Volatility has gripped the cannabis sector, with the MSOS ETF plummeting by 15.24% after the DEA’s recent decision to postpone cannabis rescheduling. This move has only added to the market’s unpredictability, especially in the run-up to a divisive U.S. presidential election where cannabis policy is a hot-button issue. Nonetheless, within this storm, a few cannabis penny stocks have managed to weather the tempest, priced more economically than a famous fast-food Big Mac.

The Financial Landscape Across the Industry

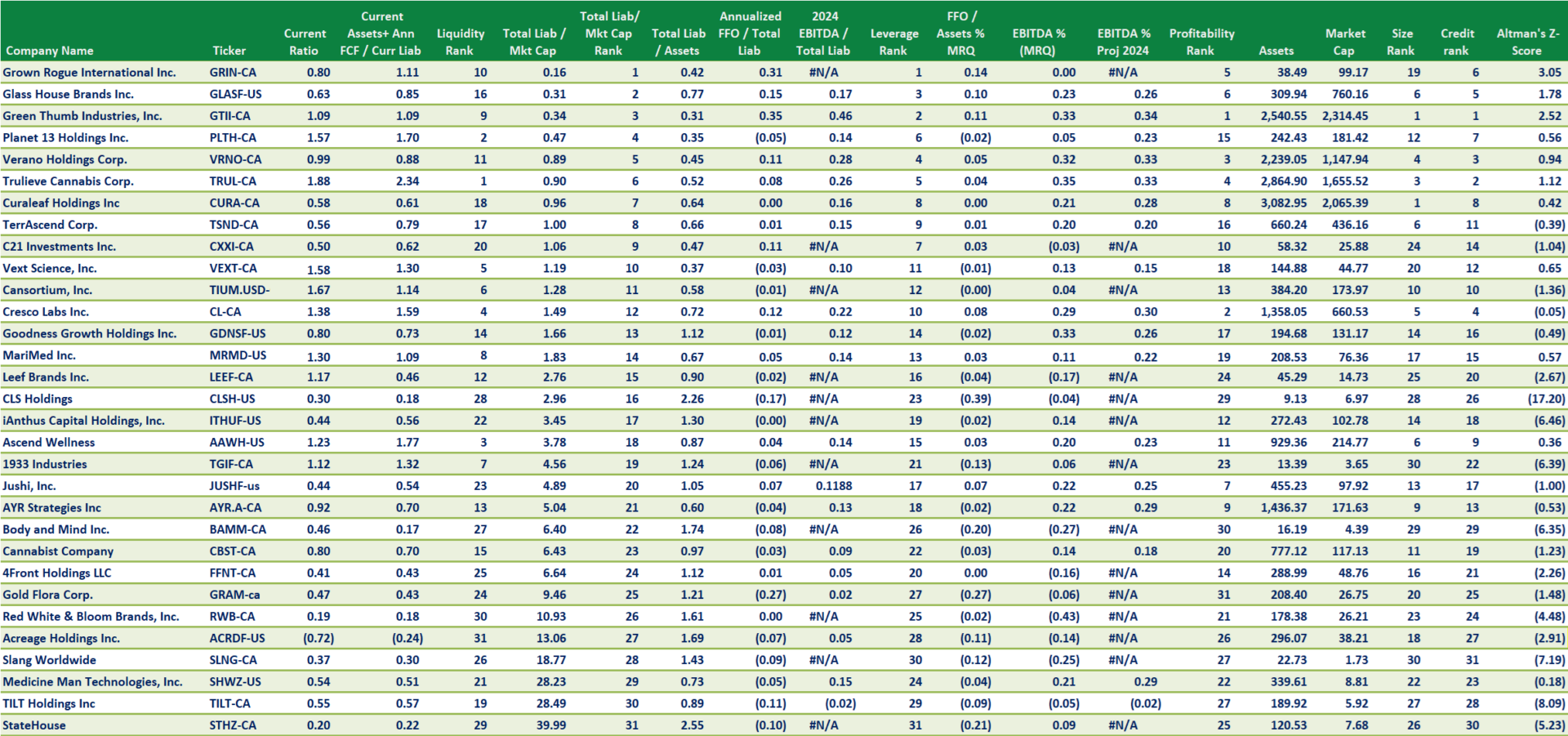

Viridian Capital Advisors reveals that the cannabis sector bears a median debt-to-EBITDA ratio of 2.98 times for analyzed companies, suggesting that many are operating within sustainable debt levels despite the hurdles posed by taxing regulations like the 280e code.

While the majority of firms stay afloat, a subset of companies in the upper quartile exhibits worrisome levels of leverage, hinting at continued financial shake-ups within the sector.

The Standouts in the Crowd

Amidst the chaos, a handful of companies have managed to stand tall:

- Vext Science (ticker: VEXT) has shown resilience in the face of market flux, experiencing a slight stock price dip to $0.16. Despite a year-over-year revenue drop of 8%, the company’s strategic moves in Ohio and efficiency enhancements in Arizona have set the stage for future growth. Notably, Vext achieved a positive adjusted EBITDA of $1.08 million in the second quarter of 2024.

- C21 Investments (ticker: CXXIF) witnessed a stock price surge of 11.5295% to $0.2399, with a solid trading volume of 10,025 shares. Although facing inflationary pressures, the company managed a marginal revenue uptick of 1% year-over-year to $6.6 million by the end of the second quarter in 2023. Despite a net loss, C21 displayed robust transaction volumes and positive cash flows under challenging circumstances.

- IAnthus Capital Holdings (ticker: ITHUF) saw its stock price drop by 8.7838% to $0.0135. Despite this, the company showcased improved credit metrics, boasting an 11.1% revenue increase to $43.0 million in the second quarter of 2024. With a significant gross profit rise and better working capital, iAnthus is positioning itself for a resilient operational future.

Credit Woes Sweep Through the Industry

While some companies shine, others like TerrAscend, AYR Strategies, and MariMed suffered credit score downgrades. Furthermore, Red White & Bloom, Acreage, and Slang Worldwide grapple with total liabilities to market cap ratios topping 10, a telltale sign of financial distress.

Market News and Data brought to you by Benzinga APIs