CF Industries Holdings, Inc. (CF) posted a drop in fourth-quarter 2023 earnings to $1.44 per share from $4.35 in the year-ago quarter. Adjusted earnings, excluding one-time items, were $1.49 per share, missing the Zacks Consensus Estimate of $1.56. The company reported a 40% year-over-year decrease in net sales to $1,571 million for the quarter, although this surpassed the Zacks Consensus Estimate of $1,486.7 million.

The decline in sales was attributed to lower average selling prices due to reduced global energy costs, reflecting the diminished global market-clearing price demanded to meet global demand. However, sales volumes increased for urea ammonium nitrate, ammonia, and diesel exhaust fluid sales.

Segment Review

The Ammonia segment saw net sales decrease by 38% year over year to $495 million, while sales in the Granular Urea and Urea Ammonium Nitrate segments fell by around 35% to $392 million and 51% to $418 million, respectively. The Ammonium Nitrate segment’s sales dropped by 37% year over year to $120 million. The company experienced varied average selling prices and adjusted gross margins for these segments, mainly due to fluctuations in average selling prices and realized natural gas prices.

FY23 Results

For the full year 2023, CF Industries’ earnings amounted to $7.87 per share, down from $16.38 per share in the previous year, while net sales declined around 41% to $6,631 million.

Financials

The company ended 2023 with cash and cash equivalents of $2,032 million, showing a decrease of approximately 13% year over year. Meanwhile, long-term debt remained flat at $2,968 million. Net cash provided by operating activities was $480 million, down around 18% year over year.

In 2023, CF Industries repurchased around 7.9 million shares for $580 million, contributing to a total of 2.9 million shares repurchased for $225 million during the fourth quarter.

Outlook

CF Industries highlighted the constructive global nitrogen supply-demand balance in the near term and anticipates a resilient global nitrogen demand due to robust agricultural applications and a recovering industrial demand. Nevertheless, it acknowledged the challenging production economics due to natural gas costs and availability in major producing regions.

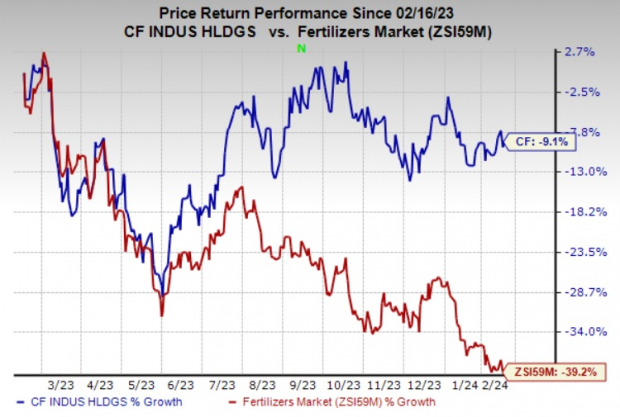

Price Performance

CF Industries’ stock declined by 9.1% in the past year, comparing unfavorably to the 39.2% fall of the fertilizer industry as a whole.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, CF holds a Zacks Rank #3 (Hold). For investors seeking alternatives in the basic materials space, stocks to consider include Carpenter Technology Corporation (CRS), Alpha Metallurgical Resources Inc. (AMR), and Hawkins, Inc. (HWKN).

Carpenter Technology Corporation is expected to see a year-over-year surge in earnings and holds a Zacks Rank #1 (Strong Buy), while Alpha Metallurgical Resources Inc. and Hawkins, Inc. are also favorable options with upward-revised earnings estimates and strong stock performance in the past year.

Investing Options

Zacks experts have identified a potential investment set to double, called a “watershed medical breakthrough”. With thousands of stocks in consideration, it is pegged for substantial upside, providing a timely, emerging investment opportunity amidst its bear market lows.

This investment has the potential to equal or surpass other recent Stocks Set to Double, and the investing community is following it quite closely.

The Incredible Rise of Top Stocks Like Alphabet and NVIDIA

Investing in stocks isn’t always a walk in the park. It requires astute judgement, a keen understanding of market trends, and an awareness of strategic opportunities. The stock market, much like the ocean, is unpredictable – one moment it’s calm, the next, there’s a massive surge.

Unprecedented Growth

Consider the phenomenal growth of stocks like Alphabet, which shot up by a jaw-dropping 143.0% in just over 9 months, and NVIDIA, which exploded by 175.9% in a mere year. These are the kinds of numbers that make investors’ hearts race—skyrocketing returns that are enough to make heads spin.

The Wild Ride of Stock Trading

Stocks. They’re wild, untamed creatures that zig and zag with whimsy. The stories of Alphabet and NVIDIA are akin to those of unicorns galloping through the market—rare, awe-inspiring, and leaving investors breathless in their wake.

Expert Guidance and Top Picks

For those who wish to navigate the tempestuous waters of the stock market, Zacks Investment Research offers sagacious advice and top stock picks. Their invaluable insights can be the sturdy ship that carries investors through the storm.

Whether it’s Alpha Metallurgical Resources, Inc. (AMR), CF Industries Holdings, Inc. (CF), Carpenter Technology Corporation (CRS), or Hawkins, Inc. (HWKN), Zacks Investment Research’s top stock and runner-up recommendations present a potential lifeline for those seeking to navigate the turbulent market.

A Closer Look at CF Industries

Additionally, for those intrigued by the remarkable growth of CF Industries Holdings, Inc., it’s worth delving into their recent financial performance. While their Q4 earnings trailed and sales were impacted by lower prices, this could be an opportunistic moment for investors to consider whether this represents a potential undervalued opportunity.

Stock trading is indeed an adventure, replete with twists and turns, and the views and opinions expressed herein, while being captivating, are also the views and opinions of the author. Hence, always approach stock trading with the required precaution, wit, and a readiness to ride the waves of the market.

Through all the excitement and turbulence of the stock market, one thing remains certain—Zacks Investment Research may just hold the key to uncovering the next unicorn stock. For now, investors can ride the waves and watch closely, because the market, much like the open sea, is always full of surprises.

Would you dive headfirst into such an unpredictable market? The allure of massive returns makes it hard to resist, doesn’t it?