Investing

Figuring out how to invest your money to generate consistent returns can seem daunting, especially if you don’t have extensive financial knowledge. Our investing section provides novice investors with the key strategies and tips for how to invest money wisely. We deliver actionable advice to help you build wealth steadily over time.

Simply put, investing as a beginner can look confusing initially. But sticking to proven, time-tested investing principles can help you avoid costly mistakes and accumulate real returns. We believe successful investing doesn’t require taking excessive risk. By learning how to assess risk vs reward and allocating capital prudently, regular investors can steadily build wealth over the long run.

From setting investment goals and building a diversified portfolio to rebalancing and maximizing returns, we cover the essential investing basics. You’ll learn timeless wisdom from legendary investors like Warren Buffett and Peter Lynch that can guide your own investment decisions. We explain key terms and concepts clearly, so you can grasp investing fundamentals quickly.

While investing always involves some degree of risk, going in with the right knowledge helps tilt the odds in your favor. We believe the average individual has the ability to invest successfully on their own and grow significant wealth over time. By teaching you how to invest money wisely, we aim to empower our readers to take control of their financial futures.

Ready to start growing your money? Browse our investing for beginners articles covering stocks, mutual funds, ETFs, real estate, and alternative assets. Learn how to open a brokerage account, build a portfolio, and invest with a long-term mindset. Sign up for our free investing newsletter to get simple money tips delivered to your inbox daily.

Top Stock to Watch: Photronics (PLAB)

Photronics Inc. (PLAB), a global leader in photomasks for semiconductor production, reports strong growth leading into its earnings report on February 25, with shares ...

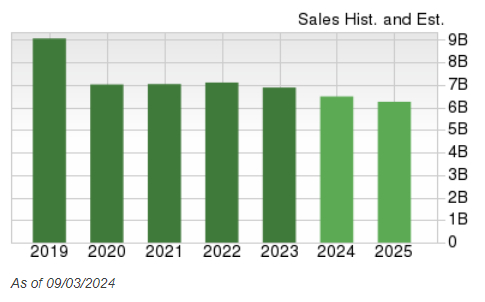

Market Decline Spotlight: Xerox (XRX)

Xerox Holdings Corporation (Ticker: XRX) is experiencing significant challenges in the evolving digital landscape, leading to a notable decline in its business performance. The ...

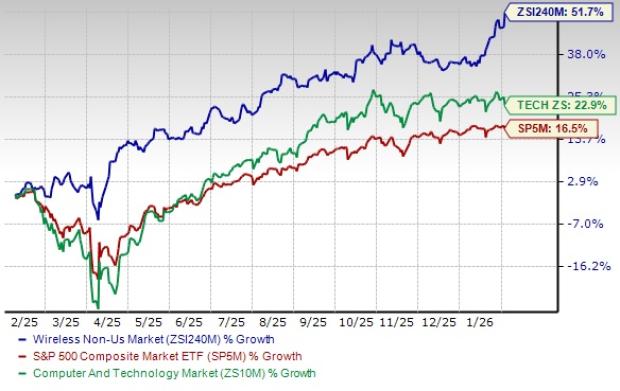

Three International Wireless Stocks Poised for Success in Thriving Market

The Zacks Wireless Non-US industry has experienced a significant uptick, gaining 51.7% over the past year, compared to 16.5% for the S&P 500. Key ...

Top Stocks to Consider During the Market Dip: Is HOOD a Smart Buy After a 50% Drop Ahead of Earnings?

Robinhood Markets, Inc. (HOOD) saw its stock price reach all-time highs in October, reflecting its evolution from a stock-trading app to a significant player ...

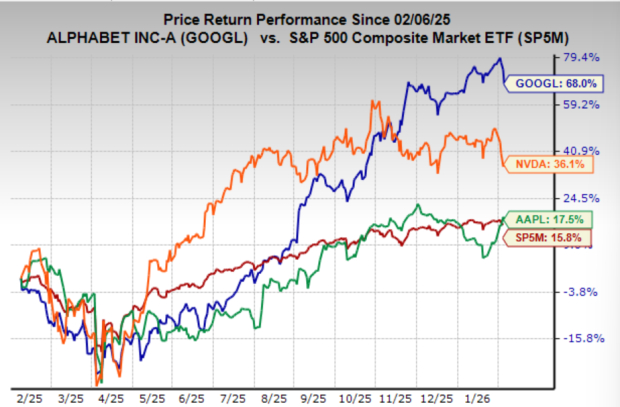

Exploring Alphabet: The Pinnacle of Business Innovation

Alphabet Inc. (GOOGL) reported its fourth-quarter and full-year results for 2023 on October 30, revealing an 18% revenue increase, with annual sales surpassing $400 ...

