Cheniere Energy Partners Reports Missed Earnings Despite Increased LNG Volumes

Cheniere Energy Partners, L.P. CQP reported earnings per unit of 84 cents for the third quarter of 2024. This figure fell short of the Zacks Consensus Estimate of 92 cents but showed an improvement from the 60 cents recorded in the same quarter last year.

Quarterly revenues reached $2.06 billion, a decline from $2.13 billion in the previous year, and also undershot the Zacks Consensus Estimate of $2.09 billion.

Factors contributing to lower-than-expected earnings included increased costs of sales and a reduced gross margin per MMBtu for liquefied natural gas (LNG) deliveries. However, these were somewhat balanced by a rise in the volume of LNG shipped.

Cheniere Energy Partners: Earnings Overview

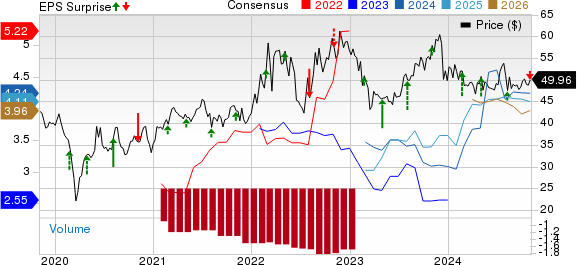

Cheniere Energy Partners, L.P. price-consensus-eps-surprise-chart | Cheniere Energy Partners, L.P. Quote

Operational Performance

In the third quarter, Cheniere Partners dispatched 104 cargoes, marking a 4% increase from 100 cargoes a year ago, and exceeding our estimate of 103.

The total LNG volume for the period was 377 trillion British thermal units (TBtu), which was higher than the 359 TBtu from the previous year and surpassed our estimate of 375 TBtu.

Adjusted EBITDA stood at $852 million, a 7% rise from $793 million a year ago. Even so, this figure did not meet our estimate of $922 million. The rise was mainly driven by increased delivery volumes, although it was offset by a diminished gross margin per MMBtu compared to last year.

Costs and Expenses Breakdown

The total cost of sales for the quarter was $773 million, up from $682 million a year prior, and exceeding our estimate of $681 million. Conversely, operating and maintenance expenses dropped to $200 million from $211 million in the third quarter of 2023, missing our forecast of $214.3 million.

Total operating costs and expenses rose to $1.2 billion, compared to $1.1 billion in the prior year’s September quarter, and also surpassed our estimate of $1.15 billion.

Financial Position

As of September 30, 2024, Cheniere Partners held $331 million in cash and cash equivalents, alongside a net long-term debt of $14.8 billion.

Future Guidance

The partnership has confirmed its distribution guidance for 2024, predicting a distribution range of $3.15 to $3.35 per common unit, with a base distribution of $3.10.

Market Position and Alternatives

Cheniere Partners currently holds a Zacks Rank #3 (Hold).

Investors exploring opportunities in the energy sector may consider other stocks rated Zacks Rank #2 (Buy). Below are some noteworthy alternatives:

The Williams Companies, Inc. WMB is a leading energy infrastructure company in North America. Williams focuses on finding, producing, gathering, processing, and transporting natural gas and natural gas liquids, with a pipeline network spanning over 33,000 miles, solidifying its status as one of the largest gas transporters in the U.S.

The Zacks Consensus Estimate for WMB’s 2024 EPS is set at $1.75, with upward revisions noted for both 2024 and 2025 earnings estimates in the last month.

Archrock Inc. AROC specializes in midstream natural gas compression services, offering stable fee-based revenues. The Zacks Consensus Estimate for AROC’s 2024 EPS stands at $1.10, with similar upward revisions seen in recent weeks.

Kodiak Gas Services Inc. KGS operates in the contract compression infrastructure space, managing high-horsepower compression units. The Zacks Consensus Estimate for KGS’s 2024 EPS is forecasted at 99 cents, currently holding a Zacks Style Score of B for Value and Growth.

Research Insights

Industry experts have selected their top stock picks, with one standout expected to double in value in the coming months. This company targets millennial and Gen Z markets, achieving nearly $1 billion in revenue last quarter alone, making it a compelling option for investors.

For detailed insights and additional recommendations, the full list of Zacks’ top picks can be accessed here.

Williams Companies, Inc. (The) (WMB) : Free Stock Analysis Report

Cheniere Energy Partners, L.P. (CQP) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report

Kodiak Gas Services, Inc. (KGS) : Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.