Most Popular

Significant Friday Options Movement: TSLA, META, COST

Tesla Inc (TSLA) recorded unusually high options trading volume today, with 1.9 million contracts traded, equivalent to approximately 193.7 million underlying shares. This volume ...

Rising Coffee Prices Amid Global Supply Issues

As of today, May arabica coffee (KCK26) is up 1.40% to $4.05, while May ICE robusta coffee (RMK26) has increased by 0.83% to $31. ...

XPEL Stock Drops Below 200-Day Moving Average

On Monday, XPEL Inc (Symbol: XPEL) shares fell below their 200-day moving average of $71.88, trading as low as $71.03, representing a decline of ...

First Trust Nasdaq Bank Falls Below Key 200-Day Moving Average – Significant Impact on FTXO

In trading on Friday, shares of the First Trust Nasdaq Bank ETF (FTXO) fell below their 200-day moving average of $35.47, hitting a low ...

JPIB Achieves Key Technical Milestone

In trading on Friday, shares of the JPIB ETF (Symbol: JPIB) fell to $48.285, entering oversold territory with a Relative Strength Index (RSI) reading ...

Broadcom’s Stellar Quarter Puts Bears on Notice

Broadcom (NASDAQ: AVGO) reported a strong Q1 2026 earnings, with revenue reaching $19.3 billion, a 29.5% increase year-over-year, slightly surpassing estimates of $19.1 billion. ...

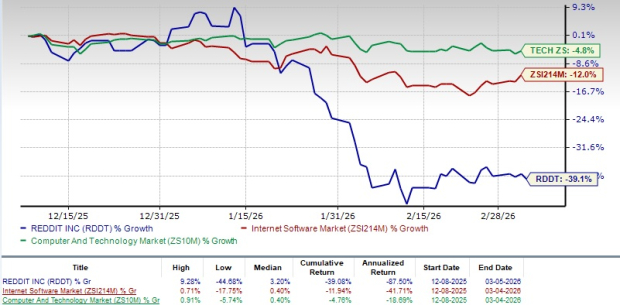

RDDT Stock Plummets 39% Over Last Quarter: Time to Reassess Your Investment?

Reddit (RDDT) has seen its shares drop by 39.1% over the past three months, significantly underperforming against the broader Zacks Computer & Technology sector, ...

Market Declines as Inflation Concerns Rise and US Job Data Weakens

U.S. stock indexes experienced significant losses today, with the S&P 500 down 0.95%, the Dow Jones Industrial Average down 1.00%, and the Nasdaq 100 ...

Trex Faces Overbought Market Conditions

Shares of Trex Co Inc (TREX) reached an oversold status on Friday, with a Relative Strength Index (RSI) reading of 26.7. The stock traded ...

LQD Experiences Significant Drop Below Key Moving Average

On Wednesday, shares of the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) fell below the 200-day moving average of $105.98, trading as ...