Capri Holdings Limited CPRI came up with fourth-quarter fiscal 2024 results, wherein both the top and bottom lines missed the Zacks Consensus Estimate and declined on a year-over-year basis. Softness in demand for luxury fashion items hurt the company’s performance. While Capri Holdings continued to face challenges in the wholesale channel, the retail channel performed better.

Impressively, Versace, Jimmy Choo and Michael Kors brands continued to resonate well with consumers. Better customer engagement resulted in the addition of 11.6 million new consumers joining the database, marking 14% growth compared to the last year.

Q4 Details

This designer, marketer, distributor and retailer of branded apparel and accessories posted adjusted quarterly earnings of 42 cents per share, showcasing a decline from 97 cents in the year-ago period. Also, the metric fell short of the Zacks Consensus Estimate of 72 cents.

Total revenues of $1,223 million slightly fell short of the Zacks Consensus Estimate of $1,295 million and decreased 8.4% year over year. On a constant-currency basis, total revenues declined 7.9%. The retail sales experienced a mid-single-digit decline owing to soft demand for luxury fashion items. In the wholesale sector, revenues fall by a high-teen percentage primarily due to muted demand in the Americas and EMEA regions.

Adjusted gross profit decreased approximately 11.1% year over year to $767 million. The adjusted gross margin contracted 190 basis points (bps) to 62.7% due to lower full-price sell-throughs.

Adjusted operating expenses declined 7.1% year over year to $689 million. The metric, as a percentage of total revenues, rose by 76 bps to 56.3%.

The company reported adjusted operating income of $78 million, down from $121 million in the prior-year quarter. The adjusted operating margin shrunk 270 bps to 6.4%. This decline can be attributed to factors including soft gross margin and expense deleverage resulting from lower revenues.

Capri Holdings Limited Price, Consensus and EPS Surprise

Capri Holdings Limited price-consensus-eps-surprise-chart | Capri Holdings Limited Quote

Segment Details

Revenues from Versace dipped 3.6% year over year to $264 million. The downtick stemmed from sluggish consumer demand in the Americas and EMEA regions, partly mitigated by higher revenues in Asia.

Retail sales experienced a mid-single-digit increase, while wholesale revenues saw a double-digit decrease. Revenues fell 1% and 11% in the Americas and EMEA, respectively, but improved 6% in Asia. Versace’s global database expanded by 1.9 million new consumers, up 30% year over year.

Jimmy Choo’s revenues came in at $137 million, down 9.3% year over year. This was due to a slowdown in consumer demand in all the three regions.

Retail sales experienced a low-single-digit decline while wholesale revenues saw a double-digit decrease. Specifically, revenues fell 9%, 6% and 14% in the Americas, EMEA and Asia, respectively. Jimmy Choo’s global database expanded by 0.7 million new consumers, up 12% on a year-over-year basis.

Revenues from Michael Kors fell 9.7% year over year to $822 million. This downside can be attributed to a softening consumer demand in all the three regions.

Retail sales recorded a high-single-digit decline while wholesale revenues witnessed a double-digit fall. Specifically, revenues in the Americas declined 9%, while in the EMEA, the metric fell 7%. Revenues in Asia plunged 16%. Michael Kors’ global database expanded by 9 million new consumers, representing 13% growth year over year.

Other Financial Aspects

Capri Holdings ended the quarter with cash and cash equivalents of $199 million, long-term debt of $1,261 million and total shareholders’ equity, including non-controlling interest, of $1,600 million.

As of Mar 30, 2024, CPRI had 1,239 retail stores. These include 769 Michael Kors, 234 Jimmy Choo and 236 Versace stores.

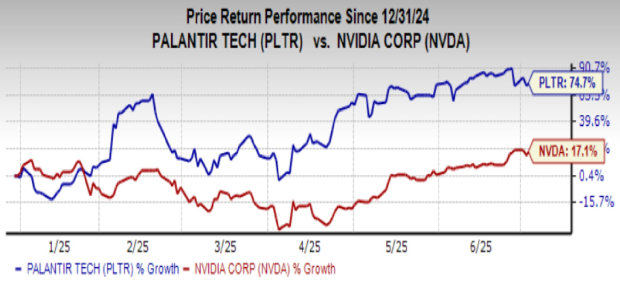

Shares of this Zacks Rank #4 (Sell) company declined 25.4% in the past three months against the industry’s growth of 6.1%.

Image Source: Zacks Investment Research

3 Picks You Can’t Miss

We have highlighted three better-ranked stocks, namely, Abercrombie & Fitch Co. ANF, The Gap Inc. GPS and Levi Strauss & Co. LEVI

Abercrombie & Fitch, a specialty retailer of premium, high-quality casual apparel, currently sports a Zacks Rank of #1 (Strong Buy) at present. ANF has a trailing four-quarter average earnings surprise of 715.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales and earnings indicates growth of 6.4% and 24.2% from the year-ago figures.

Gap, a fashion retailer of apparel and accessories, currently carries a Zacks Rank #2. GPS has a trailing four-quarter earnings surprise of 180.9%, on average.

The Zacks Consensus Estimate for Gap’s current financial-year sales and earnings per share suggests a decline of 0.3% and 3.5%, respectively, from the year-earlier levels.

Levi Strauss, which designs and markets jeans, casual wear and related accessories for men, women and children, presently carries a Zacks Rank of 2. LEVI has a trailing four-quarter earnings surprise of 16.4%, on average.

The Zacks Consensus Estimate for Levi Strauss’ current financial-year sales and earnings suggests growth of 2.9% and 15.5%, respectively, from the prior-year actuals.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.