Flight of the Phoenix: Air Lease’s Soaring Success

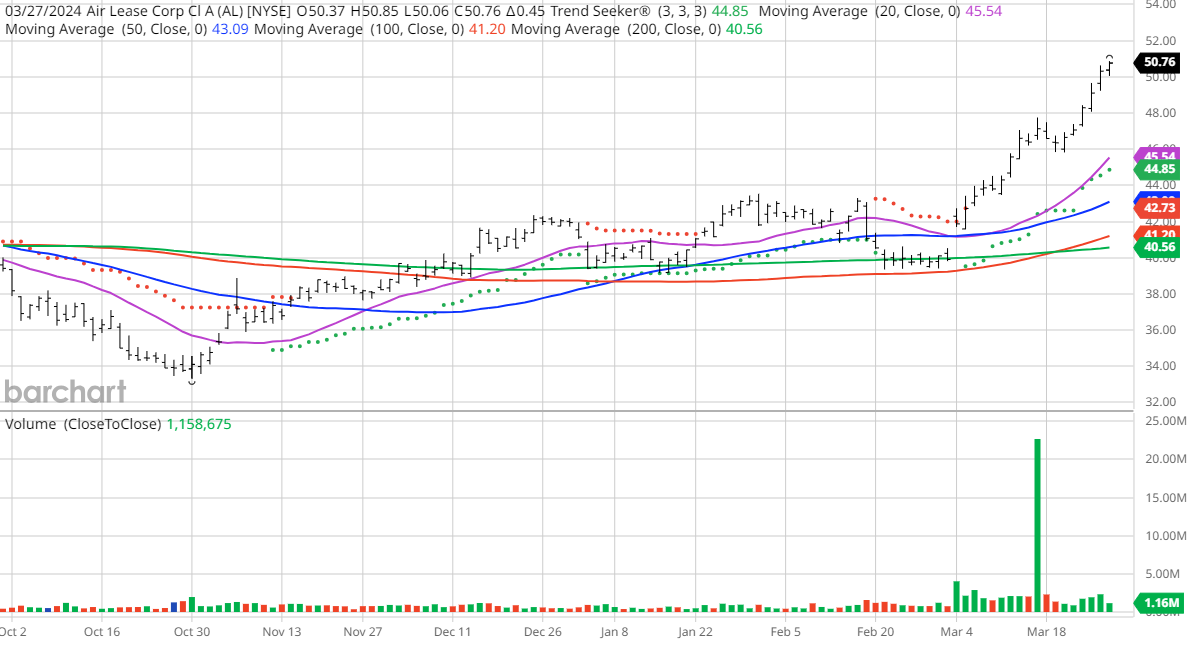

Air Lease Corporation, the high-flying aircraft leasing company, has been making waves in the market. The company’s stock (AL) has seen a meteoric rise, gaining a remarkable 16.81% since the Trend Seeker signaled a buy on 3/6. Unveiling a fleet of 463 aircraft, including both narrowbody and widebody jets, Air Lease has positioned itself as a key player in the global aviation industry.

The Sky’s the Limit: Technical Triumph

Boasting a stellar track record in technical indicators, Air Lease is a beacon of success. With a dazzling array of achievements including a 100% technical buy signal, 38.90+ Weighted Alpha, and a 35.72% gain in the last year, the company has consistently outperformed market expectations. Flying high above its moving averages and with a robust Relative Strength Index of 82.02%, Air Lease’s technical support level stands strong at $49.48.

Financial Fuel: Fundamental Fortitude

Looking at the fundamentals, Air Lease continues to impress. With a market cap of $5.60 billion, a P/E ratio of 9.53, and a dividend yield of 1.63%, the company shows stability and growth potential. Revenue is projected to grow 6.30% this year and an additional 10.00% next year, while earnings are estimated to increase at a steady pace over the next 5 years.

Market Sentiment: Analysts’ Aeronautic Assessments

- Wall Street analysts have shown strong support for Air Lease, issuing 7 strong buy and 1 hold recommendations this month. With price targets ranging between $41 and $62 and a consensus target of $53, analysts see significant upside potential for the stock.

- On Motley Fool, individual investors have voted overwhelmingly in favor of Air Lease, with 139 out of 146 voters confident that the stock will beat the market.

- Value Line and CFRAs MarketScope have also weighed in with positive assessments, further bolstering investor confidence in Air Lease’s future prospects.

Final Approach: Investing Caution — While the future looks bright for Air Lease, investors are advised to proceed with caution. The stock’s exceptional volatility and speculative nature require a disciplined approach to risk management. Diversification and regular evaluation of stop-losses are essential to navigate the turbulent skies of the market.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.