An Insight into the Phenomenon

One cannot help but marvel at the exceptional journey of Celestica (CLS), a company that has not just weathered the storms but emerged stronger with each passing day. Since the fateful day of 10/4 when it closed at $23.70, this behemoth has managed to soar by a jaw-dropping 76%. This steadfast ascent, reminiscent of a phoenix rising from the ashes, provides a captivating saga of resilience and growth.

A Glimpse into Celestica’s Offerings

Celestica Inc., with its headquarters nestled in the vibrant city of Toronto, Canada, is an epitome of excellence in providing supply chain solutions across North America, Europe, and Asia. The company’s forte lies in Advanced Technology Solutions, and Connectivity & Cloud Solutions segments. Engraved in its DNA are a plethora of services ranging from design and development, new product introduction, engineering to logistics and asset management, among others. As a trusted partner catering to diverse sectors including aerospace, defense, industrial, capital equipment, and more, Celestica Inc. stands tall as a beacon of innovation and reliability in the competitive market landscape.

The Drumbeat of Technical Indicators

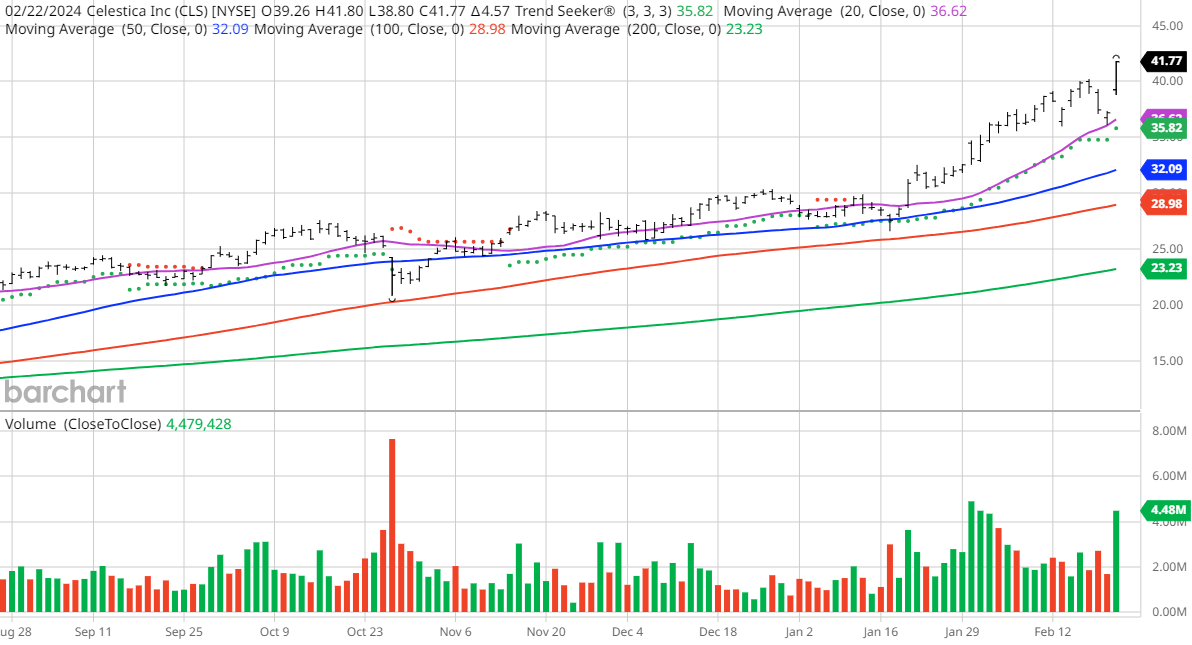

Peering into the technical realm, the numbers unveil a compelling tale of success for Celestica. Technical buy signals, an impressive Weighted Alpha of 232.26+, and a remarkable 221.06% gain in the last year underscore the company’s meteoric rise. With a Trend Seeker buy signal and comfortably above its moving averages, Celestica exudes confidence and stability. The recent trading price of $41.77 echoes a story of resilience and unwavering momentum.

An Eloquence of Fundamental Factors

The fundamental analysis paints a rosy picture for Celestica, with a market capitalization of $4.40 billion and a P/E ratio of 15.42. Wall Street’s optimistic projections of revenue growth at 10.00% this year, coupled with an estimated earnings increase of 20.20% this year and a compelling 18.70% compound annual growth rate for the next 5 years, further reinforce the company’s robust financial standing and growth prospects.

The Eye of Analysts and Investors

While Wall Street analysts remain divided in their recommendations, the stock continues to command attention and respect from seasoned investors. The intriguing interplay of price targets, buy recommendations, and individual investor sentiment reflects a complex mosaic of opinions and perspectives towards Celestica. In a world where consensus is rare, the stock’s ability to polarize opinions only adds to its enigmatic allure.

The Final Word

As we stand on the cusp of Celestica’s remarkable journey, it is imperative to acknowledge the company’s volatile yet promising nature. The caveat of extreme volatility calls for a prudent and diversified investment approach, reflecting a blend of risk tolerance and strategic portfolio management. Celestica, with its unwavering upward trajectory, beckons investors to embark on a journey filled with challenges and triumphs, much like the ebb and flow of the financial markets themselves.