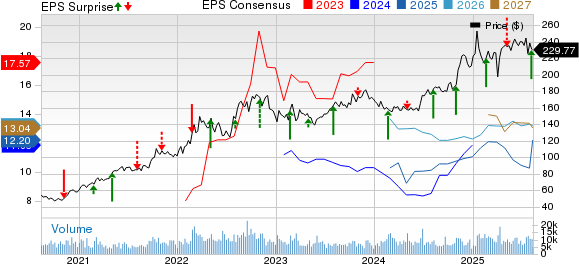

Cheniere Energy, Inc. (LNG) reported a second-quarter 2025 adjusted profit of $7.30 per share, exceeding the Zacks Consensus Estimate of $2.30 and up from $3.84 year-over-year. Revenue for the quarter was $4.6 billion, surpassing the expected $4.1 billion and representing a 43% increase from $3.3 billion a year ago, primarily due to a more than 45% rise in LNG sales.

The company disclosed consolidated adjusted EBITDA of $1.4 billion and distributable cash flow of $0.9 billion. During the quarter, Cheniere shipped 154 cargoes. Additionally, Cheniere announced plans to raise its quarterly dividend from $2 to $2.22 per share, pending board approval, and allocated $1.3 billion to growth initiatives.

As of June 30, 2025, Cheniere’s net long-term debt was $22.5 billion, with a debt-to-capitalization ratio of 66.2%. The full-year consolidated adjusted EBITDA guidance is updated to $6.6 billion to $7 billion. The company anticipates generating over $25 billion in available cash by 2030.