“`html

Investor Optimism Rises Amid Consumer Concerns and Rate Cut Speculations

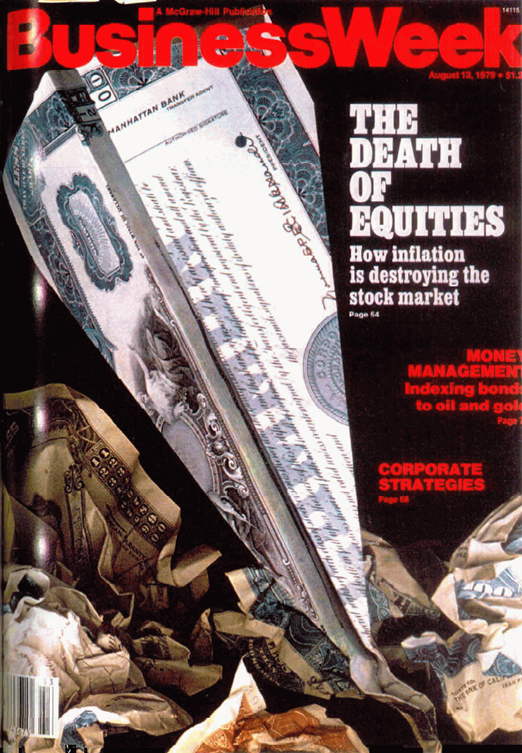

Many investors with experience will remember a famous BusinessWeek cover from 1979. It boldly stated, “The Death of Equities.”

This cover illustrated a tough time for the stock market that began in the early 1970s.

Long-term investors suffered significant losses. From early 1973 to the magazine’s cover release in August 1979, the price return plummeted by nearly 17%.

For those aiming to retire, that was hardly encouraging.

However, if someone had viewed this magazine cover as a contrarian signal to buy, they would have enjoyed a significant turnaround—achieving 17.4% annual gains over the next 20 years, translating into 2,375% cumulative returns. A $20,000 investment would have grown to nearly half a million dollars.

The takeaway is clear: extreme investor sentiment could signal a potential shift in the market’s direction.

A Recent Observation on Market Trends

While it may not have the same weight as the BusinessWeek cover, consider this recent image:

Source: @BarChart

The image shows a bear on life support, paired with a strong bullish stock chart.

Currently, there is noticeable optimism in the market.

The put-to-call ratio has recently dropped to 0.44, the lowest since July 2023 and the second-lowest since March 2022. This ratio indicates that bullish investors show less interest in hedging their portfolios than they have in years.

And why would they hedge?

The S&P has hit 45 all-time highs in 2024—marking its best performance to date in this millennium. Furthermore, the value of the median U.S. household stock portfolio has surged to $250,000, nearly double its level at the beginning of 2023.

Source: The Daily Shot

The essential message: Investors are feeling bullish as their portfolios grow, and fear seems to be diminishing. The fear of missing out (FOMO) is beginning to prevail once more.

It’s almost as if you can hear Warren Buffett’s advice echoing: “Be fearful when others are greedy.”

Caution Amidst Optimism

Nevertheless, it’s important to note that the current market is pricey. Regular readers of the Digest will recognize various indicators emphasizing this point over recent weeks and months.

Yet, high prices do not necessarily mean an imminent market downturn. Historical data reveals that major gains can often occur just before a peak. For instance, between October 20, 1999, and March 9, 2000—a mere 141 days—the Nasdaq surged by 88%.

We should remain open to the possibility of experiencing such a rise, and if we find ourselves years from a peak, it’s still valuable to take advantage of those gains.

As we frequently state in the Digest, price…

“““html

Market Disparities: Understanding the Bull’s Risks Amid Financial Struggles

In the world of investing, if the market wants to climb, that’s our main concern for portfolio values. However, risk must always be taken seriously. History shows us that economic forces, like a hibernating bear, can return with bitterness and anger.

As Financial Optimism Grows, What Economic Signals Should Investors Watch?

Start by examining two distinct market players.

Below is a comparison of the two-year stock performance for Ferrari (in black) and Dollar General (in green).

Source: StockCharts.com

Ferrari’s stock has surged by 162%, while Dollar General has dropped by 65%.

This reflects a trend we’ve discussed throughout the year: the existence of a K-shaped economy. Some sectors are thriving, while others face hardship.

So, how close are we to this imbalance affecting the stock market?

Before we explore that, let’s take a look at the state of “Dollar General” America.

Exploring Wealth Statistics in America

In 2022, 58% of Americans were living paycheck-to-paycheck. By August, that number rose to almost 66%. This trend isn’t limited to low-income individuals.

MarketWatch reports that 48% of people earning $100,000 annually are living pay-to-pay, as are 36% of those making $200,000 or more.

Additionally, credit card debt has skyrocketed to a record $1.14 trillion, as reported by the New York Federal Reserve. Over the past year, 9.1% of credit card balances have slipped into delinquency.

The New York Fed’s September 2024 Survey of Consumer Expectations indicates that consumers believe their chances of missing debt payments in the next three months are the highest since April 2020.

