Tech Stocks

Technology stocks have been top performers over the past decade, handily outpacing the broader market. Our technology stock investing coverage provides investors with guidance, analysis and recommendations on the tech sector. We dig into the financials, growth trajectories and market opportunities for leading technology stocks.

With names like Apple, Microsoft, Amazon and Alphabet dominating the markets, tech stocks are impossible for investors to ignore. The technology sector accounts for over 25% of the S&P 500’s total value. We help investors understand the forces shaping winners and losers in this transformational sector.

From e-commerce and cloud computing to semiconductor chips and cybersecurity, game-changing tech trends create huge potential for stock upside. Yet picking long-term winners presents challenges, with tech company fortunes changing quickly. Our technology stock analysis aims to identify established leaders and emerging disruptors with durable competitive advantages.

Beyond mega-cap tech stocks, we also provide coverage of less-followed small and mid-cap names operating under the radar. These rapidly-growing tech stocks can handily outperform with the right catalysts. We provide tech investors diversified stock ideas across market caps and sub-sectors.

While tech stocks carry higher risk, they have also produced spectacular rewards over time. By staying on the cutting edge of tech stock news and analysis, our coverage pinpoints opportunities while assessing downside hazards.

Maximize Your Cloud Experience with This Tool

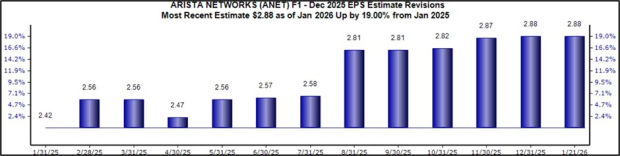

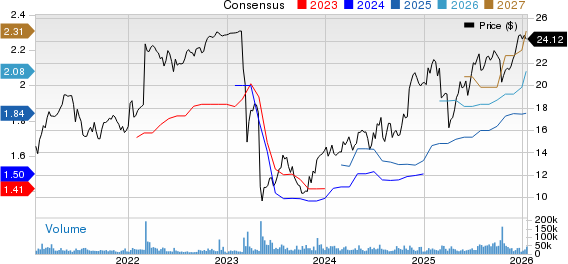

Arista Networks (ANET), a leader in cloud computing and networking, has seen significant stock performance over the past year, driven by strong demand and ...

Top Growth Stocks to Consider for January 22nd

**Three Strong Growth Stocks Noted for January 22nd** On January 22, three stocks have been highlighted for their strong growth potential by Zacks Investment ...

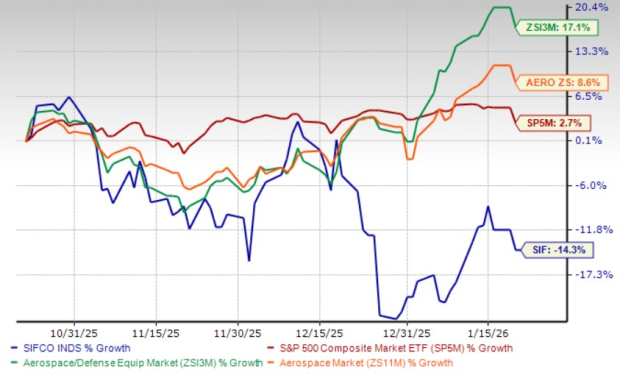

SIFCO Experiences 14.3% Decline Over Three Months: Strategies for Investors

SIFCO Industries, Inc. (SIF), based in Cleveland, OH, has seen its stock price decline by 14.3% in the past three months, significantly underperforming against ...

Top Growth Stocks to Consider for January 21st

Three top-ranked stocks for growth are highlighted as strong buys on January 21st. nCino, Inc. (NCNO), a software-as-a-service company, has a Zacks Rank of ...

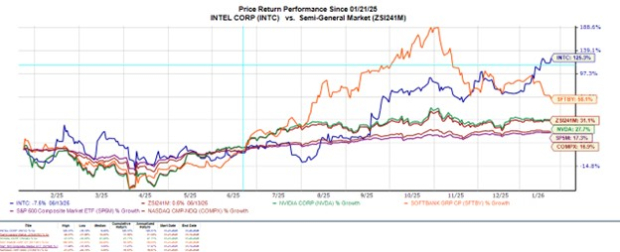

Can Intel Stock Maintain Its Momentum Ahead of Q4 Earnings?

Intel (INTC) is experiencing a significant turnaround, with its stock reaching a two-year high of $50, up from a low of $17 last April. ...

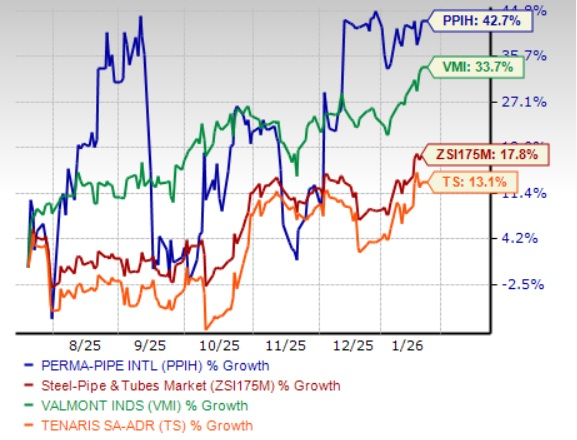

Perma-Pipe Soars 43% in Half a Year: Is It Time to Invest?

