Cboe Global Markets Announces Quarterly Dividend

Cboe Global Markets made waves in the financial markets on February 9, 2024, by announcing a regular quarterly dividend of $0.55 per share ($2.20 annualized). This declaration, a powerful statement of stability and confidence in the company’s performance, comes on the heels of a series of exceptional financial achievements. Investors, enticed by the promise of solid returns, are now keenly eyeing Cboe’s stock.

Historical and Current Analysis of Dividend Yield

At the current share price of $186.69 per share, the stock’s dividend yield stands at 1.18%. Comparing this to data collected over the past five years, the average dividend yield has been 1.48%, with the lowest reported at 1.08% and the highest at 2.02%. The deviation of yields, measured at 0.20 (n=232), tells a striking story: the current dividend yield is now 1.51 standard deviations below the historical average – a powerful indication of the stock’s undervaluation.

This dramatic statistic underlines the enticing prospects the company now offers to its investors. Furthermore, the dividend payout ratio of 0.30 signifies responsible financial management – a perfect equilibrium of rewarding shareholders and retaining capital for growth.

Market Sentiment and Shareholder Response

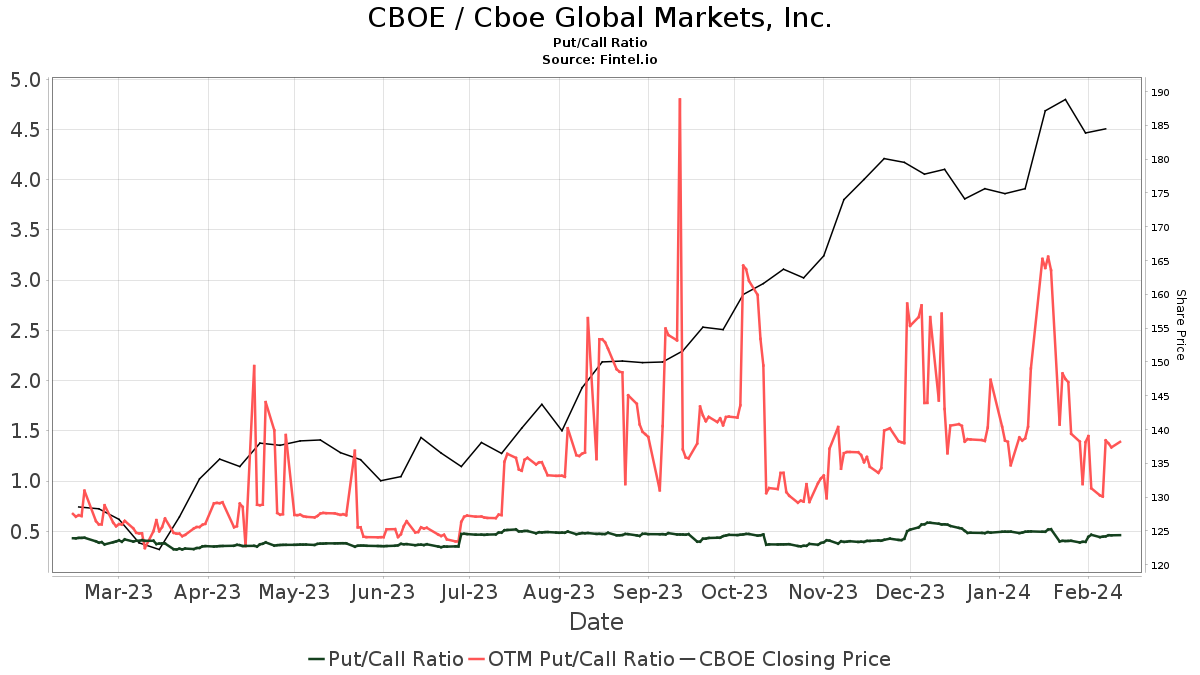

As of the most recent quarter, 1461 funds or institutions reported positions in Cboe Global Markets, marking a significant 9.52% increase. The average portfolio weight of all funds dedicated to CBOE rose by 2.55%. Even more impressively, Cboe’s put/call ratio of 0.47 paints a bullish outlook, reflecting market confidence and investor optimism.

Adding to the fervor, the consensus analyst price forecast presents a 2.63% upside, with the average one-year price target sitting at $191.60. This points to a promising trajectory for the company, setting the tone for a bright and lucrative future.

Cboe Global Markets Background and Investor Confidence

Cboe Global Markets, a pioneer in market infrastructure and tradable products, has consistently provided top-notch trading, clearing, and investment solutions to market participants worldwide. Its commitment to offering a trusted, inclusive global marketplace, coupled with leading products and technology, has carved a path towards a sustainable financial future for investors.

The company’s 3-Year dividend growth rate of 0.31% is a testament to its dedication to shareholder value, and the recent dividend declaration adds to this confidence. Evidently, investor sentiment is on the rise, buoyed by a basket of positive financial indicators and market data.

Institutional Holdings and Market Position

Notable institutional investors, such as Vanguard Total Stock Market Index Fund Investor Shares and Geode Capital Management, have recently demonstrated strong faith in Cboe Global Markets. Their strategic adjustments in portfolio allocation are a clear nod to the rising prominence and value of the company.

Vanguard 500 Index Fund Investor Shares, Viking Global Investors, and Vanguard Mid-Cap Index Fund Investor Shares have also displayed significant interest in Cboe, reinforcing the growing appeal of the company to seasoned investors.

Conclusion

With Cboe Global Markets paving the way for a new era of financial prosperity, this dividend declaration marks the amplification of investor optimism and confidence in the company’s trajectory. The signs are clear: Cboe Global Markets is primed for an upward trajectory, and investors are taking notice. This is an exciting time to be on the Cboe bandwagon, and the journey is only just beginning.