Assessing Nvidia and AMD: Which AI Stock is Better Now?

Nvidia (NASDAQ: NVDA) and AMD (NASDAQ: AMD) excel in providing artificial intelligence (AI) computing hardware. Despite Nvidia’s significant market lead, both companies faced a recent sell-off, with AMD down roughly 60% from its all-time high, and Nvidia down about 30%. This raises the question: Is AMD now a more attractive stock than Nvidia?

Nvidia’s Leadership in the GPU Market

The graphics processing unit (GPU) is essential for training AI models. Nvidia’s CEO, Jensen Huang, created the first GPU in 1999, and AMD also manufactures GPUs. These devices can handle numerous calculations simultaneously, making them ideal for computationally intense tasks such as AI. Additionally, connecting multiple GPUs into clusters can significantly amplify processing capability, with some setups including over 100,000 GPUs.

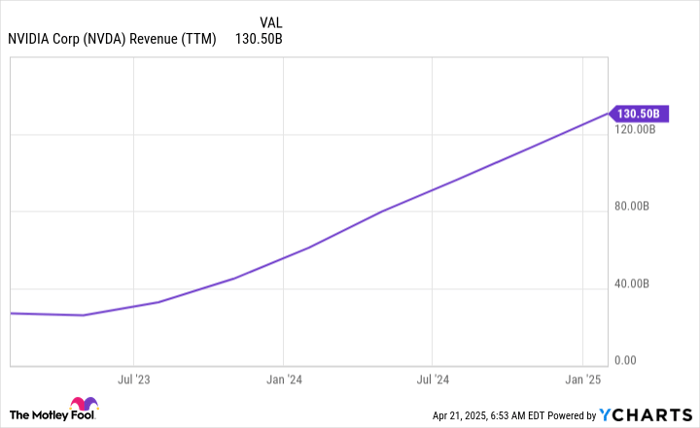

Nvidia has effectively leveraged the burgeoning AI market. Since the beginning of 2023, the company has witnessed a marked rise in revenue.

NVDA Revenue (TTM) data by YCharts.

Data center revenue, primarily from AI-related GPUs, constitutes a significant portion of Nvidia’s total revenue of $131 billion, with $115 billion attributed to this segment over the last 12 months.

AMD is also capturing a share of the data center market, reporting a 94% revenue increase in this division over the past year. However, this growth is minimal compared to Nvidia’s performance.

In 2024, AMD’s data center revenue reached $12.6 billion, which is only about one-tenth of Nvidia’s output. In the latest quarter, AMD’s data center segment grew by 69%, whereas Nvidia experienced a 93% uptick—evidence that while AMD’s segment may be expanding, it struggles to catch up with Nvidia’s scale and growth rate.

Nvidia offers a unique combination of larger scale and superior growth, making it difficult for AMD to compete. Moreover, Nvidia’s business focuses solely on GPUs and their supporting products, while AMD has other offerings that have not performed as well, hindering its overall growth.

AMD Revenue (TTM) data by YCharts.

Despite a surge in data center demand, AMD’s revenue still trails Nvidia’s, which has risen nearly 400% since early 2023. This raises concerns about AMD’s stock performance over the past year and suggests it may still be a while before potential recovery in 2025.

Investment Potential: Nvidia Versus AMD

Both companies are experiencing rapid growth in their data center divisions. However, a recent one-time event inflated AMD’s earnings per share (EPS) in one quarter, making the trailing price-to-earnings (P/E) ratio less meaningful. A better comparison involves using the forward P/E ratio, even though it relies on analyst projections rather than actual performance.

In this context, Nvidia’s stock trades at a forward P/E of 23, while AMD trades at 19, indicating that AMD is economically cheaper but not significantly so.

AMD PE Ratio (Forward) data by YCharts.

Considering AMD’s underperformance and smaller market share, one might expect it to trade at a deeper discount. However, that is not the case. Consequently, Nvidia appears to be the superior investment as it maintains a stronger position in a rapidly evolving market.

Conclusion: Is Nvidia Stock Worth Your Investment?

Before deciding to invest in Nvidia, it is essential to consider the existing expert opinions. The Motley Fool Stock Advisor analyst team has recently identified what they believe to be the ten best stocks to buy, and Nvidia did not appear on that list. The stocks selected could potentially yield substantial returns in the years ahead.

In closing, the historical context shows that stocks like Netflix and Nvidia had previously delivered extraordinary returns when recommended. As of April 21, 2025, the Stock Advisor total average return stands at 811%, outpacing the S&P 500’s 153%. Investors may want to look closely at the latest recommendations.

Keithen Drury holds positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.