NIO’s Revival Amidst China’s Stimulus Efforts

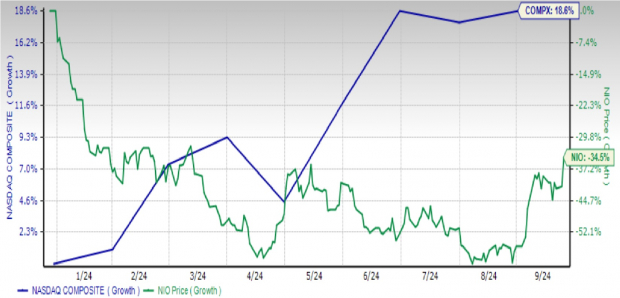

China’s flurry of stimulus measures orchestrated by the People’s Bank of China reignited hope in the hearts of electric vehicle (EV) investors, particularly those backing NIO Inc. The NIO stock witnessed a dramatic upswing, spiraling 11.7% in a single trading day and 18.3% over the past five sessions. Such gains have not only propelled NIO towards its best month this year but have also bode well for the revival of China’s economy, hinting at a brighter future for the luxury EV market.

NIO’s Financial Fortitude Shines Through

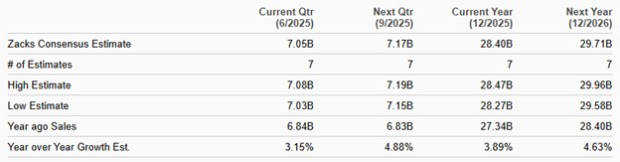

Redeeming itself from earlier setbacks, NIO reported dazzling second-quarter results that surpassed all expectations. Steered by a whopping 143.9% increase in vehicle sales compared to the previous year, the company showed no signs of slowing down. With record-breaking revenues of $2.4 billion and robust production figures, NIO has not only met but exceeded the market’s appetite for growth.

NIO’s Strategic Moves Towards Market Dominance

To further enhance its competitive stance, NIO made strategic strides by introducing the wallet-friendly Onvo brand. Launching the L60 SUV at a compelling price point undercuts rivals like Tesla, empowering NIO to challenge the market hierarchy more vigorously. By diversifying its portfolio and expanding its consumer base with cost-effective offerings, NIO is poised to cultivate a stronger foothold in the ever-evolving EV market.

Investing in NIO: A Calculated Move

As the dust settles on the recent market upheavals, stakeholders eyeing NIO’s resurgence find themselves at a critical crossroads. While the promise of significant gains looms on the horizon following NIO’s commendable track record and China’s revitalization efforts, caution must govern the decision-making process. Despite NIO’s remarkable potential, lingering operational inefficiencies present a formidable challenge that prospective buyers must navigate judiciously.