Stock Market Surges After Election: What’s Next for Investors?

Major political events often dominate headlines, and few events create as much buzz as a U.S. presidential election. This year, the market reaction following Donald Trump’s election win indicates significant investor expectations.

Trump’s proposed changes, from deregulation to tax reform, have sparked optimism among investors. After news broke that he would return to the White House, the market reacted strongly. Stocks rallied impressively, with the S&P 500 rising 3.78% and the Nasdaq climbing 4.66% between November 6 and 11. Although stocks have recently retreated, a potential recovery is beginning to show.

Understanding Post-Election Stock Performance

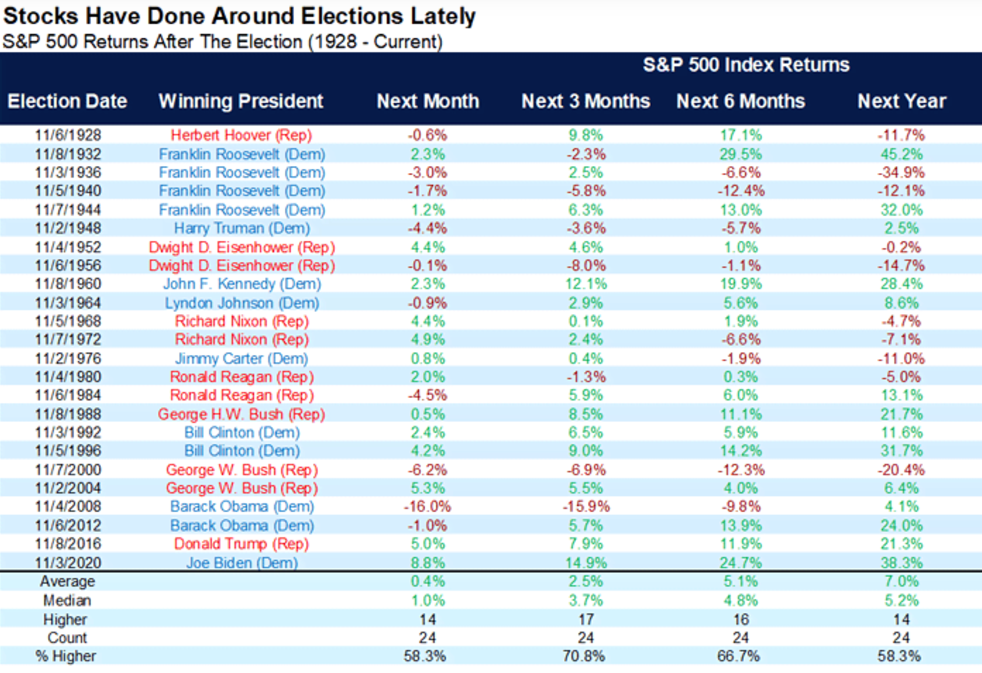

Despite the current excitement, history suggests that stock performance immediately following an election does not predict future gains. A look at the S&P 500 performance after past elections reveals an inconsistent pattern with no clear trend.

For instance, after the 2008 election, the market plummeted by about 16% in the weeks that followed, only to bounce back with a gain of over 20% in the next year. In another example, post-1976 election performance showed a slight 1% rise, followed by a more than 10% drop over the next year.

Conversely, elections can lead to gains both immediately and over the long term, as seen after the 2020 election when stocks surged by roughly 8% shortly after, further increasing approximately 30% within the following year. Conversely, after the contentious 2000 election, stocks dropped 5% and fell another 20% over the next year.

Thus, it is evident that historical stock market performance post-election is unpredictable. This certainly suggests that the recent rally should not be overly relied upon when forecasting the market for the coming year.

Looking Ahead: Positive Outlook for 2025

Despite this uncertainty, we maintain a strong bullish outlook for the S&P 500 in 2025. Factors such as pro-growth policies, stable inflation, ongoing interest rate cuts, and advancements in artificial intelligence are expected to benefit stocks significantly.

One person poised to benefit from these trends is Elon Musk. His connections with Trump may yield favorable policies for his businesses. For instance, rumors suggest Trump plans to relax regulations concerning autonomous vehicles, which would favor Tesla (TSLA) and Musk’s robotaxi ambitions.

However, Musk’s newest startup, xAI, may ultimately emerge as the most lucrative opportunity in 2025. It is regarded as a promising venture within his portfolio that could significantly impact the market.

To learn more about why we believe this company may take off – and how to profit from it – stay informed with our latest market analyses.

At the time of publication, Luke Lango did not hold (either directly or indirectly) any positions in the mentioned securities.

P.S. For ongoing insights and market updates from Luke, check out his Daily Notes on the Innovation Investor and Early Stage Investor subscriber sites.