Market News

Key Threats to Walmart’s Sustained Market Leadership

Walmart’s Competitive Landscape and Future Risks Walmart (NASDAQ: WMT) is projected to generate over $31 billion in operating income in fiscal year 2026, but ...

America’s Unexpected Favorite Auto Brand Revealed: Not Ford, GM, or Tesla!

Automakers Strive for Customer Loyalty in 2026 Rankings Hyundai Motor Company has been named the top automotive brand for customer loyalty for the 17th ...

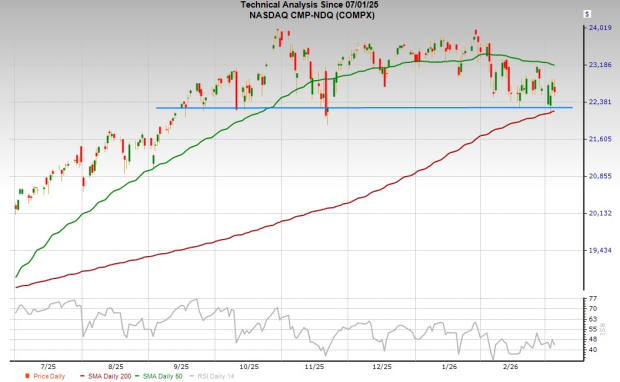

Top Retail Stocks to Consider This March

Key Points Amazon is experiencing strong operating leverage in its e-commerce sector, with a 24% rise in North American operating income from a 10% ...

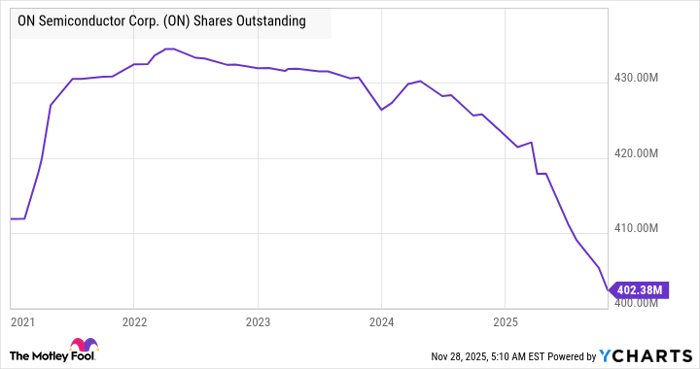

Top Chip Stocks to Invest in for the Next Decade

Key Points ON Semiconductor trades at attractive value multiples despite strong growth potential. The company is investing in share buybacks and has key partnerships ...

Lockheed and Anduril: The Battle for the Future of Army Command and Control Systems

U.S. Army’s NGC2 Command and Control Program Overview The U.S. Army’s Next Generation Command and Control (NGC2) program, aiming to enhance decision-making through artificial ...

Top Two Blue Chip Stocks to Consider Following Recent Market Dip

Market Reactions to Iran War Impacting Apple and Williams Companies Since the onset of the Iran War, Apple shares have fallen by over 5%, ...

Billionaire Stanley Druckenmiller Shifts Investments from Sandisk to Surging AI Stock with 223,000% Growth Since IPO

Key Points Billionaire investor Stanley Druckenmiller sold his entire position in SanDisk and initiated a new position in Amazon during the fourth quarter. SanDisk’s ...

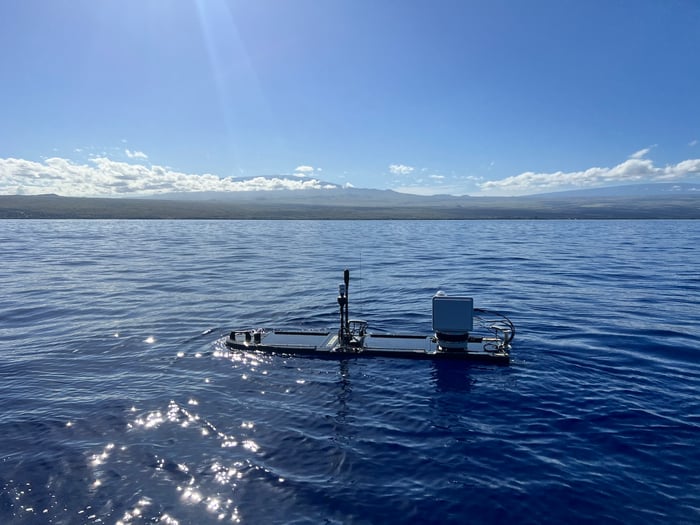

Boeing Deploys Advanced Liquid Robots for Japan’s Defense

Boeing Subsidiary Liquid Robotics Secures $25 Million Defense Contract with Japan Liquid Robotics, a subsidiary of Boeing, has secured its first significant defense contract ...

Future Price Predictions for Tesla Stock: Will It Reach $1,000?

Tesla’s Stock Outlook and Challenges Tesla Inc. (NASDAQ: TSLA) shares, currently priced at approximately $402.51, would need to increase by about 150% to reach ...

Greg Abel’s First Moves: Key Berkshire Hathaway Equity Positions Excluded from Core Holdings Lists

Berkshire Hathaway’s New Strategy Under CEO Greg Abel New Berkshire Hathaway CEO Greg Abel has outlined a strategic vision in his first letter to ...