Carnival’s Financial Health Shows Steady Improvement Amid Challenges

Carnival (NYSE: CCL)(NYSE: CUK) stands as the largest cruise operator globally. However, recent years have brought significant challenges for the company. While the business is on a recovery path, some residual effects continue to impact financial metrics.

Compared to last year, Carnival is in a more favorable position, showcasing increased revenue, positive net income, and reduced debt. The company is also benefiting from lower interest rates, which may enhance its financial outlook further. Let’s explore what the future may hold for Carnival in the coming year.

Strong Growth in Revenue and Earnings

Carnival has consistently reported impressive quarterly results. Although some milestones, such as price and occupancy records, may not be sustainable indefinitely, the company is likely to continue increasing sales and net income despite any potential moderation in demand.

The most recent example comes from the fiscal 2024 fourth quarter, which ended on November 30. Here are some key highlights from that period:

- Record revenue of $5.9 billion, a 10% increase year over year

- Record fourth-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $1.2 billion, up 29% year over year

- Record net yields, which increased by 6.7% year over year

- The cumulative advanced booked position reached a record high for the full year of 2025

- Booked positions for 2026 also set prior records in the fourth quarter

Although net income did not break any records, it was notably positive. Carnival reported a net income of $303 million for the fourth quarter, a significant improvement from a $48 million loss a year prior. For the entire year, net income reached $1.9 billion. Carnival’s booked position appears stronger than ever, as both ticket prices and onboard spending have risen, allowing the company to manage unit costs effectively. Management anticipates a further 4.2% improvement in net yields for 2025, aiming for an adjusted net income of $2.3 billion.

To capitalize on growing demand, Carnival has introduced three new ships and plans to open two exclusive destinations in the Caribbean. Additionally, their advertising initiatives led to a 60% rise in paid search clicks and a 40% increase in website visits—strategies expected to drive further demand.

Looking ahead, it is reasonable to anticipate higher revenue, escalating net income, and sustained strong demand. There is potential for robust demand to extend into 2026, with bookings stretching into 2027. Overall, the trajectory may hinge on interest rate trends and general economic conditions. A continued decrease in interest rates could stimulate consumer spending, while a stabilization in existing conditions might level off demand.

Challenges with Debt Management

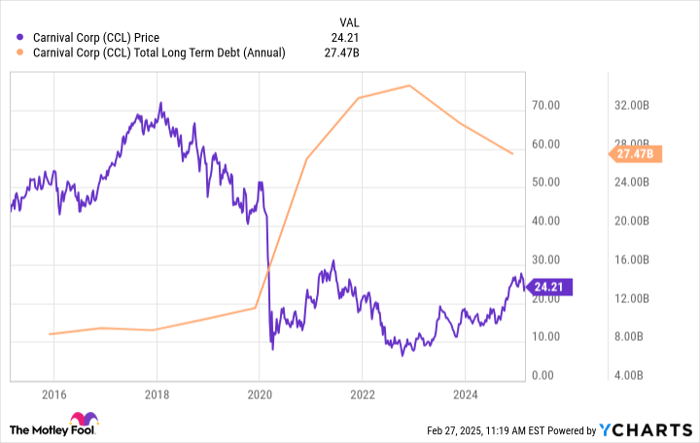

Despite improvements, Carnival still contends with significant debt. As of the end of 2024, the company’s debt level stood at $27.5 billion, which is much higher than historical averages. This situation poses risks, particularly if demand weakens before the debt is fully addressed, potentially hindering Carnival’s ability to repay responsibly.

Given this debt burden, Carnival’s stock may face challenges in maintaining its recent upward trend. However, as the company manages its debt more effectively, the stock is poised for appreciation. Observing the stock’s fluctuations over the past five years highlights its inverse relationship with rising debt. Over the previous two years, as debt levels increased, the stock price faced downward pressure.

CCL data by YCharts

Fortunately, recent improvements in business operations have led to a decrease in debt. The net debt-to-EBITDA ratio improved from 6.7 in 2023 to 4.3 in 2024, with management projecting it to decline further to 3.8 in the upcoming year.

While debt is expected to remain significant, it should decrease over time. This progression is likely to positively influence the stock price. Should interest rates continue to fall, the stock could see additional growth. Investors who remain patient may find that buying now could yield long-term benefits as Carnival’s share price progressively rises back toward previous highs.

Opportunity for Strategic Investors

Are you concerned about missing out on high-performing stocks? Now may be the perfect time to invest.

Our analysts occasionally issue a **“Double Down” stock** recommendation for companies poised for significant growth. If you feel you’ve missed your chance to invest, now is the moment to act before opportunities diminish. Consider the following statistics:

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $323,920!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be valued at $45,851!*

- Netflix: A $1,000 investment made in 2004 would now be worth $528,808!*

Our current “Double Down” alerts include three exceptional companies, and this may be a limited-time opportunity.

Continue »

*Stock Advisor returns as of February 28, 2025

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.