Perma-Pipe International Holdings, Inc. (PPIH) has seen its shares increase by 42.7% over the past six months, outperforming the steel pipe industry, which grew ...

Evaluating the Investment Potential of Dividend Aristocrats for 2026

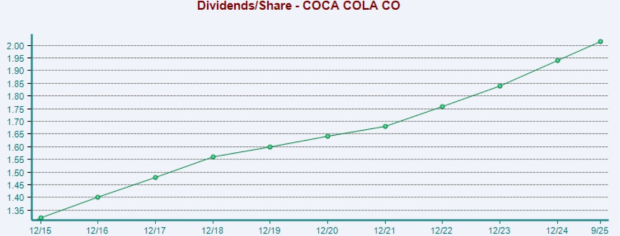

Investors seeking monthly dividend payouts can achieve this by combining shares from three major companies: Coca-Cola (KO), Caterpillar (CAT), and McDonald’s (MCD). Coca-Cola pays ...

Insights from Business Leaders on AI: A Nasdaq Survey

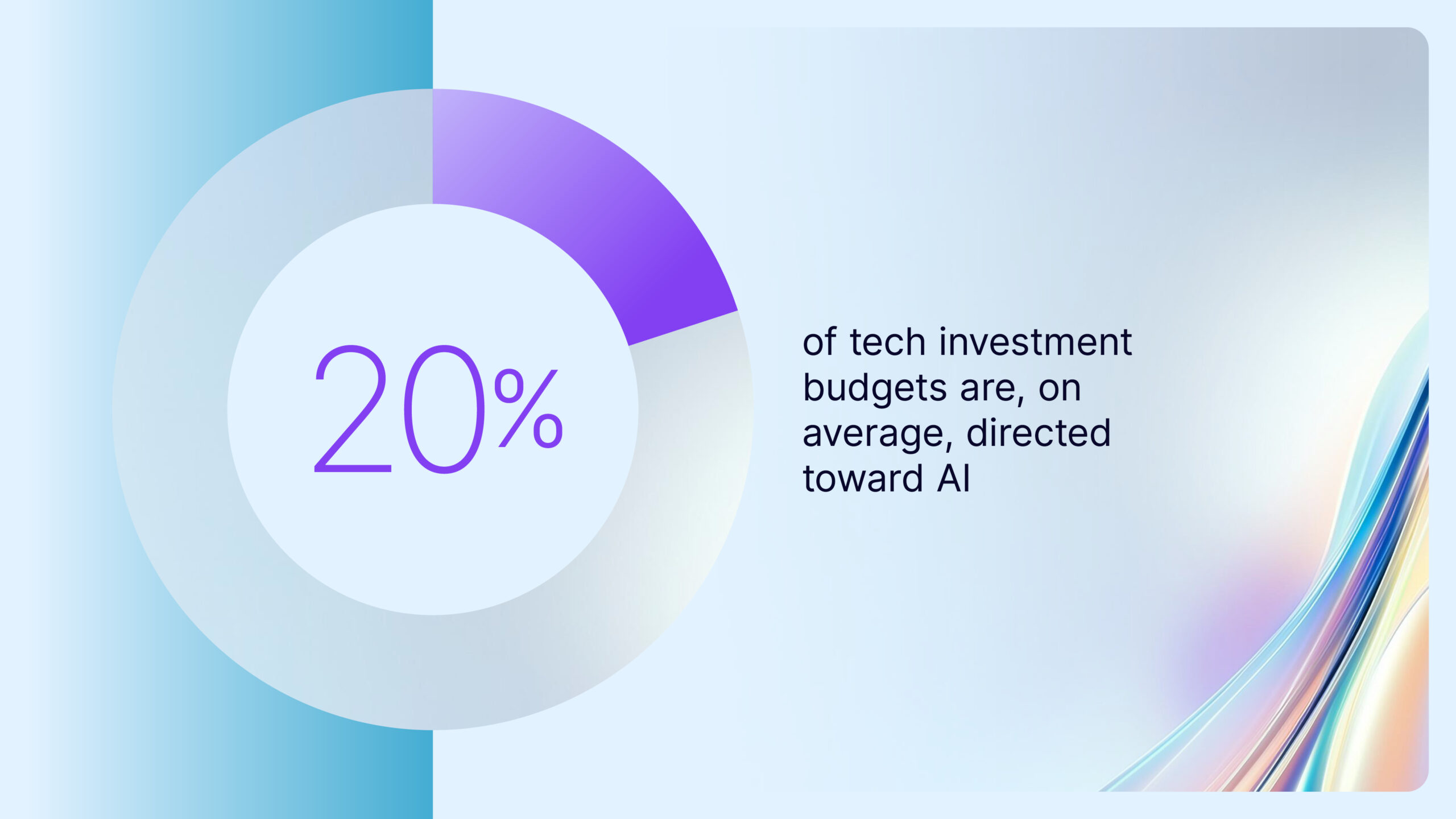

Businesses are increasingly investing in artificial intelligence (AI), with an average of 20% of their technology budgets allocated to AI initiatives, according to Nasdaq’s ...

PKE Sees 5% Stock Rise in Q3 Driven by Strong Defense Demand

Park Aerospace Corp. (PKE) reported significant earnings growth for the third quarter of fiscal 2026, with earnings per share (EPS) rising to 15 cents, ...

Top Income Stocks to Consider for January 19th

On January 19, Zacks Investment Research highlighted three stocks with strong buy ranks and income potential: First Horizon (FHN), Morgan Stanley (MS), and TE ...