Celsius Holdings, Inc. (NASDAQ:CELH) has been riding a high wave for several years, driven by the soaring popularity of its flagship energy drink, CELSIUS. The company has tapped into the consumer demand for functional, healthier energy drinks, flaunting claims that each serving can burn 100-140 calories, boost metabolic rates by 12%, and elevate energy levels for three hours. These assertions, grounded in science, were supported by self-funded studies, illustrating the company’s commitment to product efficacy. Although one might raise an eyebrow at the self-funded nature of these studies, the results speak volumes about the brand’s potential.

A Prime Growth Narrative

Celsius’s exponential growth trajectory is traced back to its pivotal distribution deal with PepsiCo, Inc. (PEP) in 2022. This strategic alliance crowned Pepsi as Celsius’s primary distributor, propelling an easier expansion into new markets. The $550 million investment by Pepsi not only signified a resounding vote of confidence in CELSIUS but also secured a going interest for the beverage giant, in the form of approximately 1.5 million shares of preferred stock, along with first rights to new market distribution. This long-term, unshakable agreement is studded with potential, with the earliest termination window not appearing until 2041.

With a scorching product and a global distribution network at its fingertips, Celsius Holdings is poised to sustain its meteoric growth. The company’s two-pronged approach hinges on amplifying its distribution channels within the United States and launching into fresh territories beyond its borders. The latest earnings report from Q3 2023 revealed that North America commanded a staggering 96% of the total revenue, amounting to $371 million. This marked a remarkable 107% surge from the equivalent quarter the previous year.

This remarkable revenue uptick is attributed to expanded distribution points, increased variety of SKUs, and improved in-store placement, fostering triple-digit revenue growth in North America. Noteworthy developments include securing 2,000 Jersey Mike’s and 3,000 Dunkin Donuts locations across the United States, elevating the brand’s visibility in the food service channel. Furthermore, it has made inroads in various settings such as colleges, hotels, and even casinos, leaving an indelible imprint. Evidently, these strategic moves have significantly augmented CELSIUS’s market share, surging to 10.5% in Q3 2023 from 4.4% in Q3 2022, securing its position as the third-largest energy drink brand in the United States.

Despite a meager 4% of total revenue hailing from international waters, Celsius Holdings’ agreement with PepsiCo presents a lucrative avenue for future growth, which will soon be showcased with its foray into Canada. Delving into its financial performance over the last three fiscal years illustrates an astronomical revenue surge, catapulting from $130 million in 2020 to a staggering $653 million in 2022, a colossal 400% surge. With a steady stream of new flavors and products, Celsius Holdings is evidently primed to keep this growth trajectory on an upward slant.

A Look at Valuation

As with all giants of growth, Celsius Holdings bears a lofty valuation. The comparisons with industry behemoths showcase that CELH consistently garners a higher price/sales multiple compared to Monster Beverage Corporation (MNST). This premium is underpinned by CELH’s robust revenue growth, consistently achieving triple-digit growth while MNST lingers behind at low double-digit growth.

While profitability figures might not currently be singing a glorious tune for CELH, the company’s steadfast focus on scaling and expanding through the PepsiCo distribution network is fueling a surge in margins. EBITDA growth over the past twelve months has pivoted to the mid-double digits, at a commendable 15%, albeit trailing MNST, which stands at 28%. Despite these disparities, CELH’s profitability trajectory underscores a promising upward swing.

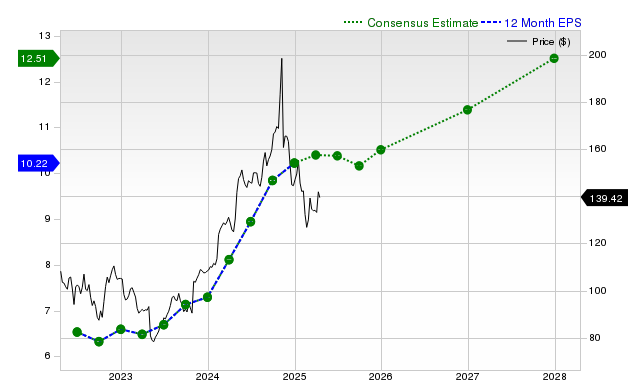

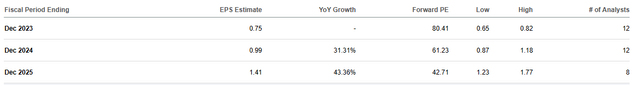

Looking ahead, earnings estimates for fiscal 2024 are perched at $0.99/share, revealing a forward P/E adorned with a 61x handle, indicative of the sanguine expectations riding on the company.

The Unfolding Drama of CELH and the Ultimate Conclusion

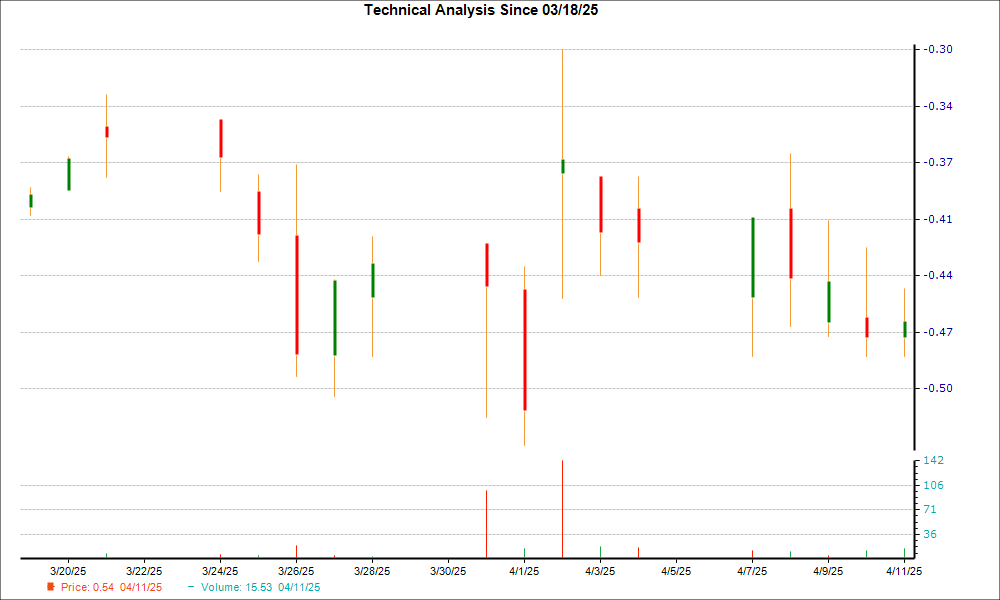

As the financial world turns, investors are riveted by the volatility incurred through the unfolding narrative of Celsius Holdings (CELH). The ebb and flow of potential earnings and risks are juxtaposed in an intricate dance, revealing a compelling saga that stirs the minds of those poised to captivate their investment strategies.

A Pending Liability

The plot thickens as CELH stands on the precipice of uncertainty, encapsulated by an ongoing legal battle with Strong Arm Productions USA, Inc, Flo Rida, and D3M Licensing Group. A jury trial in January 2023 ruled in favor of the latter, awarding a judgment of $82.6 million, affirming CELH’s breach of endorsement and licensing agreements in 2014 and 2016. The weight of this legal burden looms large, casting a shadow of doubt over the company’s financial future.

Amidst this legal quagmire, CELH’s legal team initiates an appeal, prolonging the era of ambiguity regarding the eventual fiscal impact. The company faces a potential payout ranging from $2.1 million to $82.6 million plus interest, a conundrum compounded by the counterintuitive rationale that trails the lower spectrum of this spectrum.

It’s a saga of fiscal acumen and a wry twist of fate as CELH’s legal team contends that the lower sum aligns with the company’s stock price at the time of the breach, a curious juxtaposition that fails to account for the substantial stock appreciation earned by the owners of 750,000 shares at that juncture.

The potential repercussions of this legal strife are significant, with the $82.6 million judgment accruing interest at a rate of 5.52% annually. Should the matter draw to a close in 2025, the company faces the prospect of an approximate $92 million blow, coupled with interest amounting to roughly $325 million in net income, a potential jolt of nearly 30% to the bottom line.

Conclusion

The climax of this financial theater raises questions about prudent investment strategies, casting doubts on the market’s stability in 2024. A perspicacious investor, weighing the scales of risk and reward, may find solace in the profound simplicity at the heart of CELH’s business model—selling energy drinks. The narrative of untapped international expansion, leveraging the distribution network of PepsiCo, entices investors with a tantalizing promise of sustained growth.

The valuation of high-growth companies often adopts the guise of opulence, yet juxtaposed against MNST, CELH’s premium finds purpose in the acceleration of growth rates. The company’s pricing appears commensurate and poised to bestow long-term rewards upon investors who dare to brave the tempestuous seas of heightened volatility.

Indeed, as always, it is imperative for investors to conduct their due diligence, charting a course aligned with their investment proclivities and aspirations. With the denouement of this financial epic yet to unfold, the denizens of the financial world stand poised, eagerly gazing toward the future of CELH, anticipating the next riveting chapter in this unfolding drama.