Cathie Wood Pivots: Why She’s Betting on AMD Over Nvidia

Cathie Wood stands out as a prominent figure among Wall Street investors. As the CEO of ARK Invest, she is known for her strong beliefs in emerging companies that aim to revolutionize established industries.

Nvidia has become synonymous with artificial intelligence (AI), largely due to its graphics processing units (GPUs), which are fundamental to generative AI advancements. Over the past two years, Nvidia’s growth has been remarkable and seemingly unyielding.

Start Your Mornings Smarter! Get the latest Breakfast news in your inbox every market day. Sign Up For Free »

However, true to her investing style, Wood has recently been purchasing stock in a competing GPU company rather than Nvidia. This semiconductor firm stands out for its attractiveness based on its growth potential and current low stock price.

Let’s explore this chip company and why it might become a significant player in the semiconductor industry soon.

Wood’s Growing Interest in a Compelling Chip Stock

In the past three months, ARK Invest has been steadily increasing its shares in Advanced Micro Devices (NASDAQ: AMD).

| Category | October | November | December |

|---|---|---|---|

| AMD shares bought | 122,279 | 156,637 | 156,561 |

Data source: ARK Invest

Beginning in late October, Wood began acquiring AMD shares across four of her firm’s exchange-traded funds (ETFs): the ARK Space Exploration & Innovation ETF, ARK Autonomous Technology & Robotics ETF, ARK Next Generation Internet ETF, and ARK Innovation ETF.

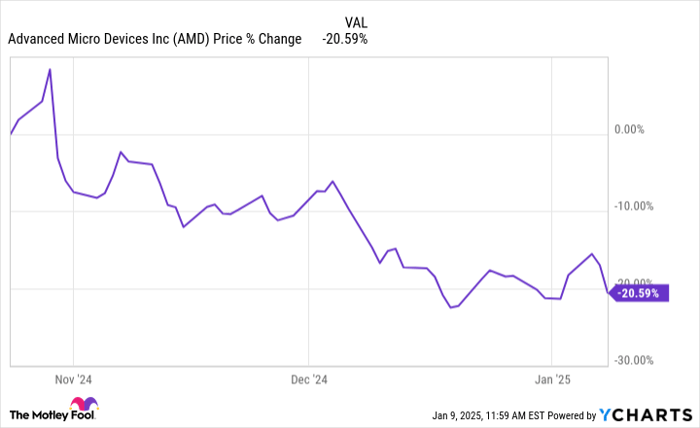

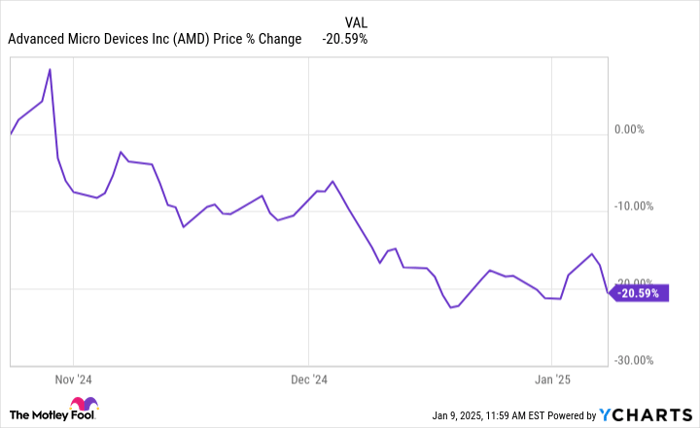

AMD data by YCharts.

Since Wood started buying AMD on Oct. 24, the stock has decreased by about 21% as of January 9. Below, I will analyze the reasons behind this decline and explore why it may be worthwhile for investors to follow Wood’s example and buy the stock while it’s down.

Why AMD Might Be Poised for Growth

AMD competes directly with Nvidia in the data center GPU sector. Despite Nvidia holding an impressive 90% market share, there’s still potential for AMD.

My take is that AMD has a real chance. Nvidia faced virtually no competition in the GPU market for the past couple of years, allowing it to set high prices for its chips and dominate the market.

During this time, AMD worked diligently to gain a foothold, gathering approximately 10% market share in data center GPUs over the last year, according to Jon Peddie Research.

The momentum follows the launch of AMD’s MI300 accelerator chip, which serves companies like Microsoft, Oracle, and Meta Platforms. Notably, these companies also purchase Nvidia GPUs but are now integrating AMD’s chipsets, allowing AMD’s data center GPU business to grow at a pace comparable to Nvidia’s. Interestingly, while Nvidia’s growth remains significant, it has begun to show signs of deceleration.

Looking ahead to 2025 and 2026, AMD is set to introduce additional GPUs in response to Nvidia’s upcoming Blackwell and Rubin chipsets. I believe AMD’s rapid growth in data center GPUs is just beginning. As spending on AI infrastructure increases in the coming years, the company could significantly challenge Nvidia—particularly regarding pricing strategies.

Image Source: Getty Images

A Look at AMD’s Valuation

The decline in AMD’s stock has led to a reset in its valuation. Currently, shares hover near 52-week lows. The company’s forward price-to-earnings multiple (P/E) of 24 aligns closely with that of the S&P 500. This similarity suggests that investors may see AMD’s potential for return as comparably favorable to that of the broader market.

Given that AMD stands as the second-largest player in the crucial AI chip market, the negative sentiment surrounding this stock is puzzling.

I believe Wood is making a strategic decision by continuing to accumulate shares at this current price point. Investors with a long-term perspective who seek undervalued growth opportunities should consider AMD now.

Where to Invest $1,000 Right Now

Our analyst team often has valuable stock insights, and it pays off to listen. After all, Stock Advisor’s average total return is 865%—an impressive outperformance compared to the S&P 500’s 170%.*

They have recently disclosed their picks for the 10 best stocks to invest in right now, with Advanced Micro Devices making the cut. Additionally, there are nine other stocks worth considering.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Randi Zuckerberg, former director of market development at Facebook, and sister of Meta’s CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool also recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.