“`html

Charlie Munger: The Unsung Hero Behind Buffett’s Success

Warren Buffett is known as one of the greatest investors of all time, but his success is largely attributed to his partnership with Charles Munger, who passed away in November 2023 at the age of 99. Munger was not only Buffett’s close friend but also his source of wisdom and wit throughout his life.

Buffett and Munger: The Role of Technical Analysis

One of my favorite investing quotes is “Simplicity is the ultimate sophistication.” Through years of exploring various investing strategies, it has become clear to me that successful investing often involves focusing on what truly matters while eliminating unnecessary complexities.

Although I consider myself a trend-following growth investor, I respect the strategies of Buffett and Munger. Munger’s wisdom emphasizes the value of long-term technical analysis in investing. He once said:

“If all you ever did was buy high-quality stocks on the 200-week moving average, you would beat the S&P 500 by a large margin over time.”

This quote resonates with me because I have employed this approach for my long-term investments without knowing Munger’s words. Even if we don’t analyze financial statements like Buffett and Munger, we can still learn from their insights to improve our investing skills.

While they are known primarily for their fundamental analysis, Munger’s quote suggests that both legends effectively utilize long-term technical indicators.

Investing in Quality Stocks at the Right Price

To better understand Munger’s 200-week strategy, it’s critical to note that Buffett learned from Munger to purchase “wonderful” businesses at fair prices rather than focusing solely on cheap stocks. On Wall Street, as in life, lower prices do not always guarantee value.

Instead of fixating on stock prices or valuations, investors should prioritize:

· Top-Performing Companies: Focus on industry leaders.

· Strong Financial Health: Invest in companies with solid fundamentals and ample cash reserves.

· Institutional Support: Pay attention to companies that attract institutional investors, as they can lead to price stability during market fluctuations.

Understanding the Importance of the 200-Week Moving Average

Here are four notable examples demonstrating the effectiveness of the 200-week moving average:

Apple (AAPL)

AAPL has long exemplified market leadership. From a split-adjusted $2 to $244 today, the stock has consistently respected the 200-week moving average, even during the turbulent 2008 financial crisis.

Image Source: trading

Remarkably, AAPL has only touched its 200-week MA five times since 2000.

Nvidia (NVDA)

Nvidia, a leader in the semiconductor industry, faced steep declines during the 2022 tech bear market. However, in late 2022, the stock rebounded from the 200-week MA, providing a critical buying opportunity for investors.

Image Source: TradingView

Microsoft (MSFT)

Following a prolonged bear market, MSFT shares started to recover in the 2010s. Investors who capitalized on a late 2022 pullback to the 200-week MA saw significant gains as MSFT shares doubled since that point.

“`

MicroStrategy and AMD: Investment Opportunities Amid Market Shifts

Highs and lows define the journey of technology stocks, with MicroStrategy and Advanced Micro Devices showing promise for patient investors.

Image Source: TradingView

MicroStrategy (MSTR)

In 2022, the cryptocurrency market faced turmoil with significant bankruptcies and the infamous FTX collapse. However, for those with faith in Bitcoin, MicroStrategy emerged as a strong performer. After falling sharply from its peak of $132 to the 200-week moving average in the $30s, the company presented a prime buying opportunity. Investors who capitalized on this strategy were rewarded as MSTR shares soared to an impressive $540 by 2024.

Image Source: TradingView

AMD Presents a Unique Investment Opportunity

Advanced Micro Devices (AMD) is recognized globally for its innovative semiconductor products and technologies in computing, graphics, and visualization.

An Important Price Point

Even stars of the stock market like AMD occasionally retreat. Currently, despite strong fundamentals, sentiment is low, making it a time for contrarian investors to consider the stock. AMD is making a notable dip towards its 200-week moving average, which may signal an opportunity for savvy investors.

Image Source: TradingView

AI Spending Remains Robust

While NVIDIA (NVDA) dominates the AI space, AMD is also seeing benefits from ongoing investment into artificial intelligence technologies. Recent skepticism surrounding DeepSeek, a Chinese large language model that allegedly needed fewer GPUs than ChatGPT, has not dampened enthusiasm for AI investments.

AMDs Value Proposition

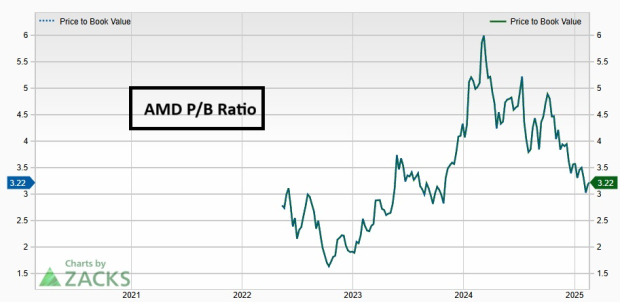

AMD’s recent price drop has rendered its stock appealing from a price-to-book perspective, now at its lowest since 2023. Historically, such a drop has been followed by significant upward moves, an encouraging sign for potential investors.

Image Source: Zacks Investment Research

Takeaway

The influence of Charlie Munger on Warren Buffett and the investment community is profound. While their strategies focus on fundamental analysis, Munger’s emphasis on the 200-week moving average underlines the necessity of patience, quality, and discipline in investing.

Zacks Research Highlights Potential High-Growth Stocks

Our analysts have identified five stocks that show the greatest potential for gains of 100% or more in the near future. Among these, Director of Research Sheraz Mian has spotlighted one stock he believes will rise the highest.

This top selection comes from one of the most innovative financial firms with a rapidly expanding customer base of over 50 million and a range of cutting-edge solutions. Historically successful picks like Nano-X Imaging, which surged 129.6% in just over nine months, set a promising precedent.

Free: Discover Our Top Stock and Four Contenders

Stay updated with the latest recommendations from Zacks Investment Research. Download the report on the 7 Best Stocks for the Next 30 Days for free today.

Apple Inc. (AAPL): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.