Charter Communications (CHTR) Reports Notable Market Movement

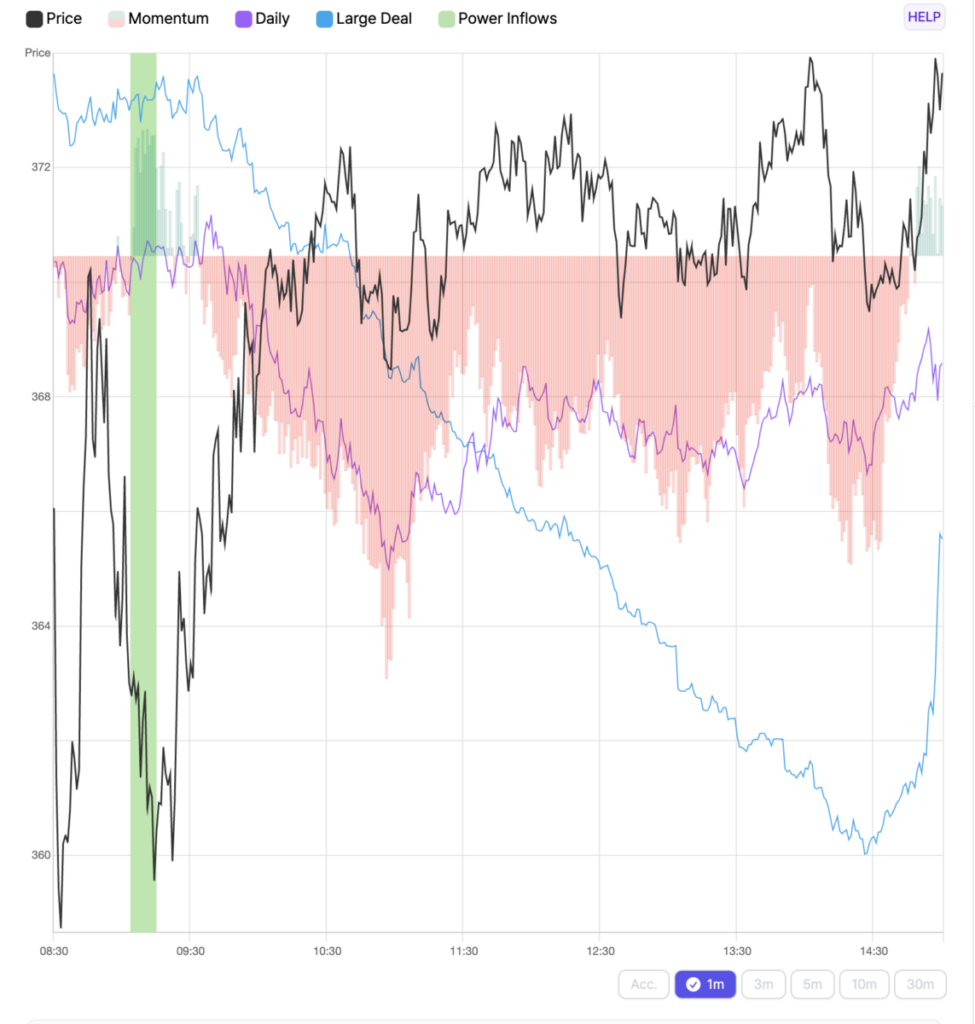

Charter Communications, Inc. (CHTR) saw a notable increase in its stock price, gaining 3.6% during today’s trading session after an early reversal.

At 10:13 AM on April 24th, a significant trading signal indicated a Power Inflow for Charter at $361.02. This signal holds importance for traders seeking to track institutional orders and “smart money” movements in the market, highlighting the potential for upward trends in Charter’s Stock. Traders interpret this as a possible entry point to take advantage of anticipated price increases.

Understanding Power Inflow Signals

Order flow analytics, also known as transaction or market flow analysis, involves examining both retail and institutional order volumes. This method helps traders understand the dynamics of buy and sell orders, including their size, timing, and patterns. For active traders, the current Power Inflow is interpreted as a bullish indicator.

Typically, the Power Inflow emerges within the first two hours of the market opening and signals the stock’s trend for the day, driven by institutional activity. By analyzing these trends, market participants can recognize trading opportunities and better assess market conditions.

While interpreting smart money flow can offer valuable insights, it is vital for traders to implement effective risk management strategies to safeguard their capital and minimize losses. A well-structured risk management plan allows investors to navigate market uncertainties with more control, enhancing the potential for long-lasting success in trading.

After Market Close Update:

At the time of the Power Inflow, Charter’s price was $361.02. Following this, the stock reached a high of $373.92 with a closing price of $373.65. This reflects returns of 3.6% and 3.5%, respectively, underscoring the relevance of maintaining a trading strategy that includes Profit Targets and Stop Losses adapted to individual risk tolerance.

It is important to note that past results do not guarantee future performance.