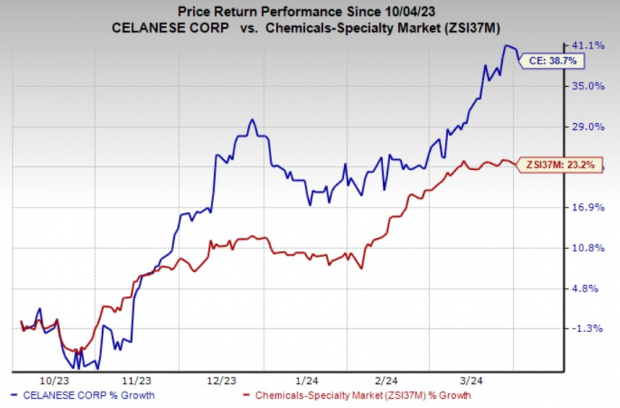

The journey of Celanese Corporation has been nothing short of remarkable as its CE shares have ascended a staggering 38.7% over the previous six months. The company’s meteoric rise has not only eclipsed its industry peers’ 23.2% uptick but has also dwarfed the S&P 500’s modest 22.3% climb during the same period.

Delve into the intriguing factors propelling this prominent chemical and specialty materials producer’s stock to such great heights.

Image Source: Zacks Investment Research

The Impact of Acquisitions & Productivity on CE’s Growth

Celanese, a Zacks Rank #3 (Hold) stock, is reaping the rewards of its productivity initiatives, investments in organic projects, and astute acquisitions despite challenges posed by soft demand and customer destocking in select end markets.

The company’s adept pursuit of acquisitions has opened new vistas for growth, investment, and synergies. The integration of DuPont’s Mobility & Materials (“M&M”) business has empowered Celanese to expand its footprint in high-value applications. In the fourth quarter of 2023, M&M contributed $120 million to the operating EBITDA of the Engineered Materials segment. Celanese anticipates unlocking incremental M&M synergies of at least $150 million in 2024.

The acquisitions of SO.F.TER., Nilit, and Omni Plastics are also poised to bolster earnings expansion within the company’s Engineered Materials segment. Furthermore, the Elotex acquisition has fortified Celanese’s foothold in the vinyl acetate ethylene emulsions domain. Not to be forgotten is the acquisition of Exxon Mobil’s Santoprene business, which has broadened Celanese’s portfolio of tailored solutions across strategic growth domains such as future mobility, medical, and sustainability.

Celanese’s momentum extends into its robust execution of productivity programs encompassing various cost reduction capital projects. These initiatives are slated to underpin its margins in 2024.

The company remains vigilant in implementing strategic maneuvers in response to the volatile market landscape and competitive environs. These actions include fortifying its commercial teams, aligning production and inventory levels with prevailing demand, instituting cost-saving measures, and optimizing cash flow. These endeavors are anticipated to drive solid cash generation and a sustained trajectory of earnings growth.

Celanese is also on a quest to elevate shareholder value and deleverage its balance sheet by generating substantial cash flows. In 2023, it achieved a record operating cash flow of $1.9 billion and free cash flow of $1.3 billion. CE disbursed $305 million to shareholders through dividends in 2023, while simultaneously reducing its net debt by $1.3 billion. The company aims to continue paring down its net debt in 2024, with total annual debt servicing costs expected to plummet by approximately $50 million on a year-over-year basis in 2024 due to its debt repayment and optimization schemes.

Charting the Trajectory of Celanese Corporation

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Exploring Promising Stock Options

In the realm of basic materials, investors may find themselves drawn to well-regarded alternatives such as Carpenter Technology Corporation (CRS), Denison Mines Corp. (DNN), and Innospec Inc. (IOSP).

The Zacks Consensus Estimate for Carpenter Technology’s earnings in the ongoing fiscal year stands at a remarkable $3.94, marking a robust year-over-year surge of 245.6%. CRS has consistently surpassed the Zacks Consensus Estimate, showcasing a 12.2% average earnings surprise over the past year. Additionally, the company’s shares have advanced around 66% in the last year. Boasting a Zacks Rank #1 (Strong Buy), CRS presents a compelling investment opportunity. Why not have a glance at the complete list of today’s Zacks #1 Rank stocks here for more insight?

Demonstrating exceptional prowess, Denison Mines is backed by a Zacks Rank #1. DNN has consistently outperformed the Zacks Consensus Estimate across the last four quarters, displaying an average earnings surprise of 300%. The company’s shares have soared approximately 106% over the past year.

For Innospec, the consensus estimate for its current-year earnings sits at $6.72 per share, signaling a commendable 10.3% year-over-year increase. Featuring a Zacks Rank #2 (Buy), IOSP has outperformed the consensus estimate in each of the preceding four quarters, with an average earnings surprise of 10.5%. Over the last year, the company’s shares have appreciated by 23%.

Could this Semiconductor Stock be Your Next Big Win?

It might be a mere fraction of NVIDIA’s size, but with NVIDIA’s unprecedented upsurge of over +800% post our recommendation, our new champion in the chip space seems primed for exponential growth.

Poised for substantial earnings expansion and an expanding client base, this stock is ideally positioned to cater to the insatiable demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is projected to soar from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Source: Zacks Investment Research

Please note that any views or opinions expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.