The mining industry in Chile is on the cusp of significant growth, heralding the need for 34,000 new professionals by 2032. The unprecedented demand represents a 36% surge compared to the previous estimation, emphatically underscoring the sector’s robust expansion and its role in fostering local development and employment opportunities.

The Rising Demand for Talent

A recent study, directed by Vladimir Glasinovic, who leads the Eleva Program within the CCM-Eleva Alliance, has yielded several pivotal insights. The analysis forecasts a compelling surge of more than one-third in the requirement for human capital over the next nine years. This substantial escalation is attributed to two fundamental factors: the imminent retirement of experienced professionals and the advent of pioneering projects in key regions.

Key Projected Initiatives

The surge in talent demand can be primarily attributed to ambitious projects such as Teck’s Quebrada Blanca 2 (Q2), which commenced copper production last year and is currently scaling its operations. Additionally, Gold Fields’ Salares Norte, slated to inaugurate in April, and Antofagasta’s Centinela Mining District, alongside Anglo American’s Los Bronces expansion set for early 2026, substantiate the industry’s relentless appetite for skilled professionals.

Specialist Concentration and Gender Dynamics

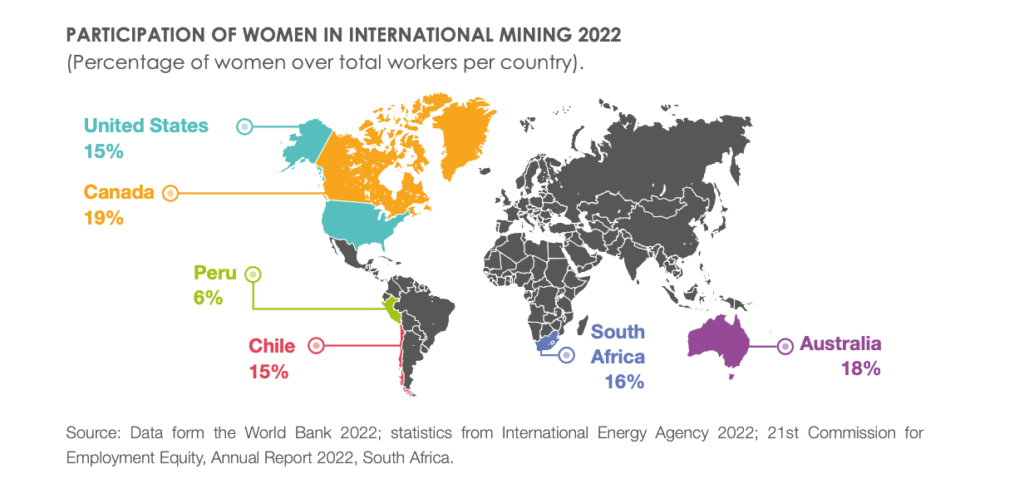

The report has pinpointed that 75% of the demand for professionals will be focused on five specific types of specialists, with mechanical maintainers topping the list. Furthermore, the study has emphasized ongoing progress and challenges in gender equity, technological impact, and the educational landscape in the country. It has been noted that female participation in the industry currently stands at 15%, with women accounting for one in every three new hires and holding 17% of decision-making positions.

Progress and Challenges

While Chile’s female participation in the labor market lags behind that of developed countries, the nation has made considerable strides in integrating women within the mining sector. Comparatively, it stands above Peru and on par with the United States in terms of women’s involvement in the industry. Moreover, the industry’s employment rates are at a 12-year high, exhibiting a remarkable 38% surge from 2020 to 2022 and a 22% increase compared to 2011.

These statistics underscore the mining industry’s pivotal position in Chile’s economy, warranting a concerted effort to address its burgeoning human capital needs. The full report, “Workforce Study of Large-scale Mining in Chile 2023-2032,” provides a comprehensive exposition of the industry’s evolving requisites and potential for sustained expansion.