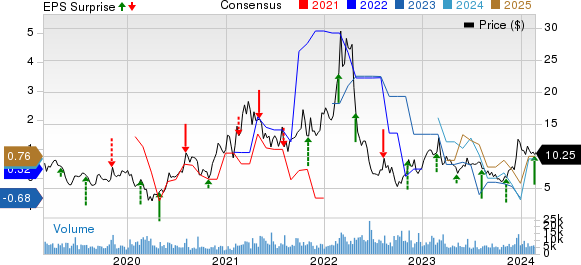

In a twist of fate akin to the ebb and flow of a turbulent market, Century Aluminum Company (CENX) showcased its resilience by recording fourth-quarter 2023 earnings of 30 cents per share. This marked a stark contrast from the year-ago quarter, where the company suffered a loss of $1.24 per share. Against all odds, Century Aluminum managed to surpass the Zacks Consensus Estimate of a loss of 23 cents per share.

Understanding the Numbers: Revenues and Shipments

Despite the commendable earnings performance, Century Aluminum experienced a slight setback in its net sales figures for the reported quarter. With net sales amounting to $512.3 million, the company witnessed a 3.3% decline year over year, missing the Zacks Consensus Estimate of $514.4 million. The decrease in sales was further exacerbated by a 6% sequential drop attributed to lower realized aluminum prices.

On the brighter side, shipments of primary aluminum stood at 173,871 tons, reflecting an increase of approximately 2.6% year over year. Additionally, shipments saw a 1.1% sequential growth, showcasing the company’s capacity to navigate through market fluctuations.

Reflecting on the Full Year: FY23 Results

Zooming out to view the broader landscape, Century Aluminum’s earnings for the full year 2023 amounted to 33 cents per share, a modest increase from the 26 cents reported in the previous year. However, net sales took a hit, plunging by 21.3% year over year to $2,185.4 million. This demonstrates the company’s ability to weather storms while aiming for sustainable growth.

Delving into the Financials and Future Prospects

The financial snapshot of Century Aluminum as of December 31, 2023, reveals a liquidity position of $312.5 million, showing an uptick from the previous quarter. Looking ahead, the company anticipates adjusted EBITDA for the first quarter to range between $5 million to $15 million, considering the dynamics of decreased raw material prices offset by lower value-added product premiums. This strategic outlook signals a proactive approach amidst challenging market conditions.

A Glimpse into Performance and Market Trends

Share performance is a key indicator of market sentiment, with Century Aluminum’s shares witnessing a 3.7% decline over the past year. This trajectory contrasts with a 2.3% rise in the industry, underscoring both the challenges and opportunities inherent in the sector.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks: Navigating the Investment Landscape

Century Aluminum currently holds a Zacks Rank #1 (Strong Buy), signaling optimism among investors. Additionally, other top-ranked stocks in the basic materials realm include United States Steel Corporation (X), Carpenter Technology Corporation (CRS), and Alpha Metallurgical Resources Inc. (AMR).

United States Steel, with a Zacks Rank of 1, has outperformed the Zacks Consensus Estimate consistently over the past year, registering an average earnings surprise of 54.8%. The company’s share price has surged by an impressive 62.7% during the same period.

Carpenter Technology, also sporting a Zacks Rank of 1, exhibited strong performance, beating the Zacks Consensus Estimate in three out of the last four quarters. With an average earnings surprise of 12.2%, the company’s shares saw a notable increase of 33.7% over the past year.

Alpha Metallurgical Resources Inc. stands out with a significant upward revision in current-year earnings estimates, reflecting positive market sentiment. With an impressive trailing four-quarter earnings surprise of 9.6%, the company’s shares have soared approximately 128.8% over the past year.

Just Released: Zacks Top 10 Stocks for 2024

Heralding a new chapter in investment opportunities, the Zacks Top 10 Stocks for 2024 present a curated selection with enormous potential. With a track record of nearly tripling the S&P 500’s growth, these top performers have been meticulously chosen to offer investors a gateway to success.

The insights presented reflect the author’s perspective and do not necessarily align with those of Nasdaq, Inc.