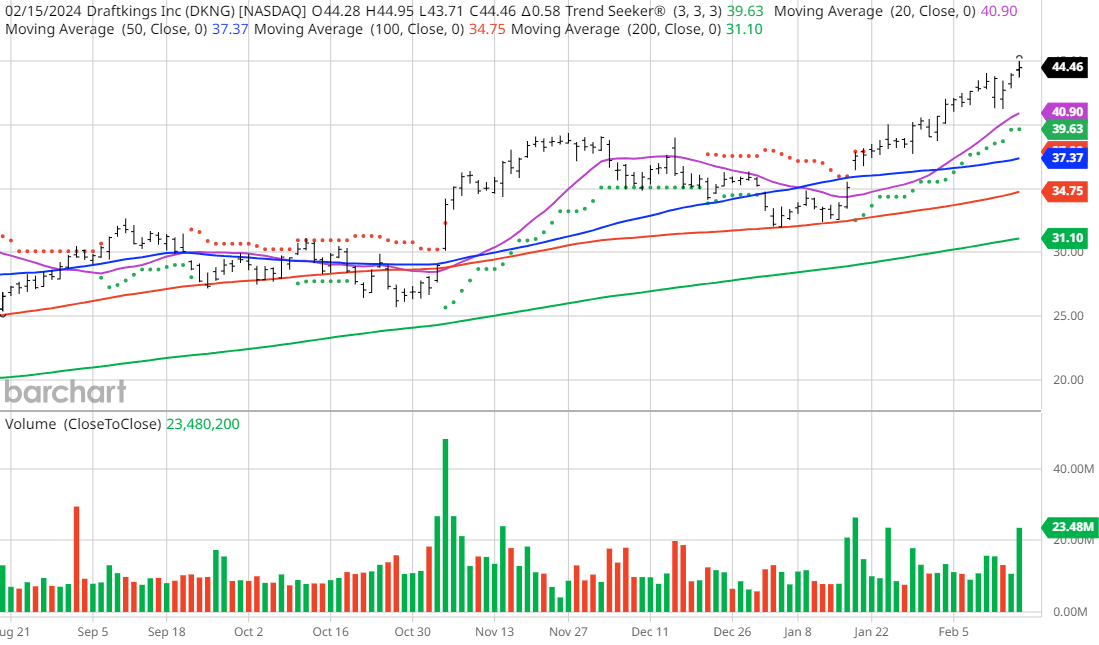

Is DraftKings (DKNG) a financial play with room to run, or is the latest surge in the stock’s price more fool’s gold than genuine treasure? According to information procured from Barchart’s screening process, the company has been on an undeniable upward trajectory. Since the Trend Seeker recommended a buy on 1/ 22, the stock has boasted a staggering 34.93% gain.

DraftKings Inc. is not merely a run-of-the-mill company, but a digital sports entertainment and gaming conglomerate with a global footprint. Their offerings range from online sports betting and casino games to daily fantasy sports and media, and they even operate retail sportsbooks. The company is also involved in the development of sports betting and casino gaming software, as well as the provision of a digital collectibles marketplace tailored for mainstream accessibility. With headquarters situated in Boston, Massachusetts, the firm has managed to carve a significant niche in a burgeoning industry.

Barchart’s Opinion systems are indicative of the immense potential embedded in DraftKings. The technical indicators currently represent a staggering 100% buy signals, complemented by a Weighted Alpha of 114.20+. Furthermore, the stock has recorded an impressive 150.06% gain in the last year, buoyed by a Trend Seeker buy signal. In addition to this, the stock is currently trading above its 20, 50, and 100-day moving averages.

From a fundamental perspective, DraftKings boasts a substantial Market Cap of $38.20 billion. Wall Street anticipates a remarkable 64.10% revenue growth this year, with a further 27.60% growth forecasted for the next year. Earnings are also projected to witness a substantial increase of 51.90% this year, followed by an additional 81.60% surge next year.

Analysts and Investor Sentiment provide an interesting backdrop, highlighting a range of disparate viewpoints that can leave investors scratching their heads. While Wall Street analysts have issued a mixed bag of recommendations, individual investors following the stock on Motley Fool have resoundingly voted for the stock to beat the market. This contrast is intriguing and makes it clear that acquiring a comprehensive understanding of the stock presents a significant challenge.

With all that said, it’s worth noting that the immensely volatile and speculative nature of these stocks demands caution. They pose a considerable risk, and investors must exercise great diligence in their approach. The Barchart Chart of the Day serves as a starting point, not a definitive buying guide. While the potential for growth in DraftKings is undeniable, it’s important to remember that such opportunities come with their fair share of risks.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.