Blockchain

The Battle for Sam Bankman-Fried’s Freedom: An Analysis of Legal Maneuvers and Sentencing Drama

Sam Bankman-Fried finds himself in a dire legal tug-of-war, his fate precariously balanced on the scales of justice. His legal team has unleashed a ...

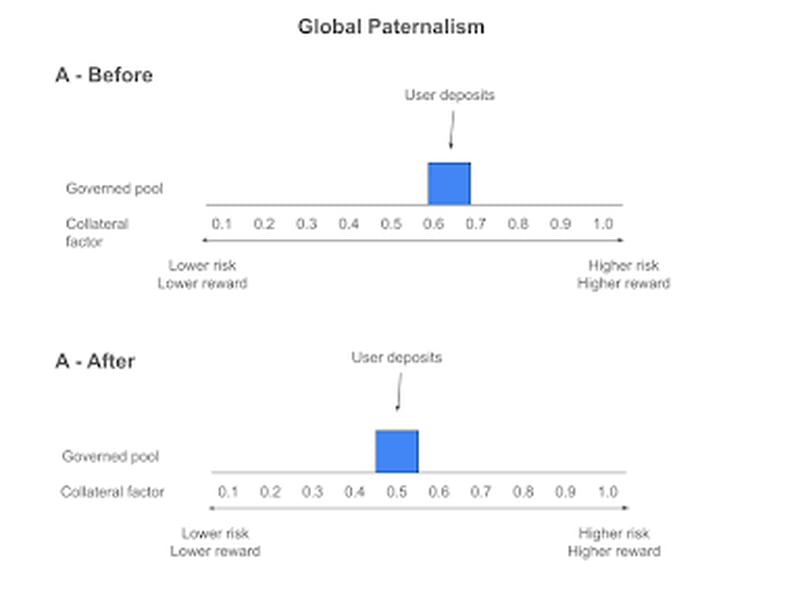

The Balancing Act: Navigating Risk in the DeFi Market

Within the ever-evolving realm of decentralized finance (DeFi), effective risk management serves as the cornerstone for the viability of lending protocols. Striking a harmonious ...

The Institutional Shift to Crypto

The Stage Is Set for Institutional Adoption of Crypto

By Javier Rodriguez-Alarcon, Chief Commercial Officer and Head Digital Investments Strategies, at XBTO The recent resolution involving Binance represents the latest milestone in the ...

The SEC Rattles Crypto with New Dealer Definitions

The SEC Rattles Crypto with New Dealer Definitions

The U.S. Securities and Exchange Commission has issued a new definition for securities dealers, encompassing crypto, in a move that could be a game-changer ...

Tokenization Surge Shifts Focus to DAOs

As Tokenization Takes off, Look to DAOs

Crypto and TradFi asset management are converging. From the record-breaking launch of the U.S. spot bitcoin exchangetraded funds (ETFs) to BlackRock CEO Larry Fink’s ...

Disruption of Bitcoin Mining in the United States

Bitcoin Mining and the Politicization of a Once Reputable Federal Agency

The EIA’s Unprecedented Overreach The Energy Information Administration’s (EIA) mandatory emergency survey of electricity consumption data has sparked significant concern among bitcoin miners, cryptocurrency ...

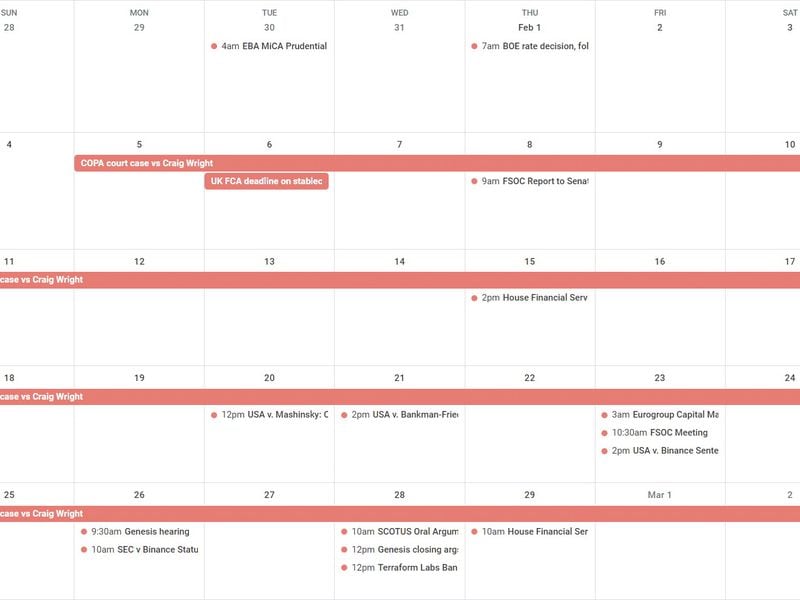

Last Month’s U.S. Crypto Crime Recap

A Recap of Last Month’s U.S. Crypto Crime Log

While our attention was focused on exchange-traded funds earlier this month, federal regulators in the U.S. announced charges or sentences for various crypto parties. ...

Real World Asset Tokenization: The Hype and The Hard Truth

Real World Asset Tokenization: The Hype and The Hard Truth

“Tokenization,” especially of “real world assets,” has recently gained significant attention in the crypto world. This trend is essentially a form of security tokens, ...

`The Crypto Community Stands Firm Against FinCEN’s Proposed Mixer Rule

In October, the Financial Crimes Enforcement Network proposed a new regulatory regime for crypto mixing services that would treat the entire class of privacy ...

The Quest for the Ideal Self-Custody Lightning Wallet in Zimbabwe

Anita Posch, a well-respected Bitcoin educator, and the author of the book “(L)earn Bitcoin”, embarked on her second test of self-custodial Lightning wallets in ...