Chipotle to Report Q1 Earnings with Analyst Downgrades in Focus

Chipotle Mexican Grill Inc. CMG is set to report its first-quarter earnings on Wednesday after the market closes. Here’s a look at the charts and the recent price revisions made by analysts.

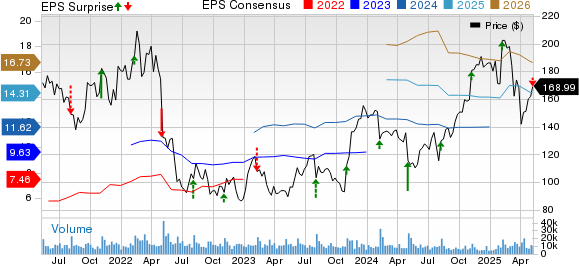

Projected Performance: Analysts expect Chipotle to show earnings of $0.28 per share, marking a 12% increase from the fourth-quarter EPS of $0.25, according to data from Benzinga Pro.

Additionally, the fast-food chain is anticipated to report revenue of $2.97 billion, an increase of 4.21% from its fourth-quarter revenue of $2.85 billion.

On Monday, the company announced a new partnership with Latin American restaurant operator Alsea, marking its entry into the Mexican market. Chipotle’s Chief Business Development Officer, Nate Lawton, stated, “We are confident that our responsibly sourced, classically-cooked real food will resonate with guests in Mexico.”

Technical Analysis: Chipotle’s stock price closed at $47.10 on Tuesday, which is below both its short and long-term simple daily moving averages. The relative strength index stood at 40.96, indicating neutrality, while the momentum indicator, the MACD line, measured at negative 0.96. This suggests that its 12-day exponential moving average is trailing behind the 26-day EMA, accompanied by a negative histogram value of 0.10.

Important Note: GameStop Short Seller Andrew Left Goes Long On China And Two US Stocks Amid Market Correction

Analyst Downgrades: Of the 26 analysts monitoring Chipotle, four have downgraded their price targets as of April 22nd, according to Benzinga data. Barclays lowered its price target from $60 to $56 while maintaining an “equal-weight” rating. Truist Securities cut its target from $74 to $61 with a “buy” rating. Guggenheim revised its target downwards from $56 to $48, holding a “neutral” rating, and Wells Fargo reduced its price target by $10 from $70 to $60, retaining its “overweight” position.

A report by Investing.com noted that Truist’s Card data analysis led to this adjustment, forecasting flat same-store sales (SSS) for Q1 2025, falling short of the 1.9% consensus estimate. Guggenheim cited early first-quarter soft trends influenced by adverse weather and calendar shifts.

Market Performance: Year-to-date, Chipotle has seen a decline of 21.36%, and it is down 19.21% compared to the previous year. However, the stock rose by 2.12% in premarlet trading on Wednesday.

The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 and Nasdaq 100 indices, made gains in the premarket session. The SPY advanced by 2.20% to $538.84, while the QQQ rose by 2.67% to $456.34, based on Benzinga Pro data.

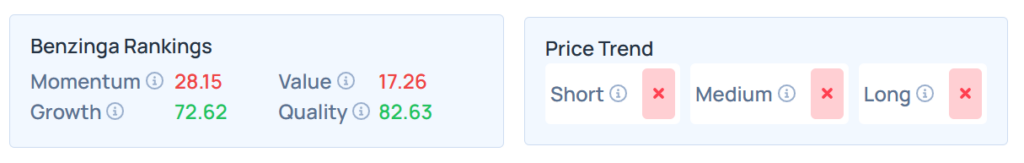

Benzinga Edge Stock Rankings indicate that Chipotle’s CMG exhibits a weaker price trend across short, medium, and long-term outlooks. Its momentum ranking falls at the 28.15th percentile, while its value ranking is similarly low at 17.26th percentile, details of which alongside other metrics are accessible here.

Next Steps:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs