Setting the Stage

Back in July 2023, an article cautiously rated Celsius Holdings’ stock a hold near $48, citing concern over its lofty valuation, despite being optimistic about its growth potential and newly forged partnership with PepsiCo (PEP).

To date, Celsius Holdings clings tenaciously to resilience, soaring an impressive 70% over the past year, establishing itself as a heavyweight contender in the monumental energy drink sector. Over the last six months, I have closely monitored the stock and am proud to be a shareholder myself. The company’s recent 23% rally only adds to my conviction that CELH is an attractive buy.

An In-Depth Investment Rationale

Celsius Holdings stands out as one of the most promising non-tech growth stocks for the coming years for several compelling reasons.

Firstly, the company commands the third-largest slice of the rapidly expanding energy drink market, surging past the 10% mark. Among major competitors, only Monster (MNST) and Red Bull have a larger share, leaving others trailing at a distant 4% or less. This dominant position forms a sturdy platform for sustained expansion.

Secondly, Celsius is not content with merely domestic success. The recent announcement of an international foray into Canada in collaboration with Pepsi signals the commencement of a potentially significant growth phase. With plans to penetrate major markets like the UK, Germany, Japan, and Australia, Celsius is poised to accelerate its expansion and fortify its global footprint.

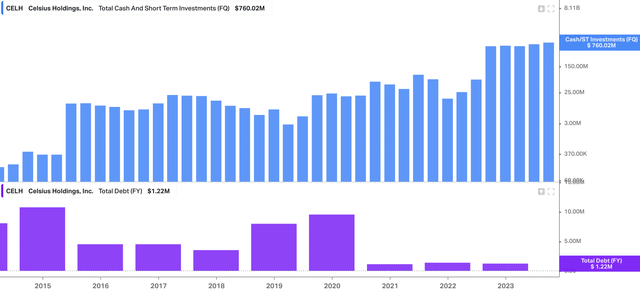

Lastly, Celsius’s expanding market share directly leads to an ever-swelling cash reserve. This financial robustness will not only fuel further international expansion but also enable the company to opportunistically acquire rivals or invest in strategic initiatives, thereby enhancing its long-term growth prospects.

In sum, boasting a dominant domestic market share, a robust international expansion plan, and a rapidly growing cash reserve, Celsius Holdings is well-positioned to seize a significant chunk of the burgeoning energy drink market, making it a compelling investment opportunity for non-tech growth investors.

Celsius’s considerable cash hoard and minimal debt ignite optimism about its prospects. The partnership with Pepsi and a strong presence on social media obviate the necessity for substantial debt-driven growth or extensive marketing campaigns. Consequently, robust cash flow is expected as Celsius expands globally in the years ahead.

This incoming capital is likely to be channeled into research and development for new flavors and returning value to shareholders. As the company matures, an uptick in share buybacks is anticipated, akin to Monster’s strategy of slashing outstanding shares by 18% since 2016.

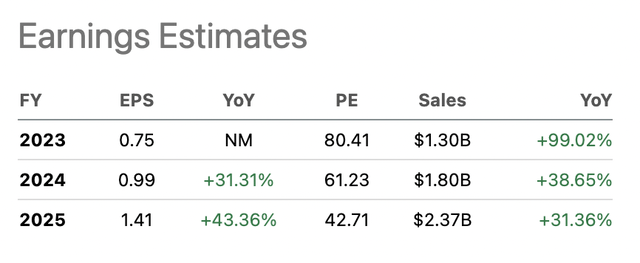

Although the valuation remains lofty, with skeptics arguing it’s stretched, the buoyant growth rate, market share, and margins justify it. Currently trading at 80x 2023 P/E, 61x next year’s earnings, and 43x 2026 estimates, Celsius is undoubtedly pricy. Nevertheless, the likelihood of it reaching bargain levels anytime soon is slim, despite the preference for a more attractive valuation.

Celsius Holdings boasts a commendable 90% five-year sales CAGR, with analysts anticipating sales to nearly double in 2023, followed by consistent growth in the 30-40% range in the subsequent years. Should Celsius replicate its US success in foreign markets, these estimates could soar significantly, also applying to earnings per share (EPS).

