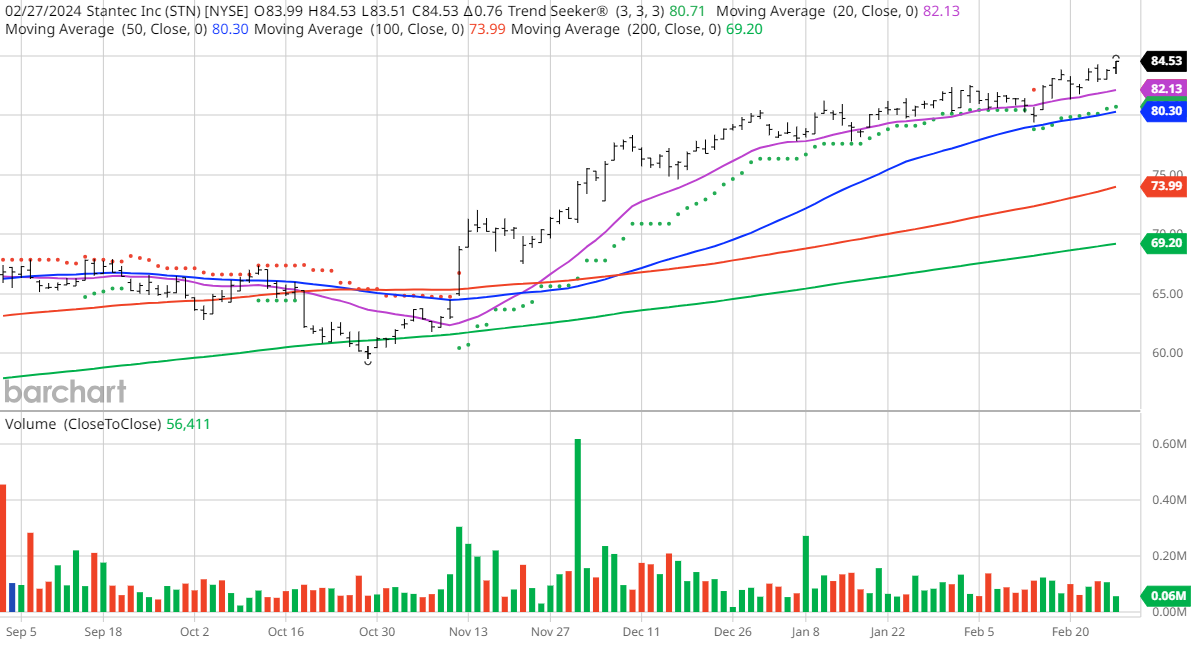

Unveiling the resplendent trajectory in the stock market, today’s spotlight shines brightly on Stantec (STN), the eminent infrastructure consulting firm. Using Barchart’s sophisticated screening tools, this gem emerged – boasting top-notch technical buy signals, Weighted Alpha supremacy, unwavering momentum, and the coveted Trend Seeker buy signal. Since the propitious date of 2/14, the stock has surged by a commendable 2.60%.

In the tightly woven fabric of professional services, Stantec Inc. stands as a stalwart. It offers a plethora of consulting services across engineering, architecture, interior design, landscape architecture, and more, catering to clients in Canada, the United States, and beyond. The company’s rich tapestry includes a spectrum of planning and design consulting services, transportation planning, project delivery consultancy, and environmental compliance services. Founded back in 1954, Stantec Inc. has been a trailblazer in the field, with its headquarters proudly stationed in Edmonton, Canada.

Barchart’s Opinion trading systems operate dynamically, updating every 20 minutes to capture real-time market fluctuations. Let’s delve into the indicators:

- 100% technical buy signals

- 48.80+ Weighted Alpha

- Impressive 44.59% gain in the last year

- Trend Seeker buy signal

- Residing above its 20, 50, and 100 day moving averages

- Notching 10 new highs and up by 4.42% in the last month

- Boasting a Relative Strength Index of 64.76%

- Crucial technical support level hovers at $83.85

- Currently trading at $84.53, with the 50-day moving average at $80.30

Bolstering the formidable technical prowess, let’s dissect the fundamental factors:

- Impressive Market Cap of $9.56 billion

- P/E stands at 30.42

- Generous dividend yield of .69%

- Forecasts from Wall Street paint a rosy picture, predicting a 13.00% revenue growth this year, followed by an 11.60% surge next year

- Anticipated earnings surge by 19.00% this year, with an additional 15.30% growth forecasted for the following year, setting the stage for a consistent annual growth rate of 7.02% over the next 5 years

Turning our gaze towards Analysts and Investor Sentiment – a crucial horizon to navigate:

- Wall Street analysts chime in with 6 strong buys, 3 buys, and 2 hold recommendations this month

- Price target estimates dance in the $81 to $93 range, culminating in a consensus price target of $87.54 for a 4% upward swing

- Individual investors on Motley Fool resoundingly vote 77 to 7 in favor of the stock outperforming the market, with seasoned investors echoing the sentiment at 18 to 0

- Value Line bestows an average rating of 3 upon the stock, coupled with a price target of $89 for a 5% gain, lauded for its Price stability and Earnings predictability

- CFRAs MarketScope offers a buy rating, echoing the bullish sentiment

- An impressive 2,540 investors keep a keen eye on the stock on Seeking Alpha, a testament to its allure

Cloaked within these revelations lies a humble yet essential disclosure: the Barchart Chart of the Day illuminates stocks undergoing exceptional price appreciation. While not tantamount to buy recommendations, these stocks exude volatility and speculation. Should you opt to add them to your portfolio, a prudent strategy of diversification and steadfast stop-loss discipline is paramount in navigating the tempestuous waters of the market.

As of the publication date, Jim Van Meerten maintains no positions, either direct or indirect, in any of the securities spotlighted in this article. All information and data herein serve informational purposes solely. For further insights, please refer to the Barchart Disclosure Policy here.

Opinions expressed herein belong to the author and do not necessarily align with those of Nasdaq, Inc.