Amidst a global economic landscape rife with uncertainty, the recent surge in Chinese equities has sent shockwaves reverberating through the financial world. This dramatic upswing comes hot on the heels of China’s Central Bank unveiling a potent stimulus package designed to jolt its lethargic economy into action.

This stimulus strategy, including interest rate cuts, decreased reserve requirements for banks, and a hefty injection of one trillion yuan ($142 billion) into the financial system, has injected a much-needed dose of adrenaline into the Chinese financial sector.

Given that China boasts the enviable title of the world’s second-largest economy by GDP, the repercussions of this stimulus transcend borders, promising a boon for global markets. This article delves into a curated selection of top-notch stocks that investors should have on their radar in the wake of this seismic shift.

Standout in the E-Commerce Arena: JD.com Shines Bright

Dubbed the Amazon of the East, JD.com has carved a niche for itself as a powerhouse in China’s bustling e-commerce landscape. With a coveted Zacks Rank #1 (Strong Buy), JD.com is not one to be underestimated. The mammoth company, revered for its vast array of genuine products, holds the coveted title of being China’s leading online direct sales entity in terms of revenue generation.

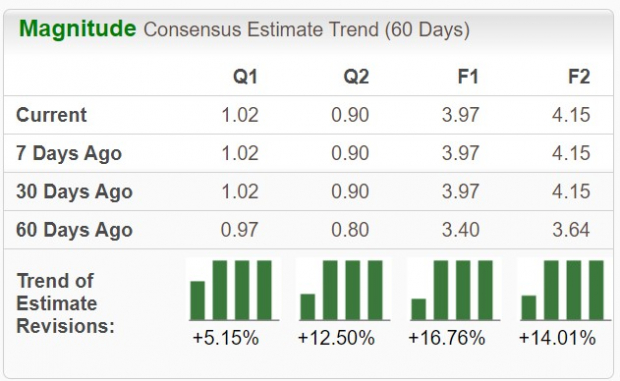

Forecasts paint a rosy picture of JD.com’s trajectory, with its revenue stream expected to swell by a respectable 3% in fiscal 2024 and FY25, cruising past the $160 billion mark with ease. What’s more, the company’s earnings per share (EPS) is slated to witness a meteoric 27% surge this year, followed by a projected 4% uptick in FY25, topping out at a tantalizing $4.15 per share. The cherry on top? JD.com’s glowing rating, buoyed by a flurry of positive earnings estimate revisions over the last 60 days.

Not to be overshadowed are heavyweights Alibaba and PDD Holdings, both sporting a Zacks Rank #3 (Hold), making them noteworthy contenders in this vibrant landscape.

Cream of the Crop in Internet Services: TCEHY & BIDU Leading the Charge

A juggernaut in the online domain and bestowed with a Zacks Rank #2 (Buy), Tencent Holdings is a force to be reckoned with. Operating an internet services portal that delivers a smorgasbord of value-added services including internet, mobile, telecom, and online advertising offerings, Tencent looms large on the global stage.

Furthermore, Tencent’s foray into the realm of video games is nothing short of spectacular. Projections indicate a staggering 32% EPS surge in FY24, catapulting to $3.05 as opposed to the $2.31 benchmark set in 2023. With a promising 14% EPS growth anticipated for the upcoming year, Tencent’s star continues to ascend, with EPS estimates witnessing upward momentum of 4% and 2% for FY24 and FY25 in the past 60 days.

Often hailed as the Google of China, Baidu reigns supreme as the premier search engine provider in the Middle Kingdom and clinches a commendable Zacks Rank #3 (Hold).

Expanding Horizons: Diversified Stocks Worth Exploring

Pioneering the multi-use integrated resort concept, Las Vegas Sands stands poised to reap the benefits of China’s economic revitalization efforts. With a robust presence in Macao, China’s gambling mecca, Las Vegas Sands is well-positioned for exponential growth, showcasing double-digit EPS projections for FY24 and FY25.

Meanwhile, Freeport-McMoRan, an American mining colossus seeing a stock surge on the back of positive Chinese economic tidings, is making waves in the commodities sector. With advantageous agreements in the realm of copper treatment and refining with various Chinese entities, Freeport-McMoRan’s impressive financial metrics and a Zacks Rank #3 (Hold) cement its status as a stock to watch.

The American Infrastructure Renaissance: Opportunity Knocking

Brace yourself for a monumental transformation as the American infrastructure undergoes a long-overdue facelift. It’s a bipartisan initiative of seismic proportions, signaling the dawn of a new era. Trillions are set to be injected into revitalizing the nation’s roads, bridges, and buildings, paving the way for unprecedented growth and wealth creation.

Are you primed to seize the moment and ride the wave of opportunity in this burgeoning landscape?

Zacks has rolled out a Special Report tailored to guide you in navigating this dynamic terrain. Best of all, this invaluable resource is now at your fingertips, free of charge. Uncover the 5 elite companies poised to flourish amid the colossal wave of infrastructure spending that’s about to reshape the economic landscape.Download Now for FREE: Strategies to Capitalize on the Infrastructure Surge >>

Chinese Equities Surge on Stimulus Package – Top Stock Picks for Consideration

Golden Opportunities in Chinese Market

Chinese equities are currently experiencing a robust rally following the announcement of a substantial stimulus package. Investors are eyeing this emerging market with renewed enthusiasm, as the economic landscape continues to evolve.

Favorable Outlook for Tech Giants

With tech behemoths like Baidu, Tencent Holding Ltd., JD.com, and Alibaba Group Holding Limited leading the charge, there is an undeniable air of excitement surrounding the tech sector. These industry powerhouses are attracting significant attention from investors seeking opportunities in the flourishing Chinese market.

Diverse Investment Horizons

For those looking for a more diversified investment strategy, PDD Holdings Inc. Sponsored ADR provides a unique avenue. On the other hand, Freeport-McMoRan Inc. and Las Vegas Sands Corp. present alternative opportunities for investors aiming to broaden their portfolio within the Chinese market.

ETFs as a Strategic Investment

Additionally, the iShares China Large-Cap ETF offers a more passive approach to investing in Chinese stocks. This exchange-traded fund provides a convenient option for investors looking to capitalize on the promising growth prospects of the Chinese market as a whole.

Innovative Giants in the Limelight

Alphabet Inc. stands out as another intriguing option for investors seeking exposure to cutting-edge tech companies. With its innovative approach and strong market position, the company represents a compelling choice in the current investment landscape.

Looking Towards the Future

As Chinese equities continue to soar amidst the backdrop of a stimulus package, investors are presented with a range of enticing opportunities. Analyzing the market trends and exploring stocks like Baidu, Tencent, JD.com, Alibaba, PDD Holdings, and Alphabet Inc. could prove beneficial in capitalizing on this financial upswing.

Valuable Insights from Zacks Investment Research

For comprehensive stock analysis reports on these key players and more, investors can benefit from the insights provided by Zacks Investment Research. By leveraging these resources, investors can make well-informed decisions and navigate the dynamic Chinese equity market with confidence.

Authoritative Perspectives

It’s imperative to note that the views expressed in this article are solely those of the author from Zacks Investment Research. While providing valuable insights, these opinions do not necessarily align with those of Nasdaq, Inc., urging investors to conduct thorough due diligence before making any investment decisions.

To delve deeper into the latest market trends and stock analysis, visit Zacks.com for a detailed exploration of the current investment landscape filled with exciting opportunities.