While the outcome of Celsius in international markets remains uncertain, the potent blend of their social media dominance, delectable flavors, and constant innovation bodes well in their favor. Furthermore, with only 10 calories, compared to the 100-200+ calories in many competitors, Celsius taps into the escalating consumer demand for healthier options, securing a distinct competitive edge.

On the whole, I firmly believe CELH ranks among the highest-quality growth stocks for investors. Its exponential margin growth and the precedent set by Monster Beverage point to substantial room for further expansion. With a burgeoning cash stash and boundless potential for sustained growth, CELH epitomizes a compelling investment opportunity.

Many investors missed out on the remarkable growth of Monster Beverage. Let’s not replicate that oversight with Celsius Holdings. This burgeoning energy drink company has the potential to carve a substantial niche in the portfolios of long-term investors.

Assessment of Price Targets

Factoring historical average valuation ranges and analyst estimates into the equation, we can craft a price target for the next twelve months. While I lean towards conservative estimates, Celsius Holdings presents a unique challenge.

My analysis yields a projected stock price at a 7.5% discount from my fair value target of $64.50. This equates to a potential risk-to-reward ratio of 2.8x, which has been rounded up to our target goal of 3x.

The Potential Upside of CELH: A Bull-Case Scenario

As an ardent believer in Celsius Holdings, my optimism has been piqued by the company’s product and its potential for expansive growth. This unyielding conviction has led me to envision a bull-case scenario which could yield a remarkable 50% upside for CELH’s stock.

In this optimistic projection, I foresee several factors contributing to CELH’s prosperity:

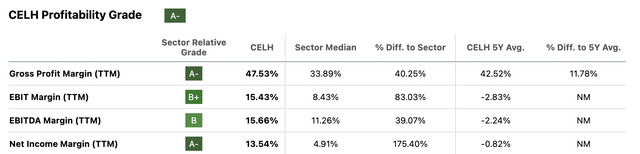

- Continued Margin Expansion: CELH’s gross margins surpassing 50% and bottom-line figures reaching the high teens.

- Outperforming Global Expansion: Higher sales growth and customer retention exceeding initial expectations on a global scale.

- Sustained U.S. Dominance: Continued growth in domestic market share.

- Earnings Beat and Raise: Consistently surpassing analyst estimates and raising guidance.

This potent combination of catalysts, fueled by strong management execution and sustained brand adoption, could drive the stock even higher in the years to come. Despite its impressive five-year growth, I firmly believe CELH has the potential for several more years of exceptional performance.

The Persisting Risks

The risks associated with CELH that I pinpointed previously continue to hold relevance:

1. Intense Competition: The energy drink market is vast and saturated, attracting numerous players striving for a share of the pie. Heightened competition often results in price wars and dwindling profit margins. New entrants may engage in price cuts to gain market share, thereby exerting pressure on CELH’s profitability.

2. Regulatory Concerns: While CELH positions itself as a wholesome alternative with added vitamins and low calories, lingering concerns exist about potential misleading marketing. The presence of other potentially harmful ingredients raises further regulatory issues. A subsequent lawsuit on deceptive claims could tarnish the company’s brand reputation and balance sheet.

3. Valuation Issues: Despite an improved valuation from its previous peak, it still carries risks. Despite CELH’s current profitability, an 80x P/E ratio is challenging to justify in a potential recession or bear market. While looser monetary policy by the Fed could offer some upside, the risk profile remains elevated on the other side of the coin.

A Promising Conclusion

After thorough consideration, I am convinced that Celsius Holdings presents a compelling long-term investment opportunity within a sizable, defensive, and expanding industry. Their delicious and relatively healthy energy drink has garnered consumer loyalty, setting them apart in the market.

CELH possesses a robust balance sheet and, with its growing brand strength, has the potential to evolve into a cash cow in the future. The ongoing partnership with Pepsi has proven immensely beneficial, granting them prime shelf space and facilitating their ultimate goal: global expansion.

I foresee international customers embracing Celsius with the same enthusiasm witnessed in the US. This confidence, along with the stock’s current price and attractive potential for upside, solidifies my position as a long-term investor in CELH.

If the price were to regress to the mid-$50s, I would unquestionably increase my holdings. In fact, anything below $52 would be a boon for any retirement portfolio. CELH should not be underestimated – it is arguably the best non-tech growth stock heading into 2024.