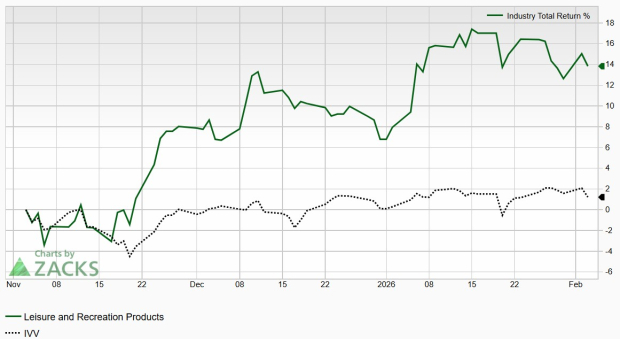

Stock Spotlight: Callaway Golf (CALY)

**Callaway Golf Company Achieves 52-Week High amid Strategic Moves** Callaway Golf Company reached a 52-week high recently, driven by increasing stock volume and buying ...

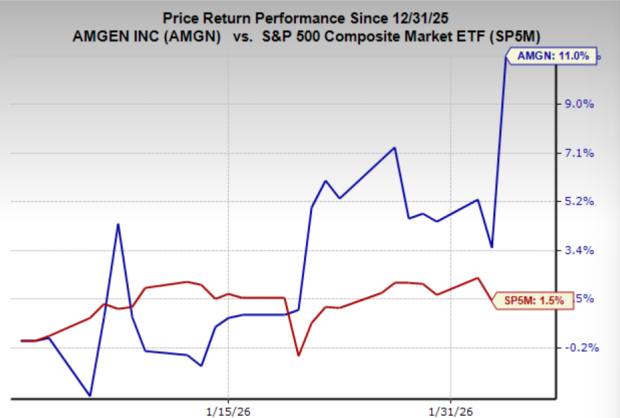

Amgen Stock Reaches New 52-Week High: Is It Time to Invest?

Amgen Inc. (AMGN) reported robust earnings in its latest quarter, with a 9% revenue increase

Top 4 Silver Mining Stocks to Capitalize on Strong Market Trends

The Zacks Mining – Silver industry is experiencing strong momentum, driven by increasing silver prices and robust industrial demand, particularly from the solar energy ...

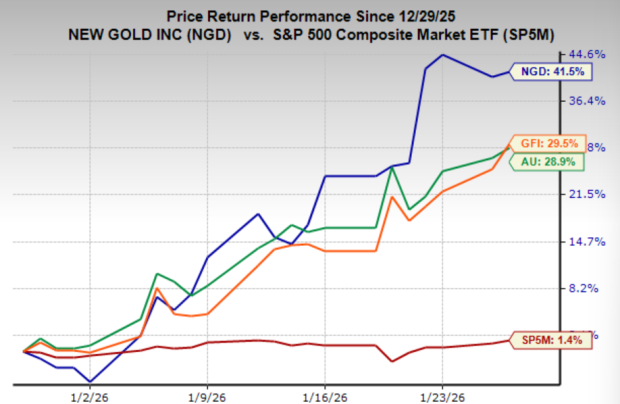

Is It the Right Moment to Invest in Mining Stocks Amid Gold’s Decline?

Gold and silver experienced extreme volatility on January 27, 2026, with gold plunging approximately 11% and silver collapsing over 30% in a single session, ...

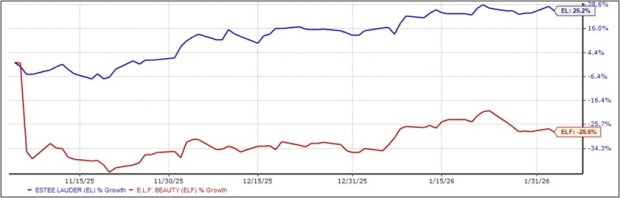

Comparing Aesthetics: ELF or EL?

During the Q4 2025 earnings season, Estee Lauder (EL) and e.l.f. Beauty (ELF) are in focus, with significant performance disparities noted. Over the past ...