Revving Up the Charts

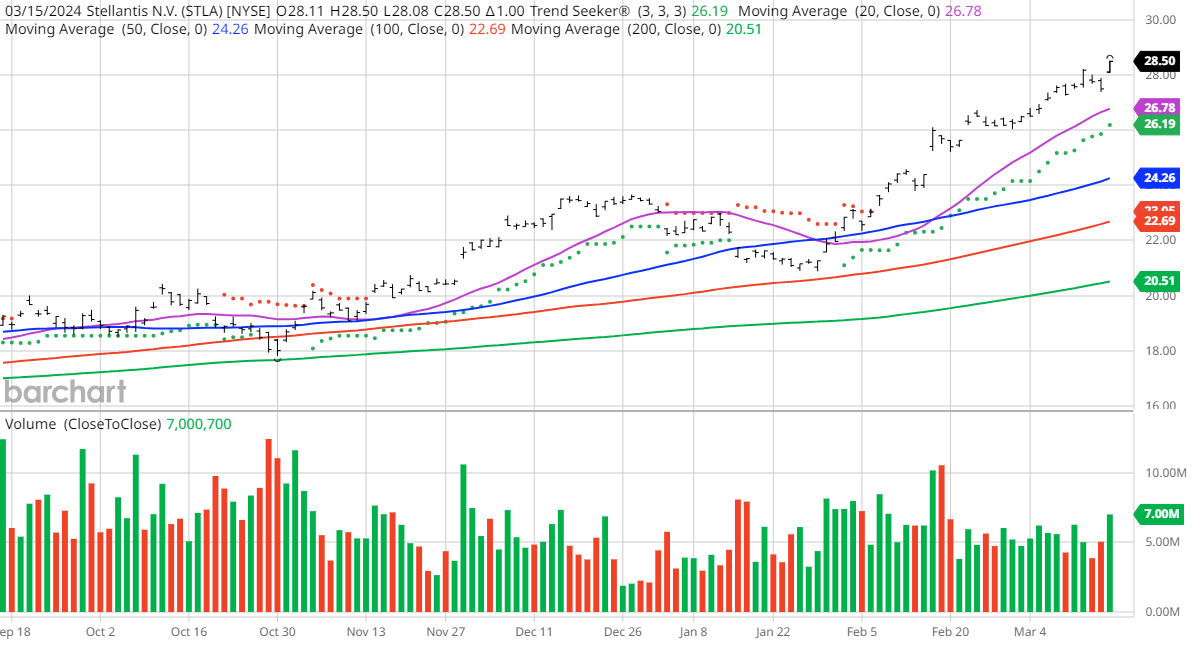

Stellantis, the international auto manufacturing giant, has taken the wheel with a remarkable resurgence in the stock market. Identified through Barchart’s meticulous screening process, the company has shown strong technical buy signals, Weighted Alpha figures, and a significant uptrend since a recent buy signal on 2/7, clocking a 21.23% gain.

The Power Under the Hood

Stellantis N.V., known for its automobiles, commercial vehicles, engines, and mobility services, has a rich history dating back to its foundation in 1899. Headquartered in the Netherlands, the company operates a wide range of brands like Alfa Romeo, Chrysler, Jeep, and Peugeot through its global network of distributors and dealers.

On the Fast Track

Barchart’s technical indicators are flashing green with a stellar performance: 100% technical buy signals, a Weighted Alpha of 83.50+, and a 68.94% gain in the last year. The stock is currently riding high above its moving averages and has seen 11 new highs in the last month, backed by a solid Relative Strength Index of 73.66%.

Behind the Numbers

With a market cap of $89.29 billion, Stellantis commands attention in the global auto market. Despite receiving less coverage from Wall Street analysts due to its foreign headquarters, the stock has garnered strong support from individual investors and research firms like CFRAs MarketScope.

Steering Investor Sentiment

Wall Street analysts have issued varying recommendations, with price targets ranging from $21 to $41, suggesting a consensus of $31 for a 9% gain. The Motley Fool community and experienced investors are bullish on the stock, while Seeking Alpha boasts a substantial following of 44,080 investors keenly monitoring Stellantis.

Caution Around the Bend

As with any high-performing stock, caution is advised. The Barchart Chart of the Day serves to highlight exceptional price movements, but it is essential for investors to exercise prudence, diversify their portfolios, and adhere to stop-loss strategies to navigate the volatility of such stocks effectively.

On the date of publication, the author did not hold any positions in the securities discussed. The information provided is for informational purposes only and does not constitute investment advice.

The views expressed in this article are solely those of the author and do not represent the opinions of Nasdaq, Inc.