CVS Health Outshines Cigna in Stock Performance and Growth Prospects

CVS Health and The Cigna Group (CI) dominate the U.S. healthcare market, boasting market caps of around $77 billion and $84 billion, respectively. Both companies effectively integrate pharmacy benefit management with insurance and care delivery, creating consumer-focused healthcare solutions.

As they navigate policy challenges and the rise of GLP-1 therapies, investors are evaluating which of these firms is better positioned for sustained growth in today’s dynamic market. Below is an analysis of each company’s performance and strategies.

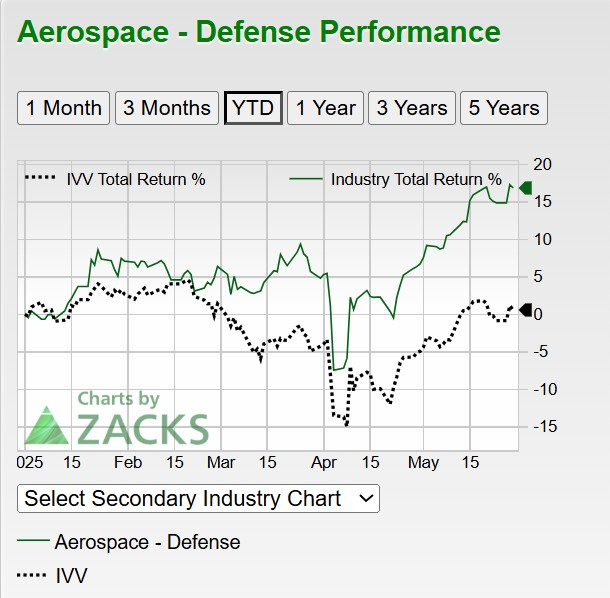

CVS Stock Outperforms Cigna and the S&P 500

Year-to-date, CVS Health shares have increased by 39.7%, surpassing Cigna’s 14.7% gain and the S&P 500’s 1.3% decline. This strong performance reflects renewed investor confidence due to CVS’s turnaround efforts led by its new leadership team. Key factors include stabilization of the Aetna segment, robust Q1 earnings, and raised full-year earnings guidance. CVS has emerged as a top S&P 500 performer in 2025, indicating a positive long-term growth trajectory.

Image Source: Silkcharts

In contrast, Cigna’s stock performance is bolstered by its Evernorth Health Services segment, which focuses on specialty pharmacy and pharmacy benefit services. The sale of its Medicare businesses to HCSC has allowed Cigna to concentrate on higher-margin commercial insurance and health services. Cigna’s initiatives like EncircleRx and the upcoming EnGuide platform improve GLP-1 therapy affordability and its overall market position.

Though Cigna has not matched CVS in near-term performance, its disciplined capital strategy and long-term EPS growth target of 10-14% appeal to investors focused on stability.

Image Source: Zacks Investment Research

Diverging Strategies: Long-Term Outlook for CVS and Cigna

CVS and Cigna are pursuing different strategies to foster long-term growth, influenced by their unique strengths and market positions. CVS Health is making the most of its integrated platform, processing 1.7 billion prescriptions and operating 9,000 health locations to enhance care coordination and efficiency. The company reported a 71.8% year-over-year EPS growth in Q1 2025, exceeding estimates, while also enhancing its full-year guidance. Its focus on Medicare Advantage and the divestiture of ACA exchange plans aim to bolster profitability, although regulatory pressures and GLP-1 trends present near-term challenges.

Adjusted EPS: CVS

Image Source: Zacks Investment Research

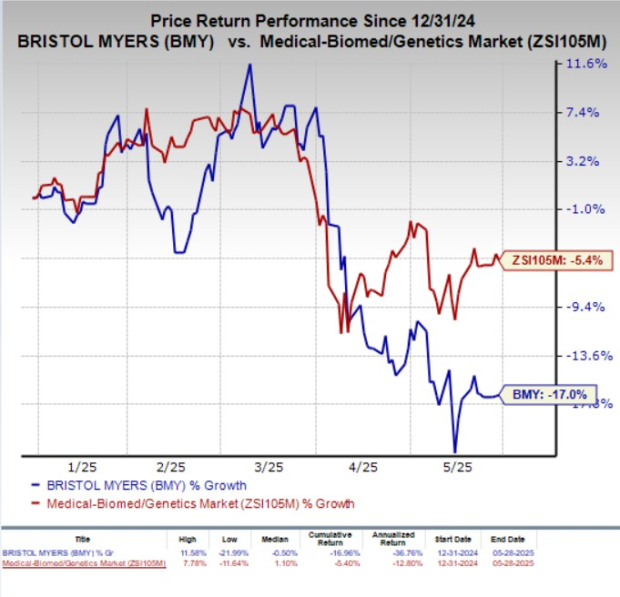

Cigna reported more than 15% year-over-year growth in adjusted EPS in Q1 2025, alongside $1.9 billion returned to shareholders. This growth is supported by 8% revenue growth in Evernorth and 9% membership growth in Cigna Healthcare. The Medicare Advantage divestiture aims to streamline operations and refocus on the employer market and specialty pharmacy. Cigna’s EncircleRx and EnGuide platforms will further drive cost reduction and adherence in GLP-1 therapy, aligning with its future in value-based care.

Overall, Cigna has a long-term EPS target of 10-14% and maintains strong capital discipline, projecting a safer growth path. In contrast, CVS offers broader technological integration but with higher volatility. Cigna’s service-led approach presents consistent prospects facilitated by solid capital returns.

Adjusted EPS: CI

Image Source: Zacks Investment Research

Mixed Valuation Signals

CVS is trading at a trailing P/E ratio of 9.65x, slightly above its 5-year median of 9.55x. Conversely, Cigna’s trailing P/E stands at 11.42x, which is below its 5-year median of 12.06x but higher than CVS’s ratio. This indicates that while Cigna might appear overvalued compared to CVS, it is still seen as reasonably priced in the context of its historical performance.

Image Source: Zacks Investment Research

Conclusion: CVS as an Attractive Investment

As a Zacks Rank #2 (Buy) stock, CVS demonstrates robust momentum with a 39.7% year-to-date increase, fueled by strong earnings, strategic realignment, and a clear focus on growth sectors like Medicare Advantage. Its comprehensive care delivery network and tech advancements position it to benefit from ongoing healthcare integration trends. Despite regulatory challenges, CVS’s reasonable valuation and growth visibility make it an attractive buy opportunity.

Cigna maintains a solid fundamental base with a Zacks Rank #3 (Hold), focusing on service-led growth rather than aggressive expansion. For investors seeking opportunities with improving fundamentals, CVS presents a stronger investment case at this time.

Only $1 to See All Our Buys and Sells

We’re not kidding.

This unique offer allows 30-day access to our stock picks for just $1, with no further obligation. Thousands have taken advantage while others remain cautious, wondering about the catch. The goal is to let you explore our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, with significant gains in 2024 alone.

Get the latest recommendations from Zacks Investment Research for free.

Cigna Group (CI): Free Stock Analysis Report

CVS Health Corporation (CVS): Free Stock Analysis Report

Read the original article on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.