Investing Opportunities: Why Amazon and Cava Group Remain Strong

On March 9, President Donald Trump announced a pause on the previously planned expanded tariffs affecting most countries. This development caused stock prices to surge, yet uncertainty remains about future market movements. Despite the recent rally, many equities are still underperforming for the year, creating potential investment opportunities especially in companies like Amazon (NASDAQ: AMZN) and Cava Group (NYSE: CAVA). Here is an analysis of why investing in these companies could be a wise decision right now.

Amazon’s Resilience Amid Economic Pressures

Amazon may experience various impacts from tariffs, particularly if they lead to inflation or recession. Such economic challenges could lead to decreased consumer spending on its e-commerce platform. Sellers might see rising costs and, consequently, pass these onto customers, potentially reducing Amazon’s sales volume. Even its key growth areas—advertising and cloud computing—could see declines during economic downturns.

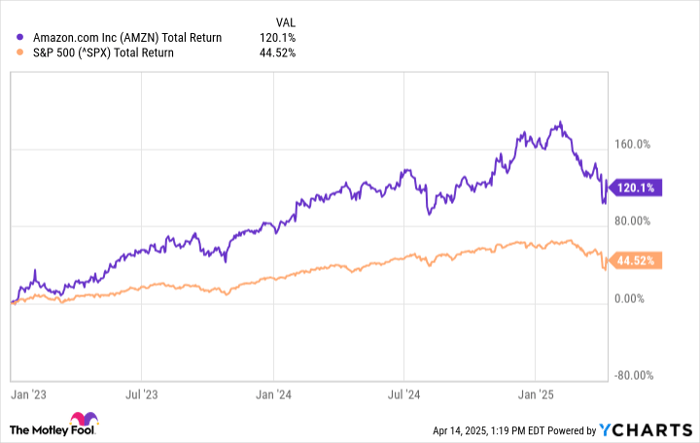

Given these challenges, it’s no surprise that Amazon’s stock has dropped significantly this year. However, this scenario could represent a compelling buying opportunity for investors. Amazon has faced significant economic challenges before; in 2022, it reported a rare net loss largely due to a tough economic climate. Here is a look at the stock’s performance since then.

AMZN Total Return Level data by YCharts.

Amazon’s competitive advantages include a strong commitment to customer service, boasting over 200 million Prime subscribers. Its robust cash flow allows for strategic investments, helping it navigate economic hurdles. Significant future growth opportunities exist in cloud computing and artificial intelligence, where CEO Andy Jassy notes that Amazon continues to lead.

Even if a recession impacts the cloud unit negatively, it’s essential to remember that tariffs won’t directly influence this pay-as-you-go service. Furthermore, Amazon enjoys a substantial competitive edge due to high switching costs, network effects, and a reputable brand. While the stock’s bottom may not yet be reached, its strong long-term outlook positions it as a smart buy during this downturn.

Cava Group: An Expanding Restaurant Chain

Cava is a growing restaurant chain that has garnered attention since its 2023 initial public offering (IPO). The reasons for its popularity are apparent, as the company’s financial results have shown remarkable improvement.

In its latest fiscal year, Cava achieved a 33.1% increase in revenue year-over-year, reaching $954.3 million, supported by a 13.4% growth in same-restaurant sales. Adjusted net income jumped to $50.2 million from $13.3 million in 2023, along with favorable trends in gross margins and free cash flow.

Despite this growth, Cava’s shares have declined significantly this year, largely due to two factors. First, the company’s 2025 fiscal guidance indicated a potential slowdown in expansion, which upset investors. Additionally, traditional valuation metrics suggest that its shares might be overvalued, with a forward price-to-sales ratio of 8.6, while the undervalued range typically starts at 2.

It’s common for richly valued growth stocks to suffer severe corrections when they fail to meet market expectations. However, Cava’s recent drop provides an attractive entry point for investors. The company remains on a growth trajectory, with 367 restaurants by Q4, reflecting nearly 19% growth year-over-year, and it continues to open new locations across the country.

Cava’s long-term goals remain clear, with expectations for steady revenue and earnings growth as it expands. Digital sales, which accounted for 36.4% of revenue in 2024, show the company’s adaptability to modern trends. While its stock remains somewhat pricey, it has reached a more favorable valuation compared to last year, making it a candidate for future gains.

Final Thoughts on Investing in Amazon and Cava

Before deciding to invest in Amazon, consider this:

The Motley Fool Stock Advisor team highlighted what they believe are the 10 best stocks for current investments, and notably, Amazon was not included. Stocks on this esteemed list could offer significant returns in the years ahead.

For instance, consider Netflix, recommended on December 17, 2004; investing $1,000 then would now be worth $526,499! Similarly, had you invested in Nvidia on April 15, 2005, that $1,000 could have grown to $687,684!*

As a note, Stock Advisor has achieved an average return of 818% — vastly outperforming 156

*Stock Advisor returns as of April 14, 2025

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny holds positions in Amazon. The Motley Fool has positions in and recommends Amazon and Cava Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.