Revving its engine, Carvana (NYSE:CVNA) has zoomed ahead, witnessing a remarkable 802% surge in market value over the past year. Despite the company’s financials showing a promising uptrend, the stock now stands overvalued. Carvana’s growth prospects, albeit still robust, appear to be fully priced in. Like an exotic sports car with turbocharged excitement, the valuation of Carvana has accelerated far from the economic track.

Decelerating Growth Offset by Enhanced Profitability

Despite a 21% revenue dip to $10.77 billion in Fiscal 2023, Carvana’s trajectory from a 129% growth in 2021 to a mere 6% in 2022 was a calculated move. Driving toward profitability, the company aimed to ramp up its Gross Profit per Unit (GPU) – revving it to $5,984 – marking a substantial leap from around $2,000 in the prior year. This shift in gears also saw an amped-up Adjusted EBITDA per unit, underlining Carvana’s newfound focus on profitability.

The company’s tweaked strategy, honed with precision, bore fruits as the adjusted EBITDA margin reversed course, flipping from a -7.7% in 2022 to a cruising 3.1% in 2023. This systematic overhaul, tantamount to a flawlessly executed pit stop, boasted several optimizations – from cost-cutting to data analytics prowess and infrastructural fine-tuning – all accentuating operational efficiency in 2023.

Strategically positioned, Carvana operates akin to a well-oiled machine, tightly integrating its vertical processes, encompassing the end-to-end customer journey – from purchase to reconditioning, sale, and financing of pre-owned vehicles.

Looming Debt Challenges

Steering to navigate the debt maze, Carvana steered through a debt restructuring in 2023, slashing approximately $1.3 billion off its burden. By converting a chunk of unsecured debt into secured notes, Carvana bought itself more runway and lessened its short-term interest obligations by a substantial $455 million over the next couple of years.

Through this dimensional shift in debt dynamics, Carvana now has more maneuvering room to revamp its operational cogs, especially in enhancing the customer experience to stand out among competitors.

While basking in the glow of these debt reduction milestones, Carvana still shoulders $5.2 billion in long-term debt. If macroeconomic headwinds obstruct the smooth ride, the debt quagmire could resurface, clouding investor sentiment towards the company.

Valuation Rumble: Carvana vs. CarMax

Carvana, flaunting a price-to-sales ratio of 0.82, overshadows CarMax (NYSE:KMX), a seasoned player in the U.S. used car arena, with a meeker 0.43 valuation. While Carvana outpaces CarMax in growth velocity, this glaring valuation delta between the two titans beckons scrutiny.

Is Carvana Stock a Buy, Say Analysts?

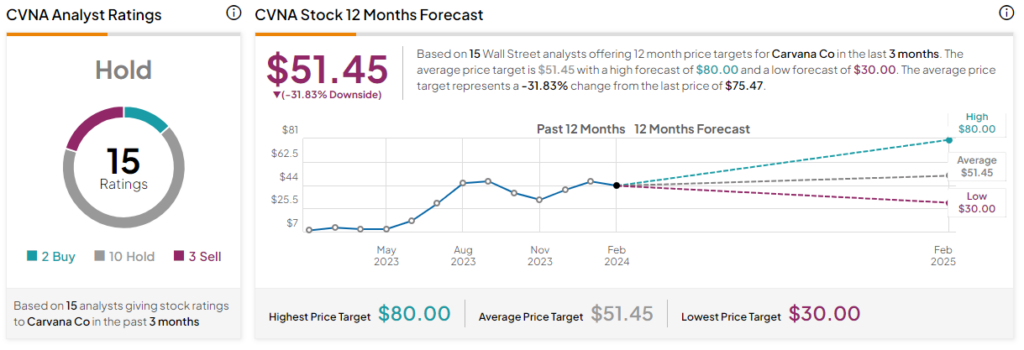

Revving their engines, analysts are divided on Carvana’s trajectory. With Hedgeye sounding off a bearish tone, sighting a 50% potential downturn in the next 18 moons, other pit crew members like BTIG are eyeing a short squeeze potential. As Raymond James tunes into the earnings symphony, they fiddle with an upgrade, fancying optimistic adjusted EBITDA numbers.

With 15 Wall Street sages casting their lots, the average target price for Carvana is $51.45, flagging a 31.8% downside risk from the current market pit stop.

On the Horizon: Carvana Treads a Risky Path Amid Recent Strides

Revving up its engines, Carvana has maneuvered through challenging terrains, steering towards profitability in 2023. As the company refuels its operations and navigates the winding road of debt restructuring, caution flags are raised. Despite these recent triumphs, Carvana finds itself priced for perfection, soaring on the heights of a turbocharged stock market performance over the past year.

Disclaimer

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.