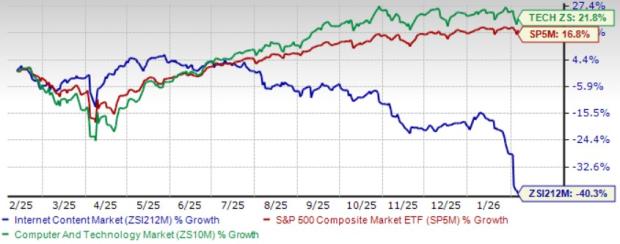

MicroStrategy (NASDAQ: MSTR), now rebranded as Strategy, is the largest corporate holder of Bitcoin with 582,000 Bitcoins as of June 9. The company’s stock has surged more than 3,000% over five years, with Bitcoin rising around 970%. Strategy plans to raise up to $42 billion over three years to increase its Bitcoin holdings, but high Bitcoin prices could lead to financial strain.

The average cost of Bitcoin for Strategy is approximately $70,000, which raises concerns about ongoing capital raises. The company has burned through over $84 million in operations and has a total cash outflow exceeding $28 billion when including Bitcoin purchases. With a market cap around $110 billion, investors are questioning whether holding Strategy stock is as favorable as directly investing in Bitcoin.

Future challenges may include greater dilution for existing shareholders due to stock offerings needed to fund more Bitcoin purchases, especially if Bitcoin valuations continue to rise.