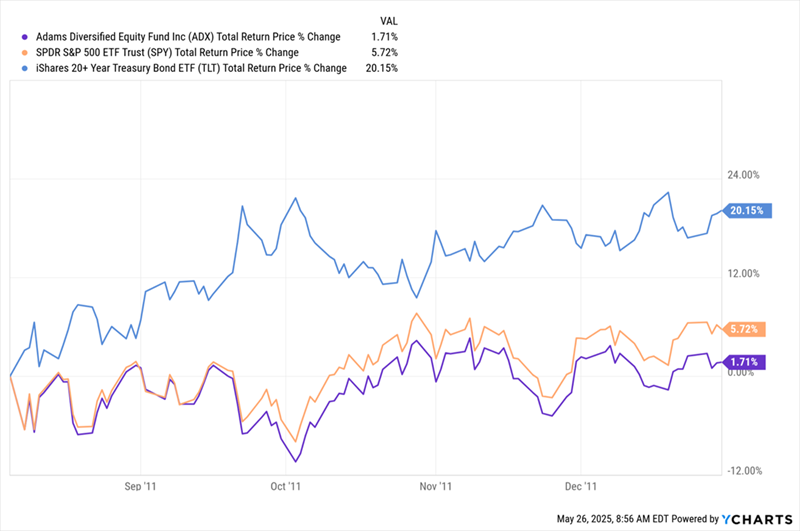

In August 2011, a debt-ceiling crisis led Standard & Poor’s to downgrade US government debt for the first time. This unprecedented action caused US long-term Treasuries to surge by approximately 20% through the end of 2011. During that period, the S&P 500 gained nearly 6%. The Adams Diversified Equity Fund (ADX), which pays a 9% dividend and holds reputable stocks like Apple, Microsoft, and JPMorgan Chase, lagged initially but proved to be a strong long-term investment.

## 2023 Downgrade Effects

In August 2023, Fitch downgraded US debt to its second-highest rating. Since then, ADX has returned about 44%, outperforming the S&P 500, which gained 30%. Meanwhile, Treasuries have performed poorly. The difference in government bond performance relates to the timing of Federal Reserve rate cuts rather than the downgrade itself.

## Recent Downgrade and Market Reaction

A recent downgrade caused short-term declines in stocks, ADX, and bonds, largely due to tariff uncertainties affecting market confidence. On May 20, concerns arose over consumer spending after Walmart and Target issued disappointing results, contributing to selling pressure.

## Impact of Downgrade on Debt Types

Importantly, the downgrade affects only certain types of US debt. According to Moody’s, it pertains to long-term issuer and senior unsecured debt while maintaining Aaa ratings for local and foreign currency.

## Investment Recommendations

Current market volatility presents potential buying opportunities, especially for equity closed-end funds (CEFs) like ADX. Investing now could replicate the favorable outcomes noted in previous downgrades.

## Conclusion

The market’s reaction to the downgrade, combined with current economic uncertainties, presents an advantageous scenario for investors seeking quality dividends and potential growth.