In the current landscape of uncertainty and unpredictability, Celanese Corporation (CE) continues to defy odds and surge ahead, fueled by a potent mix of strategic acquisitions and robust productivity measures.

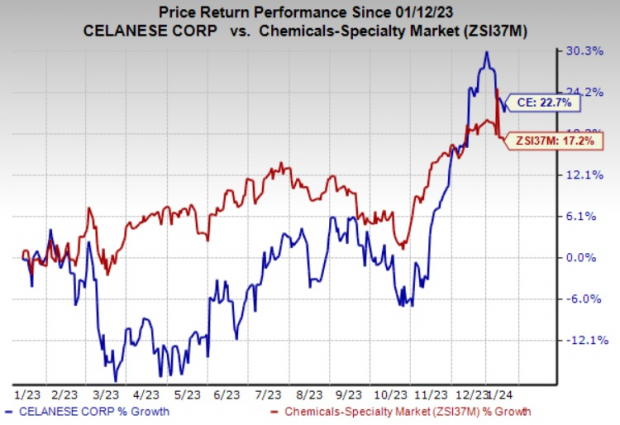

As a leading figure in the chemical and specialty materials domain, Celanese is not merely treading water in the face of challenges such as demand softness and customer de-stocking that plague certain end markets. Instead, the company has notched up an impressive 22.7% increase in its stock value over the past year, outperforming its industry, which saw a 17.2% rise.

Image Source: Zacks Investment Research

Celanese, a Zacks Rank #3 (Hold) stock, attributes its success to a series of shrewd decisions and investments. The company is riding high on its cost and productivity initiatives, investments in high-return organic projects, and the synergies garnered from recent acquisitions.

The acquisition of the majority of DuPont’s Mobility & Materials (“M&M”) business has fueled Celanese’s growth in high-value applications, contributing a substantial $125 million to the company’s operating EBITDA in the third quarter of 2023, marking a robust 15% sequential increase. Moreover, strategic acquisitions of SO.F.TER., Nilit, Omni Plastics, and Elotex have all played a critical role in expanding Celanese’s footprint and bolstering its earnings prospects.

Another feather in Celanese’s cap is the purchase of Exxon Mobil’s Santoprene business, which has significantly broadened the company’s portfolio of engineered solutions, giving it an edge in the fiercely competitive market. All these moves have set the stage for a burst of earnings expansion, particularly in the Engineered Materials segment.

The company’s relentless focus on driving productivity has been a key pillar in its strategy. A slew of cost reduction capital projects and other productivity actions are expected to provide the necessary support to its margins, ensuring sustained profitability.

To navigate the uncertain terrain of the market, Celanese is proactively implementing various strategic initiatives. These include fortifying its commercial teams, realigning production and inventory levels as per demand, implementing cost-saving measures, and optimizing cash flow. The goal is to generate robust cash flow and continue the trajectory of earnings growth.

However, Celanese is not immune to challenges, grappling with soft demand and customer de-stocking in select end markets. Although the company witnessed weak demand and continued customer de-stocking in the third quarter of 2023, its proactive initiatives aim to counter these headwinds and steer the ship in the right direction.

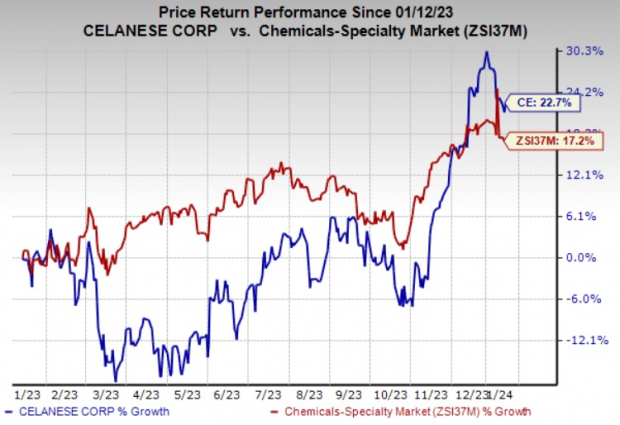

Celanese Corporation Price and Consensus

Celanese Corporation Price and Consensus | Celanese Corporation Quote

Stocks to Consider

While Celanese continues to make waves in the basic materials space, there are other stocks worth considering. Cameco Corporation (CCJ), Carpenter Technology Corporation (CRS), and Cabot Corporation (CBT) are shining stars in this arena.

The projected earnings growth rate for Cameco Corporation stands at an extraordinary 156% for the current year, with the stock soaring by an impressive 76% over the past year. Carpenter Technology Corporation boasts a year-over-year surge of 247.4% in earnings, further bolstering its status as a Zacks Rank #1 stock. As for Cabot Corporation, a year-over-year rise of 22.3% is on the cards, and with a Zacks Rank #2, it promises a compelling investment opportunity.

As Celanese and its peers continue to chart new territories and forge ahead, the basic materials landscape is rife with opportunities for investors seeking promising prospects.