Tech Stocks

Technology stocks have been top performers over the past decade, handily outpacing the broader market. Our technology stock investing coverage provides investors with guidance, analysis and recommendations on the tech sector. We dig into the financials, growth trajectories and market opportunities for leading technology stocks.

With names like Apple, Microsoft, Amazon and Alphabet dominating the markets, tech stocks are impossible for investors to ignore. The technology sector accounts for over 25% of the S&P 500’s total value. We help investors understand the forces shaping winners and losers in this transformational sector.

From e-commerce and cloud computing to semiconductor chips and cybersecurity, game-changing tech trends create huge potential for stock upside. Yet picking long-term winners presents challenges, with tech company fortunes changing quickly. Our technology stock analysis aims to identify established leaders and emerging disruptors with durable competitive advantages.

Beyond mega-cap tech stocks, we also provide coverage of less-followed small and mid-cap names operating under the radar. These rapidly-growing tech stocks can handily outperform with the right catalysts. We provide tech investors diversified stock ideas across market caps and sub-sectors.

While tech stocks carry higher risk, they have also produced spectacular rewards over time. By staying on the cutting edge of tech stock news and analysis, our coverage pinpoints opportunities while assessing downside hazards.

Top Growth Stocks to Invest in for December 2023

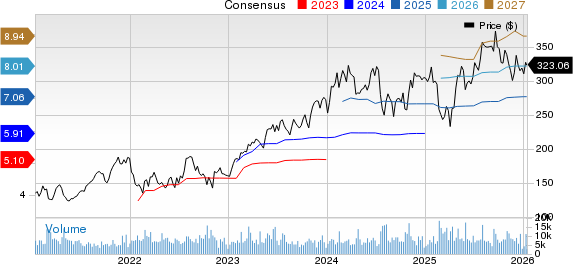

Ciena Corporation (CIEN), a network technology company, is highlighted for its strong growth potential with a Zacks Rank #1 and an 18.1% increase in ...

Top Momentum Stocks to Consider for December 22

On December 22, Zacks Investment Research identified three stocks with strong momentum and a buy rank for investors: Impala Platinum Holdings Limited (IMPUY), Pharming ...

Top Growth Stocks to Invest In This December

On December 22, three stocks with strong growth potential were identified by Zacks Investment Research. RenaissanceRe Holdings Ltd. (RNR), a reinsurance firm, holds a ...

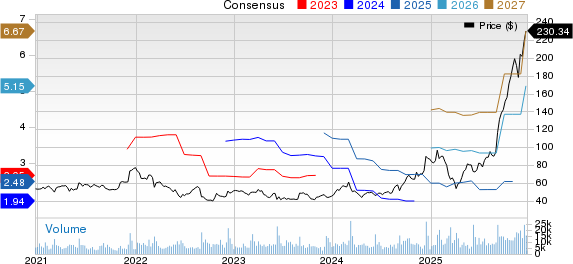

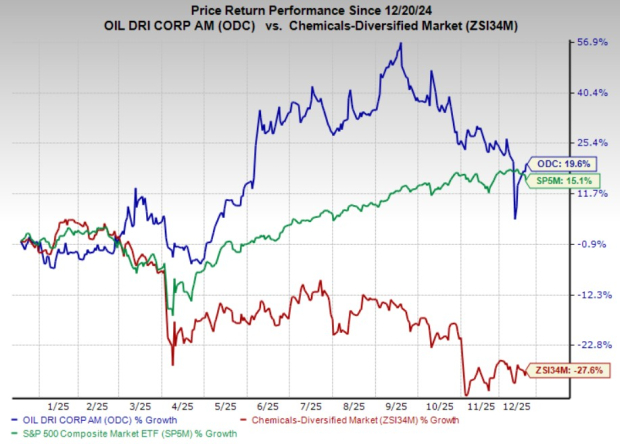

Oil-Dri Maintains Strong Business Model During Earnings Adjustments

Oil-Dri Corporation of America (ODC) reported first-quarter fiscal 2026 results for the period ending October 31, 2025, with consolidated net sales at $120.5 million, ...

CSPI Reports Year-over-Year Reduction in Q4 Losses and Revenue Growth Despite Market Volatility

Shares of CSP Inc. (CSPI) declined by 15.1% following the release of its fourth-quarter fiscal 2025 results on September 30, 2025, contrasting with a ...

Perma-Pipe Reports Significant Year-over-Year Earnings Growth Driven by Demand in Middle East and U.S.

Perma-Pipe International Holdings, Inc. (PPIH) reported a robust earnings performance for Q3 2025, showing a 152% increase in net income to $6.3 million compared ...

Top Momentum Stocks to Consider for December 18

Investors are encouraged to consider three stocks with strong momentum and a buy rank as of December 18: Materialise NV (MTLS), Calix, Inc. (CALX), ...

Top Momentum Stocks to Consider for December 17

Amtech Systems, Inc. (ASYS) has seen its earnings estimate for the current year rise by 186.7% over the last 60 days, reflecting strong market ...

FEIM Shares Surge 29% Despite Yearly Earnings Decline Due to Contract Delays

“`html Frequency Electronics, Inc. (FEIM) reported a net income of 18 cents per share for the second quarter of fiscal 2026, down 35.7% from ...

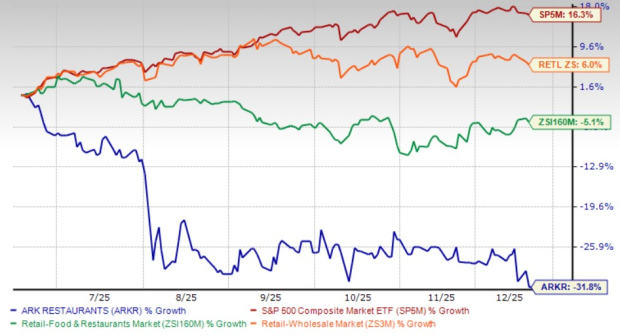

Is It Time to Hold or Sell After ARKR’s 31.8% Decline in Six Months?

Ark Restaurants Corp. (ARKR) has seen its stock decline by 31.8% over the past six months, significantly underperforming the retail restaurant industry, which declined ...