Carter’s Inc. Faces Challenges as Stock Hits 52-Week Low

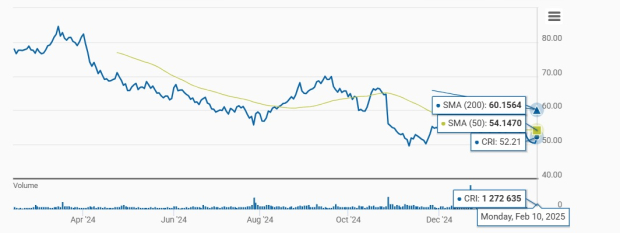

Carter’s, Inc. (CRI) reached a new 52-week low of $49.65 yesterday, closing at $52.21. This price represents a 68% decrease from its 52-week high of $88.03, illustrating a tough year for the children’s apparel leader. Over the past year, CRI stock has generally trended downward due to changing consumer preferences and fierce competition.

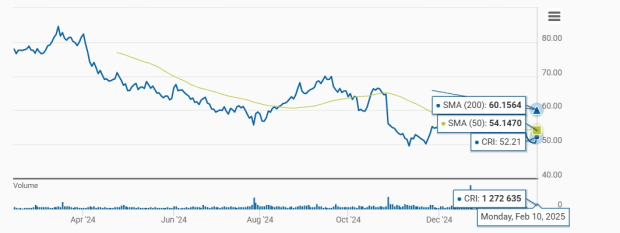

Additionally, the company is encountering significant resistance levels, raising investor concerns from a technical standpoint. The stock has remained below both the 200-day and 50-day simple moving averages (SMAs) for an extended period, which suggests a negative outlook.

As it stands, CRI is trading at $52.21, still below the 200-day and 50-day SMAs of $60.16 and $54.15, respectively, hinting at a potential ongoing decline.

CRI Struggles Below 50 & 200-Day SMAs

Image Source: Zacks Investment Research

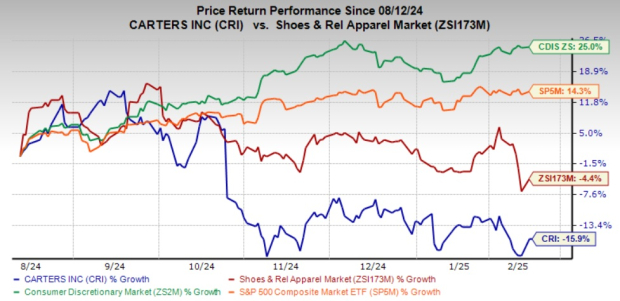

Stock Performance Over the Last Six Months

Image Source: Zacks Investment Research

Reasons for CRI’s Stock Decline

Carter’s, like many in its sector, is grappling with inflation and high interest rates that are squeezing consumer spending and affecting overall performance. The stop of pandemic-related assistance to child-care centers has added more strain to families with young kids, resulting in reduced demand for CRI’s products.

Sales figures have been declining over the past few quarters, reflecting broader market challenges. The U.S. Retail segment has shown significant reductions, with comparable sales weakening. Meanwhile, the U.S. Wholesale division experienced a slight downturn, and the International segment encountered even larger drops.

Higher selling, general and administrative (SG&A) costs, which have risen as a percentage of net sales, are also a concern. These costs have surged due to lower sales, substantial brand marketing investments, increased distribution expenses, and heightened transportation costs. For the fiscal year 2024, Carter’s expects SG&A expenses to climb due to inflation and growth-related investments, though some cost-saving strategies may soften this impact.

Outlook for CRI

Carter’s has a somber outlook for the fourth quarter of 2024, predicting a drop in both net sales and profits compared to the previous year. The company foresees higher sales declines in both U.S. Retail and International sectors, with U.S. Retail expected to fall in the high single to low double digits. Comparable sales in U.S. Retail are forecasted to decrease sharply.

In 2024, Carter’s anticipates declines in net sales, adjusted operating income, and earnings per share compared to 2023. This weak outlook is attributed to persistent macroeconomic issues, softening consumer demand, and ongoing challenges in key markets.

Strategies for Growth

Despite these hurdles, Carter’s has initiated significant pricing strategies aimed at improving profitability. Consumers have responded positively to the strength of its product line, bolstered by new marketing and pricing strategies implemented recently. The company is also concentrating on essential core products, particularly as inflation continues to impact the market.

With nearly 38% of digital orders fulfilled through stores in the third quarter—up from 35% the previous year—Carter’s is leveraging its omnichannel capabilities effectively. This approach reduces shipping costs while improving profit margins. The company is also refining its retail operations, opening 40 high-margin stores while closing about 30 low-margin ones.

Investments in AI-driven marketing personalization have enhanced e-commerce performance by boosting conversion rates and key sales metrics. Looking forward, Carter’s remains dedicated to improving its brand experience across digital and in-store platforms, while collaborating closely with wholesale partners to promote long-term growth.

Final Thoughts on CRI Stock

Given Carter’s current macroeconomic headwinds, stock performance trends, and a dismal near-term forecast, investors may want to proceed with caution. However, the company’s strategic moves, pricing adjustments, and investments in omnichannel capabilities could lead to stabilization. Existing shareholders may find it wise to retain their stock, considering the company’s potential for long-term growth. Currently, CRI holds a Zacks Rank of #3 (Hold).

Consider These Alternatives

We have identified three better-ranked stocks: Wolverine World Wide (WWW), Gildan Activewear (GIL), and lululemon athletica (LULU).

Wolverine produces various casual and active apparel and footwear, currently holding a Zacks Rank of #1 (Strong Buy). The Zacks Consensus Estimate predicts a 22% decline in current-year sales, but earnings per share (EPS) are expected to increase to 90 cents, up significantly from the prior year’s 5 cents. On average, Wolverine has delivered a trailing four-quarter earnings surprise of 17.03%.

Gildan Activewear, known for quality branded activewear, is rated Zacks Rank #2 (Buy). Its current-year EPS consensus indicates a 15.6% growth compared to last year, with an average trailing four-quarter earnings surprise of 5.4%.

lululemon specializes in yoga-inspired athletic apparel and holds a Zacks Rank of #2. Current Zacks Estimates indicate growth of 9.7% in sales and 12.5% in EPS compared to the prior year. Lululemon also boasts a trailing four-quarter earnings surprise of 6.7% on average.

Discover All Zacks’ Buys and Sells for Just $1

We’re serious.

Years ago, we amazed our members by giving them 30-day access to all of our stock picks.

Explore Investment Insights with Zero Commitment

This offer lets you try our services for just $1, with no hidden fees.

Thousands Are Benefiting from a Unique Opportunity

Many have seized this chance to explore our connected portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and other tools that yielded 256 positions with double- and triple-digit profits in 2024 alone. Conversely, some have stayed away, mistakenly believing there’s a catch.

At Zacks Investment Research, our goal is straightforward: to familiarize you with our investment offerings.

Get the Latest Stock Recommendations Today

Interested in fresh insights? Download “7 Best Stocks for the Next 30 Days” for free by clicking the link below.

Stock Analysis Reports at No Cost

Access complimentary analysis reports for the following companies:

- lululemon athletica inc. (LULU)

- Wolverine World Wide, Inc. (WWW)

- Gildan Activewear, Inc. (GIL)

- Carter’s, Inc. (CRI)

To read more about Carter’s stock drop to a 52-week low, click here.

Learn more at Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.