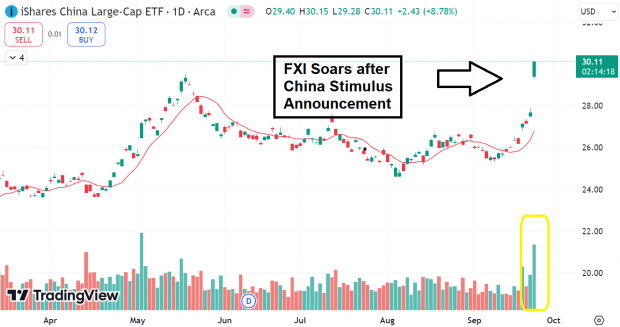

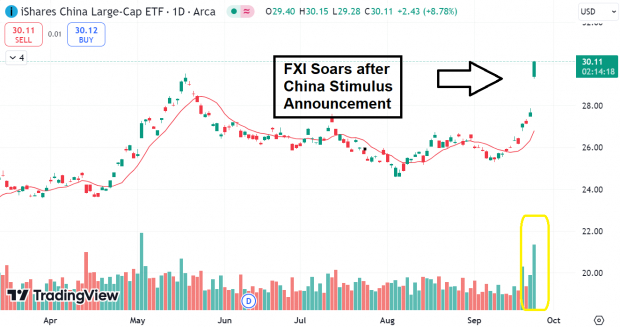

Unprecedented China Stimulus Shocks Global Markets

In a move that sent ripples through global market waters, China unveiled an unexpected and extensive stimulus plan aimed at reviving its floundering economy and stock market. The announcement caught even seasoned analysts off guard, as the iShares China LC ETF (FXI) surged by over 8% with trading volume reaching five times the 50-day average in Tuesday’s session.

Image Source: TradingView

Decoding China’s Stimulus Strategy

China’s ambitious stimulus package comprises interest and mortgage rate cuts along with eased regulations on second-home purchases. Moreover, in a radical move, the country has slashed the mandatory reserve ratio for banks and hinted at the possibility of a “stock market stabilization fund.”

Strategic Investor Insights on China’s Economic Stimulus

Seasoned investors advise focusing on liquidity when assessing the impact of China’s stimulus measures. As market maven Stanley Druckenmiller famously stated, “Earnings don’t move the overall market; it’s the Federal Reserve Board. Focus on the central banks and the movement of liquidity.” With China injecting vast amounts of liquidity into their economy, the key is not to overanalyze but to follow the liquidity trail.

Market Perception and Chinese Economy

While market sentiment towards China remains tepid, savvy investors recognize that markets often rebound when negative sentiments peak. Notably, several Chinese ADRs like Alibaba (BABA) and JD.com (JD) showcase upward trends, indicating a potential market recovery in the making.

Global Implications of the Chinese Economic Rebound

Investors must recognize that China’s fiscal stimulation has repercussions beyond its borders. Companies like Tesla (TSLA) operating in China are poised to benefit from increased sales. Further, commodity giants such as Freeport-McMoRan (FCX) stand to gain from this economic resurgence.

Upcoming Infrastructure Stock Boom in the U.S.

A massive drive to revamp the dilapidated U.S. infrastructure is on the horizon, promising bipartisan support and lucrative opportunities. Billions of dollars will flow, paving the way for substantial gains.

The key question is, “Will investors position themselves in the right stocks early to maximize their growth potential?”