The Road Less Traveled: Construction Partners (ROAD)

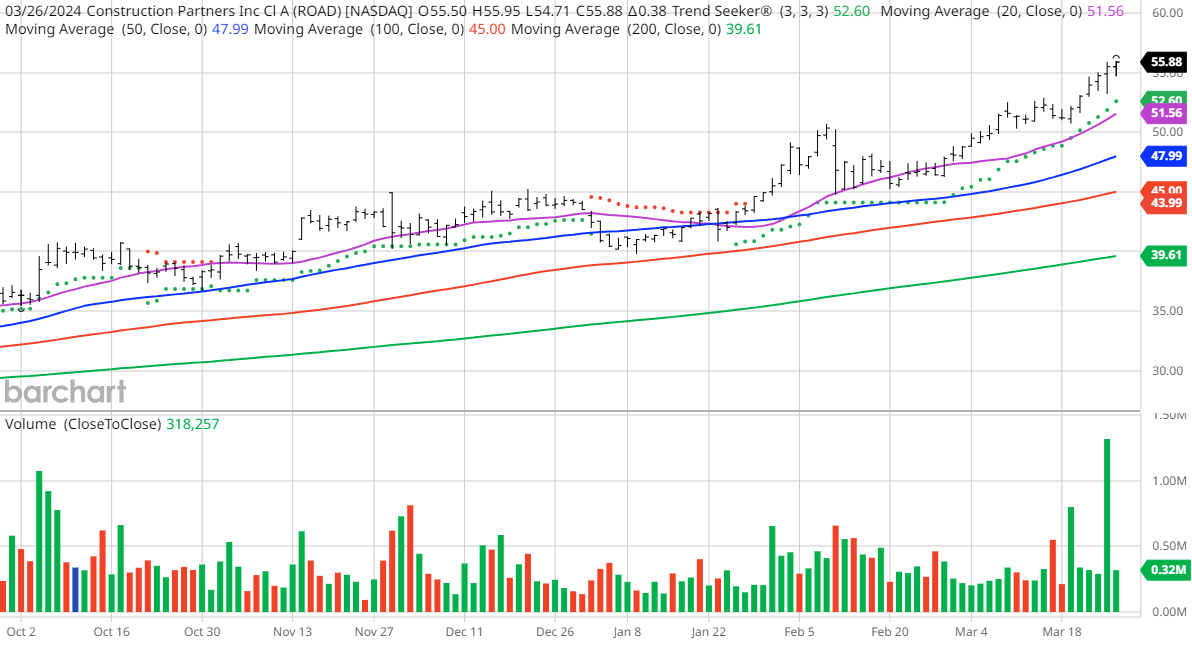

The Chart of the Day beckons our attention, and it graciously belongs to none other than the illustrious road construction firm, Construction Partners (ROAD). How serendipitous to stumble upon this gem using Barchart’s discerning screening tools, unearthing stocks brimming with technical prowess, soared Weighted Alpha, unwavering momentum, and the all-seeing Trend Seeker buy signal! Since the fortuitous buy signal on 1/29, the stock has blossomed, boasting a dazzling 25.26% surge.

Construction Partners, Inc., a beacon of civil infrastructure, weaves and nurtures roadways across Alabama, Florida, Georgia, North Carolina, South Carolina, and Tennessee. Their portfolio teems with offerings for public and private projects – highways, roads, bridges, airports, and residential marvels. Engaged in crafting and distributing the lifeblood of construction, hot mix asphalt (HMA), they pave the way for progress through foundational layers and asphalt veneers. Site development, utility systems, aggregate mining – they excel in these, wielding raw materials deftly. Boldly distributing liquid asphalt, they fuel projects internally and externally, painting a picture of innovation and reliability. Born in 2007 and based in Dothan, Alabama, the erstwhile SunTx CPI Growth Company, Inc. metamorphosed into Construction Partners, Inc., etching their journey with distinction.

Drive in the Fast Lane: Technical Indicators and Financial Fortitude

Barchart’s Opinion trading systems unveil a tapestry of technical prowess and financial fortitude:

- 100% technical buy signals

- Weighted Alpha a soaring 116.10+

- A remarkable 108.90% gain in the last year

- Embracing the Trend Seeker buy signal

- Towering above its 20, 50, and 100 day moving averages

- Shining with 16 new highs and a 19.66% rise in the last month

- A Relative Strength Index of 77.65%

- Seeking technical solace at $55.08

- Presently trading at $55.88 with a 50-day moving average of $47.99

Fundamental Factors:

- Market Cap a robust $2.93 billion

- P/E holding steady at 50.69

- Revenue foreseen to bloom by 15.10% this year, with a further 10.80% growth next year

- Earnings poised for a 41.50% upsurge this year, followed by a 27.80% lift next year, and a glorious 62.20% annual escalation for the next 5 years

Analysts and Investor Sentiment – Navigating the Road Ahead

In the realm of analysts and investor sentiment, wisdom reigns supreme:

- Wall Street heralds 5 strong buy and 2 hold recommendations in this lunar cycle

- Price targets scatter between $45 and $59, painting a meteoric trajectory

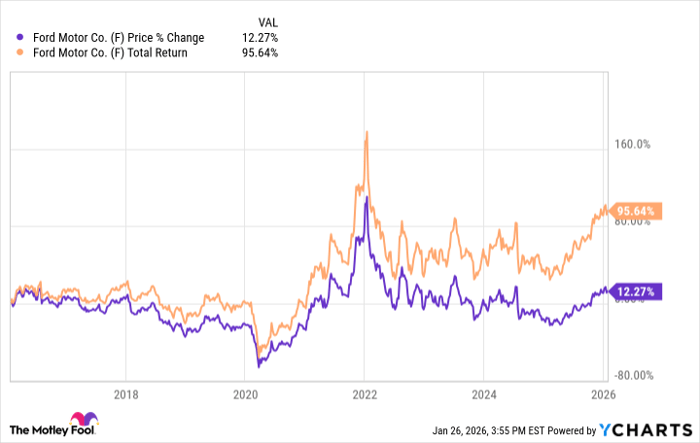

- Motley Fool’s faithful disciples vote unanimously for ROAD to outpace the market

- Value Line showers accolades with an above-average rating of 2 and a visionary price target of $56

- CFRA’s MarketScope chants the hymn of strong buy, echoing optimism

- A legion of 2,780 investors keenly watch over the stock on Seeking Alpha, fostering a community of growth

Additional disclosure: The illustrious Barchart Chart of the Day reserves its spotlight for stocks on the cusp of extraordinary price appreciation, akin to a blooming rose under the morning sun. Not mere buy recommendations, these stocks dance on the winds of volatility and speculation. Should you dare to add one to your investment canvas, a prudent diversification strategy coupled with unyielding stop-loss tactics align with the orbit of personal investment ethos. A weekly rendezvous with stop losses is strongly advised, a ritual bowing to market dynamics and personal risk thresholds.

On this day of publication, Jim Van Meerten basks in neutrality without direct or indirect stake in any of the securities adorned in this narrative. A fountain of information and data, this piece serves the singular purpose of illumination. Wander into the Barchart Disclosure Policy for a deeper understanding.

Wading through the currents of opinion and conjecture, the views painted herein belong to the artist alone, casting a kaleidoscope of reflections untethered from Nasdaq, Inc.