Tech Stocks

Technology stocks have been top performers over the past decade, handily outpacing the broader market. Our technology stock investing coverage provides investors with guidance, analysis and recommendations on the tech sector. We dig into the financials, growth trajectories and market opportunities for leading technology stocks.

With names like Apple, Microsoft, Amazon and Alphabet dominating the markets, tech stocks are impossible for investors to ignore. The technology sector accounts for over 25% of the S&P 500’s total value. We help investors understand the forces shaping winners and losers in this transformational sector.

From e-commerce and cloud computing to semiconductor chips and cybersecurity, game-changing tech trends create huge potential for stock upside. Yet picking long-term winners presents challenges, with tech company fortunes changing quickly. Our technology stock analysis aims to identify established leaders and emerging disruptors with durable competitive advantages.

Beyond mega-cap tech stocks, we also provide coverage of less-followed small and mid-cap names operating under the radar. These rapidly-growing tech stocks can handily outperform with the right catalysts. We provide tech investors diversified stock ideas across market caps and sub-sectors.

While tech stocks carry higher risk, they have also produced spectacular rewards over time. By staying on the cutting edge of tech stock news and analysis, our coverage pinpoints opportunities while assessing downside hazards.

Optimism Among Wall Street Bulls: Is ATI a Buy Opportunity?

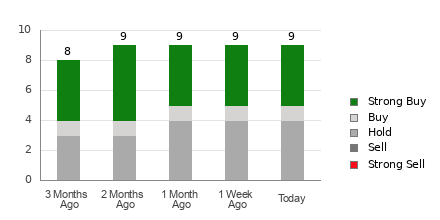

ATI (ATI) currently holds an Average Brokerage Recommendation (ABR) of 1.40 on a scale from 1 to 5, indicating a consensus between “Strong Buy” ...

Evaluating the Investment Potential of Superior Group (SGC) According to Wall Street Analysts

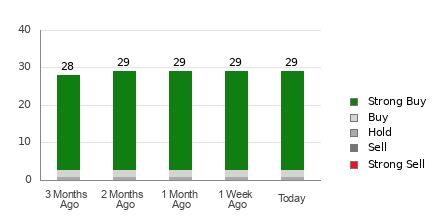

Superior Group (SGC) currently holds an average brokerage recommendation (ABR) of 1.00 on a scale of 1 to 5, indicating a “Strong Buy.” This ...

Top Momentum Stock Picks for December 12th

**Kohl’s Corporation (KSS) has been assigned a Zacks Rank #1 (Strong Buy) as of December 12, 2023, following an impressive 87.9% increase in the ...

Oil-Dri Reports Year-Over-Year Q1 Earnings Drop Due to Challenging Comparisons

“`markdown Shares of Oil-Dri Corporation of America (ODC) have decreased by 6.7% following the release of its first-quarter fiscal 2026 results for the period ...

Kewaunee Reports Yearly Net Sales Growth Despite Q2 Earnings Drop

Kewaunee Scientific Corporation (KEQU) reported a 1.3% decline in shares following its second quarter results for fiscal 2026, while the S&P 500 rose by ...

Evaluating the Investment Potential of Vital Farms (VITL) Amid Optimistic Wall Street Insights

Vital Farms (VITL) currently has an Average Brokerage Recommendation (ABR) of 1.94 based on assessments from nine brokerage firms, indicating a strong buy sentiment. ...

Essential Insights Before Investing in Marvell (MRVL)

**Marvell Technology (MRVL) receives a bullish average brokerage recommendation of 1.14, signaling a strong buy trend.** This assessment is derived from the ratings of ...

Top Momentum Stock Picks for December 11th

“`html Topgolf Callaway Brands Corp. (MODG) has a Zacks Rank #1 (Strong Buy) as of December 11, 2023. Its current year earnings estimate has ...

IDT Stock Declines After Strong Q1 Earnings Report

“`html IDT Corporation reported its earnings for the quarter ended October 31, 2025, with total revenue rising 4.3% year-over-year to $322.8 million. Net income ...

Top 3 Finance Stocks to Consider as Interest Rates Drop Again

“`html The Federal Reserve cut rates by 25 basis points on December 10, lowering the benchmark federal funds rate to a range of 3.5-3.75%, ...