Tesla Faces Challenges Amid Contrarian Predictions from Cathie Wood

Ark Invest’s Cathie Wood continues to back her bold analysis of Tesla (NASDAQ: TSLA), despite it diverging from mainstream views. In March, Wood provided an ambitious price target for Tesla stock, predicting it could reach $2,600 within five years. This projection is over 10 times its current price of around $240, which could elevate the company’s market capitalization to nearly $10 trillion, excluding share dilution.

While contrarian investments can sometimes yield positive results, I believe Wood’s price target for Tesla is exceedingly optimistic. The electric vehicle and technology company is currently grappling with slowing sales, decreasing deliveries, and a lack of new, viable product introductions.

Wondering where to invest $1,000 now? Our analysts just revealed their top 10 stocks. Learn More »

In contrast to Wood’s projection, I forecast a decline in Tesla’s stock price to around $26. Here’s why.

Slumping Deliveries and Growing Inventory

In recent years, CEO Elon Musk’s attention has been split among various ventures, including multiple political pursuits. However, Tesla’s core business remains focused on manufacturing and selling electric vehicles (EVs), particularly the Model 3 and Y lines. Improved sales of these models are essential for the company’s growth.

The first quarter of 2025 showed troubling trends for Tesla’s EV division. Deliveries plummeted to 337,000, marking a 13% decline year-over-year and the lowest figure since Q2 2022. The waning demand for its EV products could be attributed to intensified competition and consumer boycotts against Musk’s endeavors. Compounding these issues, the company is significantly lowering its average selling prices for vehicles, adversely impacting revenue growth.

At the same time, Tesla is accumulating a troubling inventory surplus, producing 26,000 more vehicles than they sold in the first quarter. Such inventory buildup poses significant risks for an automotive manufacturer. It can adversely affect Tesla’s free cash flow and deplete its cash reserves if the trend continues. Additionally, with rapid vehicle depreciation, unsold cars will further diminish in value over the coming quarters.

Facing this situation is particularly concerning for a company that was once valued at over $1.5 trillion and is now down to a market cap of $770 billion, even as it remains part of the so-called “Magnificent Seven.”

Questionable New Product Rollouts

Many Tesla supporters, including Wood, often highlight the various initiatives the company is pursuing beyond automotive manufacturing. However, the question remains: What tangible products have been delivered? Although Tesla’s energy generation and battery pack segment has shown improvement, it still represents a minor portion of overall operations and struggles to generate substantial profit.

Moreover, new ventures such as the Optimus Robot, self-driving taxis, artificial intelligence applications, and the Semi EV truck have yet to reach mass production. While the Cybertruck has launched, its sales represent a small fraction of total EV business, plagued by recalls and customer dissatisfaction.

Despite claims from Musk and the management team about future innovative offerings to stimulate growth beyond EVs, little has materialized after years of promises. There is no strong reason to believe that significant product rollouts will occur in 2025. Expecting results based solely on optimism is ineffective when faced with the current market realities.

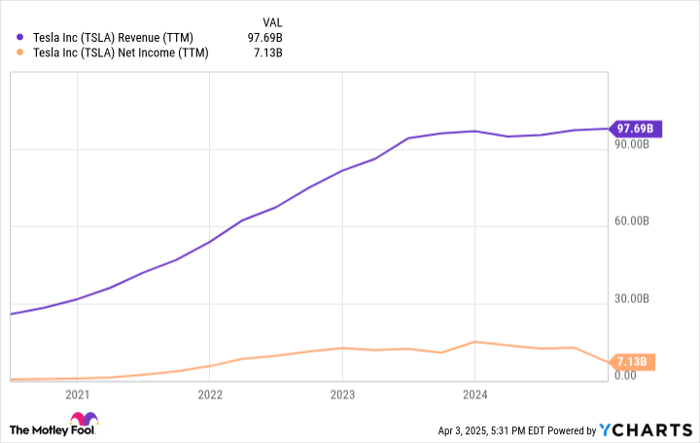

Data by YCharts.

Further Declines Likely for Tesla Stock

Considering the unpredictable economic climate and prevailing anti-Musk sentiment, Tesla’s stock may likely suffer further declines. Revenue has stagnated around $100 billion for the last two years, and recent disappointing delivery figures are expected to lead to a significant sales contraction. Meanwhile, profits have dwindled; net income stood at $7 billion for 2024, and this figure may drop further in 2025.

With a net income of $7 billion against a market cap of $770 billion, Tesla’s current price-to-earnings ratio (P/E) is approximately 117. With projected falling earnings in 2025, the P/E ratio will worsen. A low-growth company with high capital intensity, like Tesla, commands a much lower P/E ratio—around 10 would be appropriate, which would yield a reasonable stock price around $26. This aligns with the valuations of Tesla’s automotive peers.

Considering Tesla’s underlying financial health, a stock price of $2,600 seems improbable. Such projections reflect unattainable aspirations rather than feasible outcomes, likely disappointing investors like Cathie Wood who hold Tesla shares.

A Second Chance for Investment Opportunities

If you’ve ever felt you missed the opportunity to invest in successful stocks, this could be your chance.

Occasionally, our expert analysts recommend a “Double Down” investment strategy for companies poised for growth. If you’re concerned about having missed the investing boat, now is an ideal time to get in before it’s too late. The returns speak for themselves:

- Nvidia: An investment of $1,000 in 2009 would be worth $244,570 today!*

- Apple: A $1,000 investment in 2008 has grown to $35,715!*

- Netflix: If you invested $1,000 in 2004, it would have ballooned to $461,558!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, suggesting there may not be another opportunity like this soon.

Continue »

*Stock Advisor returns as of April 5, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.