AI Investment Skyrockets amid Growing Demand for Energy

Microsoft and the Next AI Revolution

In March 2023, Microsoft (MSFT) founder Bill Gates reflected on two groundbreaking technological advancements he has encountered. Writing on his website, he highlighted the graphical user interface he saw in 1980, which became essential for modern operating systems like Windows. The second innovation was OpenAI’s ChatGPT, a large language model. Gates tasked his contacts to have the AI take an AP Biology exam, expecting it to struggle with the exam’s complexities. Surprisingly, ChatGPT not only passed but also answered 59 out of 60 questions accurately.

As large language models like ChatGPT undergo further enhancements, it’s increasingly clear to experts that the future of innovation lies in artificial intelligence. Consequently, tech powerhouses, often referred to as the “Magnificent 7,” including Meta Platforms (META) and Microsoft, are investing billions in Nvidia (NVDA) hardware and data centers to secure their positions in the AI landscape. According to IDC Research, worldwide spending on AI is projected to more than double by 2028, reaching a staggering $632 billion with an expected compound annual growth rate (CAGR) of around 29%.

Data Centers and Growing Energy Needs

Currently, the tech giants dominate the AI sector due to high startup costs, particularly for GPUs and data centers. However, the expenses extend beyond initial construction. Data centers consume vast amounts of energy. A December 2024 report from the US Department of Energy (DOE) predicted that energy usage in data centers could “double or triple by 2028,” following a trend of doubling over the past decade. With an already strained energy grid, major tech companies will need to address their own energy demands. Here are two reasons why the energy sector is poised for growth in the coming years:

· High Demand: The US electrical grid is nearing its capacity. For instance, during a recent heat wave, The Electricity Reliability Council of Texas (ERCOT) had to pay Bitcoin miner Riot Platforms (RIOT) over $30 million to reduce its electricity consumption due to soaring demand from data centers.

· Regulatory Environment: Recently, President Donald Trump initiated an energy-friendly agenda, declaring a “National Energy Emergency” through executive order. This move aims to tackle the nation’s “inadequate energy supply and infrastructure” by loosening regulations for energy producers.

Three Companies Positioned for Growth

1. OKLO: A Leader in Nuclear Technology

Overview of OKLO

Oklo (OKLO) specializes in advanced nuclear technology, developing small modular reactors (SMRs) designed to offer clean, safe, and affordable energy. Their innovative reactor designs aim to improve efficiency and safety compared to traditional nuclear plants, addressing concerns about waste and operational risks.

Strong Management Team

Oklo benefits from a board of directors with significant ties in both the AI industry and governmental affairs. Sam Altman, CEO of OpenAI, serves as the chairman, while former board member Chris Wright has been appointed by Donald Trump to a leadership role at the US DOE. This robust network presents a strategic advantage for Oklo.

Momentum and Market Position

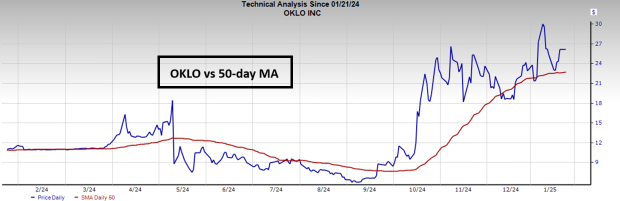

Despite currently having no revenue, investors are optimistic that forthcoming data center contracts will outweigh any immediate concerns. Over the past year, OKLO shares have surged approximately 150%, recently pulling back to the 50-day moving average, signaling renewed buying interest – a potentially promising sign.

Image Source: Zacks Investment Research

2. CEG: Expanding Through Acquisitions

Overview of CEG

Constellation Energy (CEG) holds a Zacks Rank #1 (Strong Buy) and is a prominent American energy company, offering electricity, natural gas, and energy management services. CEG is a major supplier of clean energy, focusing on expanding its nuclear and renewable energy capabilities.

CEG’s Acquisition of Calpine: A Major Financial Testimony

Deal to Expand Power Generation Capacity

Earlier this month, it was announced that Constellation Energy Corporation (CEG) has agreed to acquire Calpine Corp. for $16.4 billion. This strategic move will enhance CEG’s power generation assets across the United States, coinciding with an anticipated surge in electricity demand. The acquisition positions CEG to tap into the growing demand from AI data centers, highlighting a lucrative opportunity. Notably, CEG is purchasing Calpine at a reasonable valuation of 7.9 times the company’s projected 2026 earnings, making the deal estimated to be 20% accretive to earnings per share (EPS).

Positive Market Response Following the Acquisition

Market reactions have shown that investors view this deal as a significant positive. Typically, stock prices of acquiring companies dip after acquisition announcements. In contrast, CEG shares surged over 20%, indicating confidence in the deal’s potential benefits.

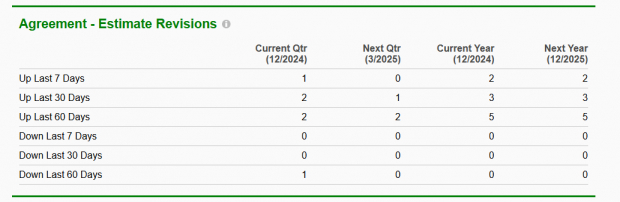

Support from Analysts on Wall Street

Further elevating the optimism around CEG is the trend among Wall Street analysts, with several increasing their earnings estimates for the stock in recent months. This endorsement from financial experts adds to the bullish sentiment surrounding the company.

Image Source: Zacks Investment Research

Spotlight on Bloom Energy: Adapting to Current Needs

Overview of Bloom Energy

Bloom Energy (BE) utilizes natural gas and various fuels to produce electricity through innovative chemical reactions. Their technology empowers businesses, including data centers, to generate clean energy independently from the traditional electric grid.

Recent Mega Deal Boosts Bloom Energy

Bloom Energy’s shares experienced a remarkable rise of approximately 59% on November 15th, following the announcement of a significant contract to supply up to 1 gigawatt of fuel cells to American Electric Power (AEP). These fuel cells are intended for AI data centers, with additional orders expected in 2025. Following this developments, BE shares are forming a high-tight flag pattern, a bullish technical signal.

Image Source: TradingView

Conclusion: A Promising Future Ahead

The synergy of the AI revolution and a new regulatory environment in Washington may catalyze growth for stocks like OKLO, CEG, and BE. Investors should remain attentive to these developments as they unfold.

7 Best Stocks to Watch in the Next Month

Recently released, experts selected seven elite stocks from a list of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.” Historically, this selection has performed well, with an average annual gain of +24.1% since 1988.

Stay informed with recommendations from Zacks Investment Research. Download the report on the 7 Best Stocks for the Next 30 Days for your further research.

Stock Analysis Reports Available:

- Microsoft Corporation (MSFT): Free Stock Analysis Report

- Constellation Energy Corporation (CEG): Free Stock Analysis Report

- NVIDIA Corporation (NVDA): Free Stock Analysis Report

- Riot Platforms, Inc. (RIOT): Free Stock Analysis Report

- Bloom Energy Corporation (BE): Free Stock Analysis Report

- Meta Platforms, Inc. (META): Free Stock Analysis Report

- Oklo Inc. (OKLO): Free Stock Analysis Report

To read more from Zacks Investment Research, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.