Tech Stocks Affected by Tariffs: Apple and NVIDIA Under Review

As new tariffs introduced by President Donald Trump on Chinese imports took effect in early April, shares of Apple Inc (AAPL) and NVIDIA Corporation (NVDA) experienced declines. However, recent tariff exemptions might have inadvertently aided these tech giants, shielding them from increased import costs and potential price hikes on their products. This situation has led to speculation regarding investment opportunities in these stocks. Let’s delve into the details.

Risks Surrounding Apple Stock Despite Recent Tariff Relief

The introduction of steep tariffs on Chinese goods by President Trump could have significantly disrupted Apple’s supply chains, similar to the interruptions seen during the COVID-19 pandemic. Fortunately for Apple, the administration exempted electronic devices, such as smartphones and computers, from these reciprocal tariffs.

Prior to this exemption, Apple aimed to boost iPhone production in India, attracted by lower tariffs, while simultaneously securing its supply lines. The company plans to manufacture over 30 million iPhones in India, addressing a considerable portion of U.S. demand, which represents about a third of global demand.

Nevertheless, the latest iPhone 17 is still being produced in China, with the launch approaching. Transitioning production to India or another location would require extensive effort and time. Additionally, there are fears of potential retaliation from China, which has already initiated inquiries into U.S. companies and might complicate Apple’s customs processes.

It is unlikely that Apple can completely disengage from China since the majority of its iPhones are produced there, and the U.S. currently lacks the workforce skilled in iPhone manufacturing. Instead, Apple has advocated for increased semiconductor production in the U.S. to revive high-value jobs.

That said, the relief from tariffs is temporary. If negotiations fail to yield timely results, Apple’s short-term profitability could struggle. President Trump emphasizes that reliance on China for essential technology like smartphones and semiconductors is unacceptable, and further tariffs could lead to iPhone price increases, adversely affecting American consumers and Apple’s sales volume. Though some tariffs remain on specific goods from China, there are also sectoral tariffs on items containing semiconductors, further endangering Apple’s already stagnant revenues.

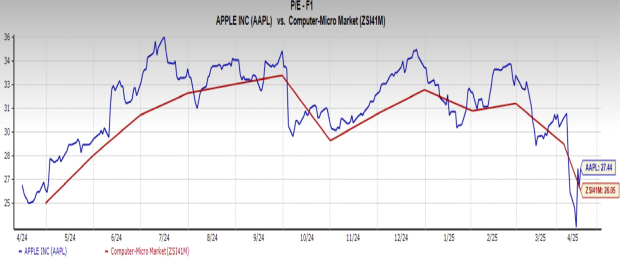

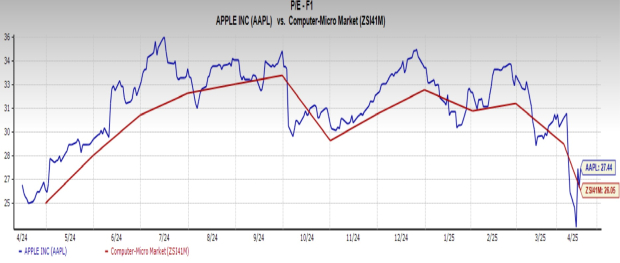

Considering supply chain risks, stagnant revenues, and tariff unpredictability, Apple currently appears to be a less favorable stock choice. The company trades at a price/earnings (P/E) ratio of 27.4X forward earnings, which is higher than the Computer – Micro Computers industry’s rate of 26.05. Hence, Apple stock might be overvalued and vulnerable if tariff complications persist.

Image Source: Zacks Investment Research

NVIDIA: The More Promising Stock Amid Tariff Uncertainty

Much like Apple, NVIDIA experienced a brief reprieve from Trump’s tariffs, as certain essential chips produced in China were exempted. Although there is now a 90-day pause on tariffs, uncertainty remains as negotiations with trade partners continue.

Despite these challenges, NVIDIA is considered a more attractive buying option during market disturbances. The growing demand for graphic processing units (GPUs) and increased investment in artificial intelligence (AI) infrastructure enhance NVIDIA’s long-term outlook. In comparison, Apple faces stiff competition, economic hurdles, and regulatory challenges that could hinder its performance.

Turning back to NVIDIA, the company is witnessing a surge in demand for its Blackwell and older Hopper chips, which boast superior AI capabilities compared to competitors. The wide adoption of NVIDIA’s CUDA software platform among developers further distinguishes it from Advanced Micro Devices, Inc. (AMD) and its ROCm platform. Major cloud service providers like Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOGL) are also investing heavily in AI data center infrastructure, presenting substantial growth opportunities for NVIDIA.

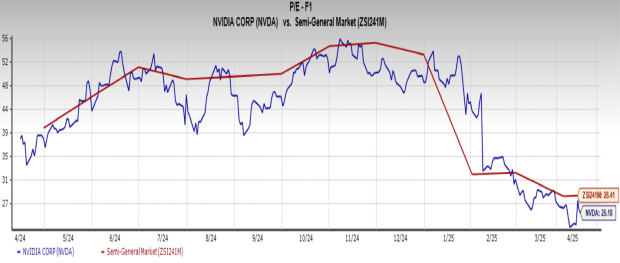

Currently, NVIDIA stock offers a more favorable valuation than its peers with a forward P/E ratio of 25.18, compared to the Semiconductor – General industry’s 28.4X forward earnings multiples. As a result, NVIDIA has a Zacks Rank of #2 (Buy), while Apple holds a Zacks Rank of #4 (Sell).

Image Source: Zacks Investment Research

You can see the full list of today’s Zacks Rank #1 (Strong Buy) stocks here.

5 Stocks with Potential to Double

Each of these stocks has been selected by a Zacks expert as a top pick for gaining over +100% or more in 2024. Although not every choice will succeed, previous recommendations have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are under the radar on Wall Street, creating a prime opportunity for early investment.

Today, see these 5 potential home runs >>

Want the latest from Zacks Investment Research? You can download our report on the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Apple Inc. (AAPL): Free Stock Analysis report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

This article initially appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.