Tech Stocks

Technology stocks have been top performers over the past decade, handily outpacing the broader market. Our technology stock investing coverage provides investors with guidance, analysis and recommendations on the tech sector. We dig into the financials, growth trajectories and market opportunities for leading technology stocks.

With names like Apple, Microsoft, Amazon and Alphabet dominating the markets, tech stocks are impossible for investors to ignore. The technology sector accounts for over 25% of the S&P 500’s total value. We help investors understand the forces shaping winners and losers in this transformational sector.

From e-commerce and cloud computing to semiconductor chips and cybersecurity, game-changing tech trends create huge potential for stock upside. Yet picking long-term winners presents challenges, with tech company fortunes changing quickly. Our technology stock analysis aims to identify established leaders and emerging disruptors with durable competitive advantages.

Beyond mega-cap tech stocks, we also provide coverage of less-followed small and mid-cap names operating under the radar. These rapidly-growing tech stocks can handily outperform with the right catalysts. We provide tech investors diversified stock ideas across market caps and sub-sectors.

While tech stocks carry higher risk, they have also produced spectacular rewards over time. By staying on the cutting edge of tech stock news and analysis, our coverage pinpoints opportunities while assessing downside hazards.

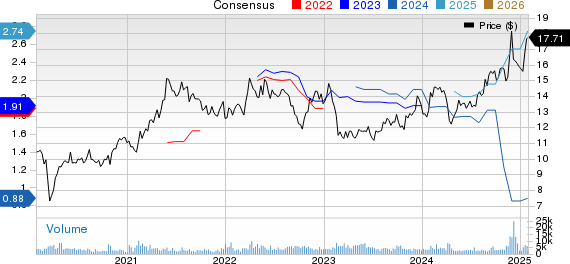

Utah Medical Reports Q4 Earnings Drop Due to Decline in OEM Sales Year Over Year

Utah Medical Products, Inc. (UTMD) reported its fourth-quarter earnings for 2025 on December 31, revealing a 6.3% drop in earnings per share (EPS) to ...

Exploring Alternative Investment Opportunities Beyond Tech Stocks

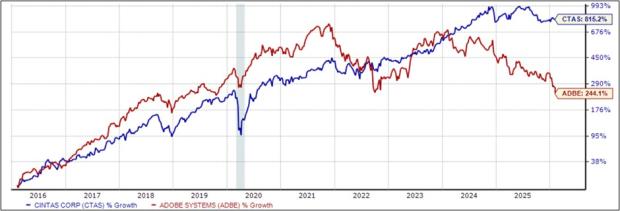

Cintas Corporation (CTAS), a company specializing in workplace supplies and uniforms, has seen its stock surge by 815% over the past decade, significantly outperforming ...

WSBF Reports 57% Year-Over-Year Increase in Q4 Earnings Driven by Margin Growth and Credit Improvements

Waterstone Financial, Inc. (WSBF) reported a 57.1% increase in net income for Q4 2025, reaching 44 cents per share compared to 28 cents per ...

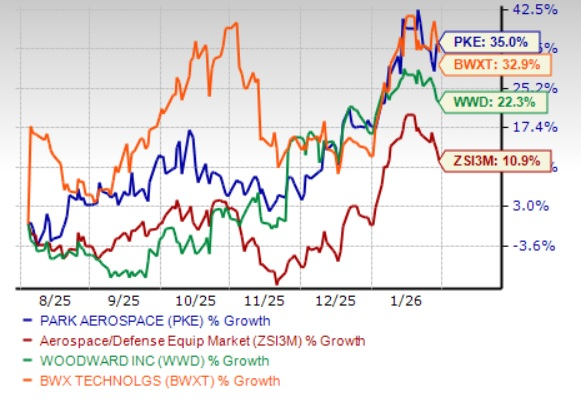

Park Aerospace Sees 35% Growth in 6 Months: Is It Time to Invest?

Park Aerospace Corp. (PKE) has experienced a 35% increase in share value over the past six months, significantly outperforming the aerospace and defense industry, ...

C&F Financial Sees Year-over-Year Growth in Q4 Earnings Driven by Increased Loans and Improved Margins

C&F Financial Corporation (CFFI) reported a fourth-quarter net income of $6.7 million for 2025, an 11% increase from $6 million in Q4 2024. For ...

Top Growth Stocks to Invest in this February 2nd

**Key Stock Recommendations for February 2, 2023** On February 2, three stocks with strong growth potential were highlighted by Zacks Investment Research. **Dollar General ...

Exploring Two Promising Microcap Value Stocks on Nasdaq

AMREP Corporation (AXR), based in Rio Rancho, NM, is primarily involved in land development and homebuilding, owning approximately 17,000 acres in Sandoval County. The ...

OVBC Shares Surge After Q4 Earnings Boosted by Robust Loan Growth and Margin Improvements

Ohio Valley Banc Corp. (OVBC) reported significant earnings growth for the quarter ending December 31, 2025, with net income rising 57.3% to $3.9 million, ...

Top Growth Stocks to Consider for Late January Investing

KT Corporation (KT), a telecommunications provider, saw a 3.5% increase in its current year earnings estimate over the last 60 days and holds a ...

Franklin Financial Sees Year-Over-Year Q4 Earnings Boost Driven by Loan Expansion and Increased Margins

Franklin Financial Services Corporation (FRAF) reported a substantial increase in fourth-quarter 2025 net income, rising to $6 million or $1.35 per diluted share, up ...