Capri Holdings Reports Weak Q4 Results Amid Strategic Changes

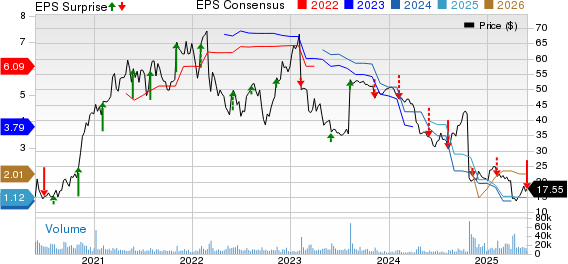

Capri Holdings Limited (CPRI) reported disappointing fourth-quarter fiscal 2025 results, with both revenue and earnings declining year over year. While total revenues exceeded the Zacks Consensus Estimate, earnings fell short.

The fourth-quarter performance reflects Capri’s early strategic turnaround effort amid ongoing macroeconomic challenges. Despite a difficult fiscal 2025, positive trends indicate that new initiatives are taking effect.

A significant highlight was Capri’s announcement to sell the Versace brand to Prada Group. This move aims to enhance focus, strengthen the balance sheet, reduce debt, and potentially restart share repurchases. The company forecasts improving performance through fiscal 2026, positioning itself for growth in fiscal 2027 and beyond.

Q4 Financial Summary

Capri Holdings reported an adjusted quarterly loss of $4.90 per share, worse than the Zacks Consensus Estimate of a 16-cent loss. This figure represents a sharp decline from an adjusted earnings of 42 cents per share in Q4 of the previous year, largely due to a non-cash tax valuation allowance charge.

Total revenues reached $1,035 million, surpassing the Zacks Consensus Estimate of $983 million. However, this figure reflects a 15.4% year-over-year decline, or a 14.1% decrease on a constant-currency basis.

Gross profit decreased 17.7% to $631 million, with a gross margin contraction of 170 basis points to 61%.

Capri reported an adjusted operating loss of $33 million, down from adjusted operating earnings of $78 million in the previous year.

Revenue Breakdown by Segment

Versace revenues fell 21.2% year over year to $208 million, with a gross profit decrease to $136 million from $171 million reported last year, reflecting a margin contraction of 60 basis points to 65.4%.

Jimmy Choo’s revenues totaled $133 million, a 2.9% decline year over year, with gross profit shrinking to $88 million from $96 million, resulting in a gross margin contraction of 390 basis points to 66.2%.

Michael Kors revenues were $694 million, down 15.6% reported, or 14.4% constant currency, with gross profit falling to $407 million from $500 million, reflecting a margin contraction of 220 basis points to 58.6%.

Financial Position Overview

At the end of the quarter, Capri Holdings held cash and cash equivalents of $166 million and long-term debt of $1.48 billion. Total shareholders’ equity, including non-controlling interest, stood at $372 million. The operating cash flow for fiscal 2025 amounted to $281 million, with free cash flow totaling $153 million.

As of March 29, 2025, Capri operated 1,158 retail stores, including 711 Michael Kors, 219 Jimmy Choo, and 228 Versace stores.

Recent Developments

On April 10, 2025, Capri announced a definitive agreement to sell Versace to Prada S.p.A. for $1.375 billion in cash. The transaction is expected to finalize in the second half of calendar 2025, pending regulatory approvals. Versace will be reported as a discontinued operation starting fiscal 2026.

Outlook for Q1 2026

Amid uncertainties around tariffs and consumer spending, Capri Holdings expects total revenues in the range of $765 to $780 million for Q1 of fiscal 2026, down from $1,067 million in the prior year. The operating margin is projected to be approximately break-even, with net interest income expected at around $15 million. Diluted earnings per share are estimated to range from 10 to 15 cents, compared to a loss of 11 cents in the same quarter last year.

For Michael Kors, revenues are forecasted at approximately $615 to $625 million with an expected mid-single-digit operating margin. Jimmy Choo’s revenues are anticipated in the range of $150 to $155 million, with a break-even operating margin.

Fiscal 2026 Expectations

For fiscal 2026, Capri anticipates total revenues of $3.3-$3.4 billion, down from $4.4 billion in 2025. The company forecasts an operating income around $100 million, including tariff impacts. Projected net interest income for fiscal 2026 is between $85 to $90 million, with a diluted earnings per share range of $1.20-$1.40, improving from a loss of $10 per share in 2024.

For Michael Kors, total revenues are expected between $2.75 to $2.85 billion, and for Jimmy Choo, projected revenues are in the range of $540 to $550 million, with an operating margin in the negative mid-single-digit range.

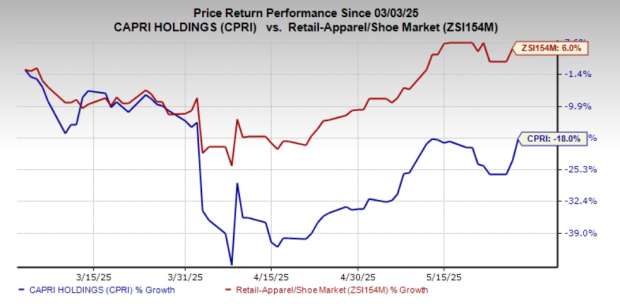

Capri’s shares have fallen 18% over the past three months, contrasting with a 6% growth in the industry.

Market Performance

Image Source: Zacks Investment Research

Investment Alternatives

Alternative stocks to consider include Canada Goose (GOOS), Allbirds Inc. (BIRD), and Stitch Fix (SFIX). Canada Goose, a premium outerwear brand, currently holds a Zacks Rank #2 (Buy).

Allbirds and Stitch Fix Report Strong Earnings Growth

Allbirds, a lifestyle brand utilizing naturally derived materials for footwear and apparel, reported an earnings surprise of 57.2%. The company currently holds a Zacks Rank of 2.

The Zacks Consensus Estimate anticipates a 16.1% growth in Allbirds’ earnings for the current financial year compared to last year. Additionally, the company has achieved a trailing four-quarter average earnings surprise of 21.3%.

Stitch Fix offers customized shipments of apparel, shoes, and accessories for all ages and also holds a Zacks Rank of 2. The Zacks Consensus Estimate indicates a projected earnings growth of 64.7% for Stitch Fix in fiscal 2025 versus the previous year. The company recorded a trailing four-quarter average earnings surprise of 48.9%.