Cerence: A Leader in Automotive AI with Strong Year-to-Date Gains

Cerence (CRNC) has experienced a remarkable 75.1% increase in share prices this year, significantly exceeding the broader Zacks Computer and Technology sector’s rise of 3.5% and the Zacks Computers – IT Services industry’s growth of 1.3%.

Positive First Quarter Results for Cerence

Since the release of its first-quarter fiscal 2025 results on February 7, CRNC stock has climbed 8%. The company reported a non-GAAP loss of 3 cents per share, surpassing the Zacks Consensus Estimate by 88.89%. Additionally, revenues hit $50.9 million, exceeding the consensus estimate by 3.62%, although this represented a significant 63.2% drop compared to the previous year.

Market Impact and Technology Reach

In the first quarter of fiscal 2025, Cerence’s technology was utilized in 51% of auto production. The company shipped approximately 11 million vehicles equipped with its technology during this period, a growth of 2.6% from the prior quarter but down 10.5% year over year. On a positive note, the number of vehicles produced using Cerence’s connected services increased by 5.1% year over year and 5.6% sequentially.

CRNC’s AI technology now powers over 500 million vehicles worldwide, which underscores its influence in the automotive AI market. This growth is fueled by the integration of generative AI (Gen AI), record platform launches, and a robust partner network. Notably, collaborations with NVIDIA (NVDA) and Microsoft (MSFT) further strengthen Cerence’s standing in the industry.

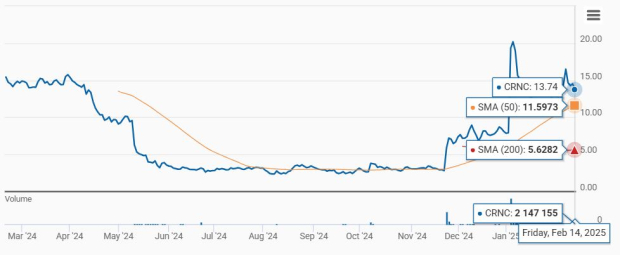

Stock Performance Overview

Image Source: Zacks Investment Research

Revenue Guidance Looks Strong for FY25

Cerence anticipates revenues for fiscal 2025 to fall between $236 million and $247 million. Adjusted EBITDA is projected to be between $15 million and $26 million. For the second quarter of fiscal 2025, CRNC expects revenues between $74 million and $77 million, which includes an estimated $20 million from fixed contracts.

Currently, the Zacks Consensus Estimate for second-quarter fiscal 2025 revenues stands at $76.57 million, indicating a growth of 12.89% from the prior year. Moreover, the consensus estimate for earnings is projected at 32 cents per share, reflecting an increase of 30 cents over the past month.

Cerence Inc. Price and Consensus

Cerence Inc. price-consensus-chart | Cerence Inc. Quote

Expanding Clientele Signals Future Growth

Cerence’s future prospects are buoyed by a growing automotive clientele. In fiscal 2024, the company secured 10 new customers and launched six Gen AI programs, indicating strong progress in deploying advanced AI solutions. Major automakers like Volkswagen, BMW, and Renault have adopted Cerence’s voice assistance systems to improve in-car experiences.

The company set a record with 22 platform launches in 2024 and recently inked a multi-year agreement with JLR to develop an advanced in-car experience. Audi has also opted for Cerence’s Gen AI technology to enhance its in-car assistant.

Partnerships Enhance CRNC’s Market Position

The launch of the Cerence Automotive Large Language Model (CaLLM), powered by NVIDIA, promises to revolutionize in-car computing by addressing challenges faced by automakers and elevating user experiences through advanced generative AI features. CRNC plans to introduce next-generation products based on its CaLLM models to the market.

Furthermore, Cerence’s collaboration with Microsoft aims to integrate OpenAI’s ChatGPT model into vehicles via Microsoft Azure, enhancing user experiences by merging automotive technology with cloud-based resources. Additionally, Tuya (TUYA) is teaming up with Cerence to offer multilingual text-to-speech capabilities for cloud developers targeting the two-wheeled vehicle market.

Valuation Concerns for CRNC

Despite these advantages, Cerence’s shares are currently considered overvalued, as indicated by a Value Score of D. Additionally, CRNC shares are trading above both the 50-day and 200-day moving averages, suggesting a bearish outlook.

Current Trading Trends

Image Source: Zacks Investment Research

Final Thoughts

Cerence is facing significant competition in the automotive voice assistance sector from companies like SoundHound AI, which also provides voice recognition and conversational AI solutions. Challenges such as declining automotive production, a slowdown in electric vehicle manufacturing, cost pressures, and weaknesses in the Chinese market may hinder CRNC’s growth potential.

Given its high valuation and a rapidly evolving competitive landscape, investors may want to hold off before making new investments. Cerence currently holds a Zacks Rank #3 (Hold), indicating it may be prudent to wait for better entry points in the stock.

Discover the Latest Recommendations

We’re serious about offering valuable insights!

For a limited time, we provide access to all our stock picks for just $1, a unique opportunity to explore our portfolio services including Surprise Trader, Stocks Under $10, Technology Innovators, and many others that saw significant gains in 2024.

Want to stay updated? Download the 7 Best Stocks for the Next 30 Days for free to see our latest recommendations.

Cerence Inc. (CRNC): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tuya Inc. Sponsored ADR (TUYA): Free Stock Analysis Report

To read the complete article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.