Currently, 50% of Americans hold a credit card balance, with the average interest rate at an alarming 24.72%, per Lending Tree.

As one might expect, American savings rates have plummeted. As of August, the savings rate dwindled to 4.8%, far below the long-term average of 8.5%, according to YCharts.com.

Furthermore, Edmunds reported that 24.2% of Americans with auto loans owe more than their vehicles are worth in Q3 2024. This situation has worsened since a Federal Reserve report in September revealed that auto loan delinquency rates are substantially above pre-pandemic levels.

The point is clear: a significant portion of our nation is struggling financially.

When Will This Impact the Wealthier Investors?

Determining the answer to that question is complex, largely due to Federal Reserve actions.

Currently, the market narrative suggests: “The Fed has begun to cut rates… lower rates are upcoming… they will boost economic growth and support low-income Americans… it’s time to invest in stocks for future gains.”

Yet, how certain are we that multiple rate cuts are imminent? That’s the crucial question.

According to the CME Group’s FedWatch Tool, just a month ago, traders estimated a 64.1% chance of at least 75 basis points rate cuts by December; now that figure stands at 0%.

This shift in outlook follows surprising payroll data and a Consumer Price Index (CPI) report showing stubborn inflation. Such conditions do not typically lead to immediate rate cuts.

Federal Reserve governor Chris Waller commented on Monday that data suggests the economy may not be slowing as much as desired.

He noted that while reacting strongly to data isn’t ideal, the overall information indicates a need to be cautious about the speed of rate cuts compared to September’s decisions.

In a recent CNBC segment, economist Ed Yardeni argued that the Fed should refrain from any additional cuts this year, pointing to persistent inflation as justification.

The interviewer responded with sheer surprise, stating simply, “Wow.”

Bottom line: Be cautious if your investment plans hinge upon significant rate cuts.

What Will Happen to Struggling Consumers If Rate Cuts are Slow?

Prolonged careful rate cuts maintain economic tensions. As financial pressure mounts, consumers may further tighten their spending, ultimately impacting those profiting in the stock market.

Here’s an important perspective:

In assessing yearly market performance, investor emotion often drives stock prices, as it involves how much investors are willing to pay. However, beyond that short time frame, operational metrics like revenue growth become more critical.

As observed in the chart below, sentiment drives stock prices with a 46% influence over one year, while revenue growth contributes just 29%.

Yet, as we extend the timeframe, this dynamic gradually shifts…

“`

Market Sentiment Soars, But Earnings Must Keep Pace for Sustainable Growth

Source: Morgan Stanley / The Future Investors

In the past two years, enthusiastic investors have driven the S&P 500 to remarkable heights largely due to positive sentiment.

To ensure this market continues to rise sustainably, it is crucial for earnings to increase significantly as well.

While earnings have indeed been growing, they have not kept up with investor optimism. For instance, in the previous year, the S&P rose by 24%, while earnings grew by only 2%.

This year’s earnings growth is more robust, yet it still lags behind overall market sentiment. Clearly, earnings hold weight, which makes the Federal Reserve’s policy on interest rates important to watch.

Focus on Sector Strengths for Portfolio Success

Investing smartly involves targeting sectors where earnings are robust, regardless of the overall stock performance.

The market comprises thousands of stocks that perform variably for diverse reasons at different times, reminding us that it’s not a monolithic entity.

One sector poised for strong performance due to earnings growth is Artificial Intelligence (AI), according to renowned investor Louis Navellier. However, not all AI stocks will benefit equally.

Attention to AI implementation, cost savings, revenue, and return on investment is essential.

Initially, market excitement can boost short-term stock prices, but long-term profitability hinges on solid fundamentals.

Navellier, known for his data-driven investment strategies, is concerned that many investors may overlook a critical shift within the AI sector that he anticipates will begin around October 21.

This change may be unexpected, but it presents an opportunity. He suggests that there are just days left to position oneself for this significant market movement, which could potentially yield sixfold returns—without investing in well-known names like Nvidia.

Such a proclamation carries weight, especially given Navellier’s past success, including gains of up to 37,000% from his Nvidia recommendation. His recent insights indicate a new method to capitalize on the AI boom, demonstrating substantial profits. For instance, one suggested AI energy stock has already doubled in value.

However, he cautions against poor investment decisions in the AI field, and he notes that some investors are opting for safer Treasury bills, which may not be the best strategy either.

Louis has developed a presentation outlining a more effective approach to investing in AI.

Instead of worrying about the bull market’s sustainability, economic inequality, or Federal Reserve actions, he recommends focusing on high-quality AI stocks that exhibit strong fundamentals.

Navellier warns that investing carelessly in early-stage AI stocks can lead to substantial losses, echoing sentiments he’s shared over his 47 years on Wall Street.

Understanding upcoming market trends could present excellent investment opportunities in 2024, often faster than expected.

To access his research, click here.

In Conclusion, Navigating Market Shifts for Profit

While positive sentiment fuels the current market rally, it’s important to remain mindful of the changing dynamics beneath this upward trend.

The bearish outlook isn’t fully eliminated yet.

Best wishes for your investments,

Jeff Remsburg