Cathie Wood Invests in Semiconductor Stocks Amid AI Surge

Cathie Wood is recognized for investing in emerging technologies, particularly genomics and electric vehicles. Her portfolio at ARK Invest often features lesser-known stocks, but she is now focusing on more mainstream investments, particularly in artificial intelligence (AI) and semiconductors.

Recent Investments in AI Chip Stocks

ARK Invest has eight exchange-traded funds (ETFs) focused on various themes. The largest holdings include Tesla, Coinbase Global, Roku, Palantir Technologies, Robinhood Markets, and Archer Aviation. Wood supplements these positions with established companies.

Wood has invested in mainstream AI stocks, holding shares of Amazon and Alphabet. She appears to be balancing more speculative investments with established firms benefitting from AI services.

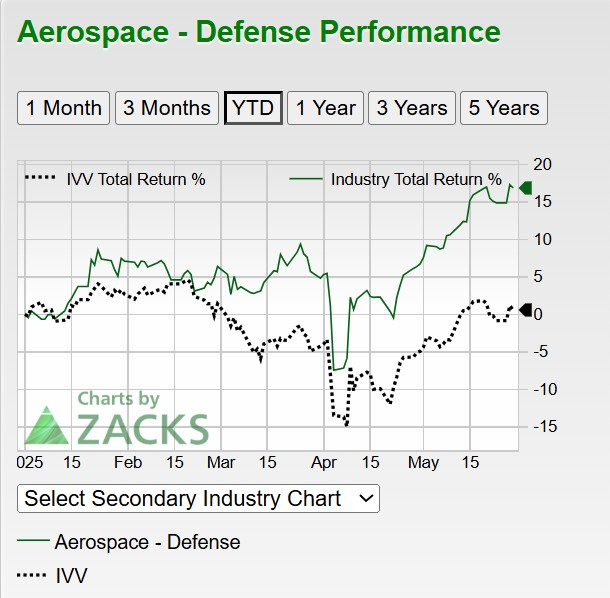

In recent months, Wood has been increasing her holdings in semiconductor companies. She re-entered a position in Nvidia during the Nasdaq sell-off earlier this year and recently purchased shares in Advanced Micro Devices (AMD).

Wood’s latest move involves acquiring a significant position in another AI semiconductor stock, which may prove to be a strategic decision.

ARK Invest Acquires Shares of Taiwan Semiconductor Manufacturing

Recent trading data indicated that ARK purchased 241,047 shares of Taiwan Semiconductor Manufacturing (NYSE: TSM) on May 19 and 20. This marks ARK’s first substantial investment in TSMC in years.

TSMC specializes in foundry services, crucial for companies like Nvidia, AMD, and Qualcomm. AI infrastructure spending is anticipated to reach trillions of dollars over the next decade, indicating continued demand for TSMC’s services.

TSMC holds a pivotal role in the semiconductor industry, generating benefits from the broader AI market dynamics rather than relying on specific chip designs.

Current Stock Outlook for Taiwan Semiconductor

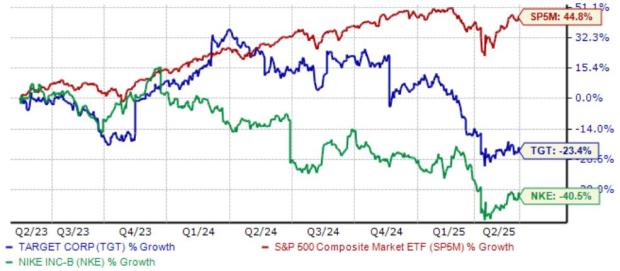

Over the past year, TSMC shares have increased by 20%, outperforming both the S&P 500 and Nasdaq Composite. Despite this growth, shares appear attractively priced.

TSMC’s forward price-to-earnings (P/E) ratio is currently about 20.8, comparable to the S&P 500 average. Given the strong demand for AI and TSMC’s critical role, its prospects are promising.

Investment Considerations

Before investing in Taiwan Semiconductor, potential investors should consider that it was not included in the Motley Fool‘s recent list of the top 10 stocks to buy. Historical performance shows significant returns for stocks recommended on such lists.

Investors may want to follow Wood’s example and consider TSMC along with other semiconductor stocks for long-term growth.

The views expressed are those of the author and do not necessarily reflect those of Nasdaq, Inc.